Interested in PayrollHero? Sign up today and get 90 days free! – USE PROMO CODE 90TTTMBP2018

Excited to receive your 13th-month pay? I am too. But on the HR and Payroll side, it can be a headache to compute and prepare. That’s why your employer some times releases your 13th-month as early as the 15th or 30th of November to comply with the payout deadline.

Here’s everything you need to know about your 13th-month pay:

1. It is a monetary benefit mandated by law.

The 13th month pay is defined as a monetary benefit based of an employee’s basic salary. This monetary benefit is a core general labor standard, with the Department of Labor and Employment (DOLE) as the agency responsible to oversee any compromises in fulfilling the mandated payout.

2. Your 13th month pay is different from your Christmas bonus.

The 13th month pay is considered a bonus mandated by law, while the Christmas bonus is a separate benefit or payout and it depends on your employer whether they’ll dole it out or not. Companies in the Philippines usually give out Christmas bonus due to team or company-wide performance or revenue-sharing.

Unlike the 13th month pay, your Christmas bonus could come in other forms. It could be cash, gift certificate, a Christmas basket, canned goods, extra leaves that could be convertible to cash if unused, or anything of value.

3. Your 13th month pay should be given to you no later than December 24 of every year.

While the law does not stop employers from giving out 13th month pay early, the law requires employers to give the mandatory benefit at least before Christmas day. According to Presidential Decree 851, the main reason why the 13th month was established as a mandatory benefit is for the Philippine labor force to “properly celebrate” the yuletide season and the New Year, and have the opportunity to invest or save.

The great thing about the Philippine Labor Code is that it provides protection from employers who do not comply with the 13th month pay provision. Aside from releasing the 13th month pay, employers are also required to submit a report of compliance to any DOLE branch on or before January 15 the succeeding year. Should your employer fail to pay your 13th month pay, you may file a money claim case with any DOLE branch.

4. Your 13th month pay may not be equivalent to your monthly basic salary.

According to the law, your basic salary should only be earnings or primary payment paid to an employee for services rendered. On the other hand, basic salary does not include:

- cash equivalent of unused vacation and sick leave credits;

- cost-of-living-allowances (COLA) granted pursuant to President Decree No. 525 or Letter of Instructions no. 174;

- overtime;

- premium;

- night differential, and

- holiday pay.

Your 13th month pay should be not less than 1/12 of the total basic salary you earned within the calendar year. This means your 13th month pay is monthly basic compensation computed pro-rata according to the number of months (or days) you have worked in your company.

Example:

Juan earns a basic salary at Php15,000 per month at company ABC. He has been working for 10 months in the company. As such, Juan stands to receive:

(Php15,000 X 10 months) / 12= Php12,500.00

If Juan has any absences or lates during the month, the pay equivalent of those should be deducted from basic salary first before determining the 13th month pay.

5. You may not be able to receive your 13th month pay.

According to the law, the following are not allowed to receive 13th month pay:

(b) Employers already paying their employees 13th month pay or more in a calendar year or its equivalent at the time of this issuance;

(c) Persons in the personal service of another in relation to such workers; and

(d) Employers who are paid on purely commission, boundary, or task basis, and those who are paid a fixed amount for performing a specific work, irrespective of the time consumed in the performance thereof, except where the workers are paid on piece-rate basis in which case the employer shall grant the required 13th month pay to such workers.

Labor Secretary Silvestre Bello III noted in an interview a rank-and-file employee nonetheless should still receive 13th month pay regardless of the way how his or her wages are paid or the nature of his or her employment as long as they have worked for at least one month. This is also stressed in the DOLE handbook.

6. You can actually view how much you stand to redeem your 13th month pay on your payslip.

Depending on how the payment has been set up, the 13th month redeemable is taken from 1/12th of your monthly basic pay worked. The figure from the previous month is them added to next month’s redeemable, and the next month and so on.

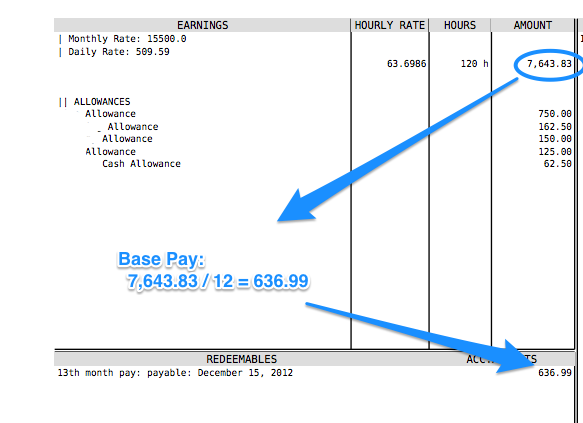

For this example, the employer used base pay to calculate an employee’s 13th month pay redeemable:

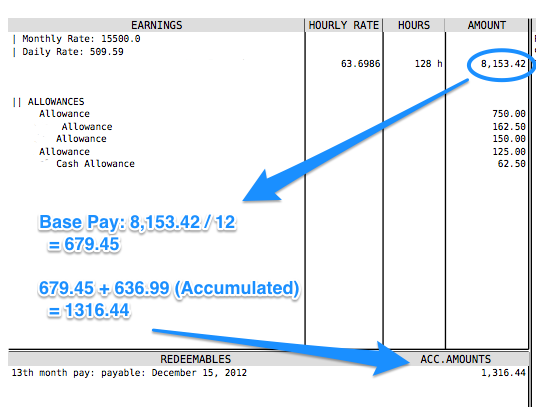

On the second payslip, the redeemable is then added to the computed redeemable for the second month, as shown here:

Should your employer use the gross pay to determine your 13th month pay, the gross pay will include allowances and payments payable to gross and then will be divided by 12. This is actually great, because your employer will be giving you a portion of the benefits or any multiplier on top of your basic pay for your 13th month pay.

Your payslip will also show when you should expect your 13th month pay. In this case, the employee from this example will receive the full 13th month on December 15.

7. Maternity leave benefit are not included in the computation of 13th month pay.

Maternity leave benefit is a benefit employed women claim as a member of SSS (Social Security Service). Even if you receive money during your maternity leave, you technically have not rendered work and earned your keep during your maternity leave. As such, Payroll will not consider the number of days on maternity leave as a factor to compute your 13th month pay.

8. Your 13th month pay is not subject to tax, except for some people.

Republic Act 10653 states that gross benefits not more than Php82,000 received by employees and officials of both public and private companies or entities will not be subject to tax. If you’re a web developer or someone in a managerial or director position in your company, this provision might not apply to you.

9. Resigned or terminated employees can still get their 13th month pay.

The Philippine Labor Code is pro-employee, and has provisions that cover those who resigned voluntarily or whose services has been terminated any time before the 13 month payment. Computation for the benefit is still the same, but it will be in proportion to the number of days a resigned employee has rendered.

10. You may want to check with Payroll about upcoming tax deficits.

Yes, this is a thing. You may have heard of tax refund, but you might also incur a tax payable if the tax withheld is less than the tax due on your annual gross compensation income. This is possible because of adjustments to your withholding tax. Payroll will usually have an updated Withholding Tax Tables on hand from the Bureau of Internal Revenue and could help you determine if there is a tax deficit ahead of the end of year computation.

Any tax deficiency will usually be deducted on the first or second pay of the succeeding year. The employer is required by law to give a tax refund or secure the deficit not later than January 25. If you already have plans for your 13th month, it’s best to check first if you have a tax deficit to avoid getting a significant deduction on the month where you’re probably broke because of the holiday celebration.

Final Thoughts

Your 13th-month pay may be a great addition to your income. To be able to maximize your expected receivable, avoid coming in late or not coming in to work. If you have to be absent for work, take advantage of your company’s leave credits or emergency leave policy to ensure you have a perfect attendance. It’s also great to pay attention to other aspects of your payslip, like your withholding tax, to anticipate any tax deficits and use your 13th month pay to cover this deductions in your first or second paycheck of the succeeding year.

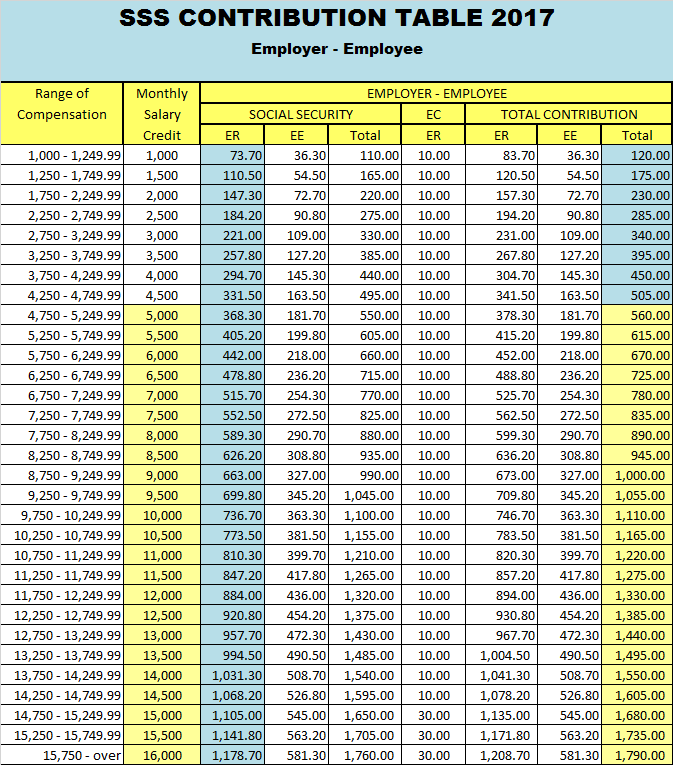

In early 2017, the Social Security System (SSS)

In early 2017, the Social Security System (SSS)