The 1.5% SSS contribution hike to 12.5% on employee’s monthly salary is expected to be implemented in January 2018. The move to increase the contribution was largely credited to President Rodrigo Duterte approving the two-stage monthly pension increase of Php2,000 to retirees. Since March, each SSS pensioner gets an additional Php1,000 on top of their previous monthly receivable from the agency. To cover the additional pensioner money, Duterte also approved the plan to increase member contribution rate of 11 percent by adjusting the yearly by 1.5 percent until it reaches 17 percent by 2020.

While this is a great thing for paying SSS members, the move is just one of the many financial and payroll adjustments needed to be done correctly by entrepreneurs and HR staff.

Employer’s Share

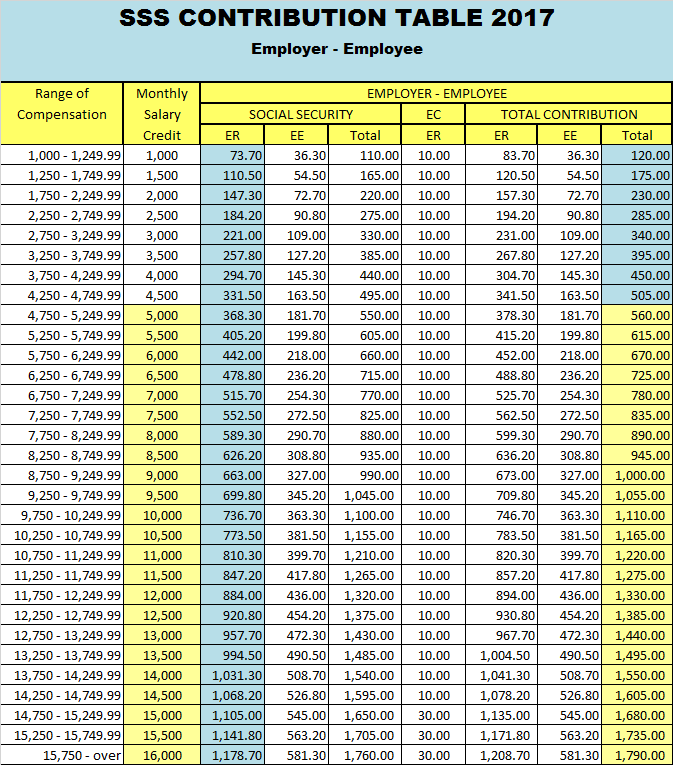

The current SSS contribution, which is 11 percent of the employee’s salary, is being shared by the employer (7.37 percent) and employee (3.63 percent). The SSS usually releases an updated contribution table to avoid confusion and overpayment/underpayment.

Early this year, SSS Chairman Amado Valdez clarified in an interview that while the current setup suggests a 70:30 employer-employee share, it does not mean that the same rate will be used in the upcoming increases.

There is little employer’s feedback publically available regarding the increase, but a trade association chair indicated that the increase could make a significant impact on operational costs. Employers Confederation of the Philippines chairman emeritus Donald Dee expressed in a statement that while the association supports the intention behind the contribution increase, there should be a study conducted regarding the matter. He also said the average cost spent per employee of the association is already higher than other companies because they spend more money on other benefits and not just SSS.

Ahead of the SSS contribution hike, it is best for companies (via HR and Payroll departments) to anticipate the changes they would need to avoid over or underpayment. Here are a few things you need to prepare ahead of the changes:

1. Make sure all employees have an online account.

The SSS has an online facility where all employees, employers, and other members access contributions and membership records, perform online transactions, request for copies, and set appointments with their SSS servicing branch. This means they can check online instead of having to talk to your HR Team about these details.

It’s easy to direct incoming employees who have yet to have an SSS number to set up their online account. For employees who have forgotten login details of their online account, they can simply do a password reset or email at onlineserviceassistance@sss.gov.ph.

2. Make sure your employer online details are also updated on your SSS online account.

SSS aims to have almost every transaction done online, which is great for HR and Payroll who needed to keep tabs on pertinent employer and employee information. On the other hand, hard changes like change in business address or company type will still require you to provide supporting documents that are needed to be submitted at a physical branch.

3. You would still need to go to SSS to pay for the contributions

It would be nice to be able to pay for your employee contributions online. As of the moment, you would still have to make the payments directly at a physical branch with the following:

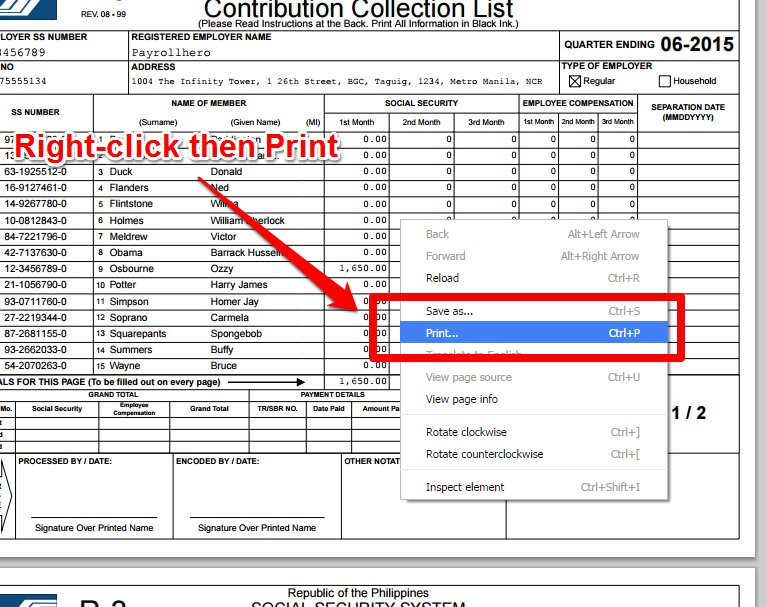

- Accomplished SSS Form R-5 or also known as the Employer Contributions Payment Form

- Accomplished SSS Form R-3 Contributions Collection List

- Cash or Check totaling amount payable to SSS

4. You would need to be diligent in keeping employee contributions updated

The R3 form is a list of all contributions collected for employee-members. HR (with Payroll assistant), need to submit this form every month or every quarter. You would need to submit this along with the USB file or the printed version and copies of the Transmittal Certification and Employee File per month.

For some companies experiencing high attrition or is expanding its workforce at a rapid pace, it can be quite taxing to prepare an accurate R3 form. It’s easy to overlook or prepare all required documents in one go and forget to include updated information that could lead to underpaying or overpaying SSS contributions. Moreover, it can also be complex when there are changes in the company that require salary adjustments.

Here are some tips for you to make this process easier to manage:

- Pay on or before the 10th day of the following month. As your employees have different SSS numbers, it will be easier for HR and Payroll to collect and prepare updated documents.

- Pay SSS contributions with the SSS branch who handles your company’s records. It can be easier for HR/Payroll or business owners to pay the contributions at a nearby branch, but it would be much easier to deal with the branch that can access your records and handle application concerns or requests faster.

- Get an HR/Payroll software who can handle repeated SSS processes. The SSS’s file generator program can be a frustrating tool to do, and some free R3 file generators online may not be reliable or safe.

An HR/Payroll software like PayrollHero can not only generate the reports you need for SSS contributions.

Generate SSS R3 forms and automate mundane HR and payroll functions with our 30-day free trial. You can also download government forms here.

5. Inform employees about the changes in SSS policies and increases in their benefits.

HR is duty-bound to not only keep employees informed about SSS policies but also inform any effects on their payslips. While a memo or an email may suffice to inform employees, HR and Payroll will still get questions from employees about deductions on their payslips down to the last cent. Unless you have an HR or Payroll assistant to assist in addressing these type of questions, handling repeated inquiries is a waste of your time and company resources.

Final Thoughts

As the government intends to make frequent increases on SSS contributions over the next five years, you may want to invest your time and effort now to make sure your HR and Payroll teams have the right processes and systems in place to deal with these increases. Streamlining HR and Payroll tasks will ensure that SSS contributions are correct and updated with minimal effort and use of resources.