One of the best books I read in 2018 was recommended to me by a friend and coach. It was called Radical Candor: How to be a great boss without losing your humanity. It’s a framework for managing a team effectively. As the title suggests the author Kim Scott proposes that there is a path to being a great boss without having to be an a**hole.

There has been a trend over the last couple of decades that has linked effective management to being ruthless and lacking compassion. One could argue that Steve Jobs was a good example of such a leader, an opinion that I can understand but personally disagree with. Donald Trump or Alan Sugar on the Apprentice both come across as bosses who are susceptible to monstrous outbursts. Regardless of whether this is a true portrayal of their management styles that is what our expectation of a leader is. In our pop culture being an a**hole is synonymous with being an effective leader.

This is why Radical Candour immediately resonated with me. It finally provided a framework as to why this style of management is effective and at the same time provided a logical path to how you can be nice and a great leader at the same time. As one of my idols Gary Vaynerchuk likes to say frequently the fact that “nice guys finish last is just not true”.

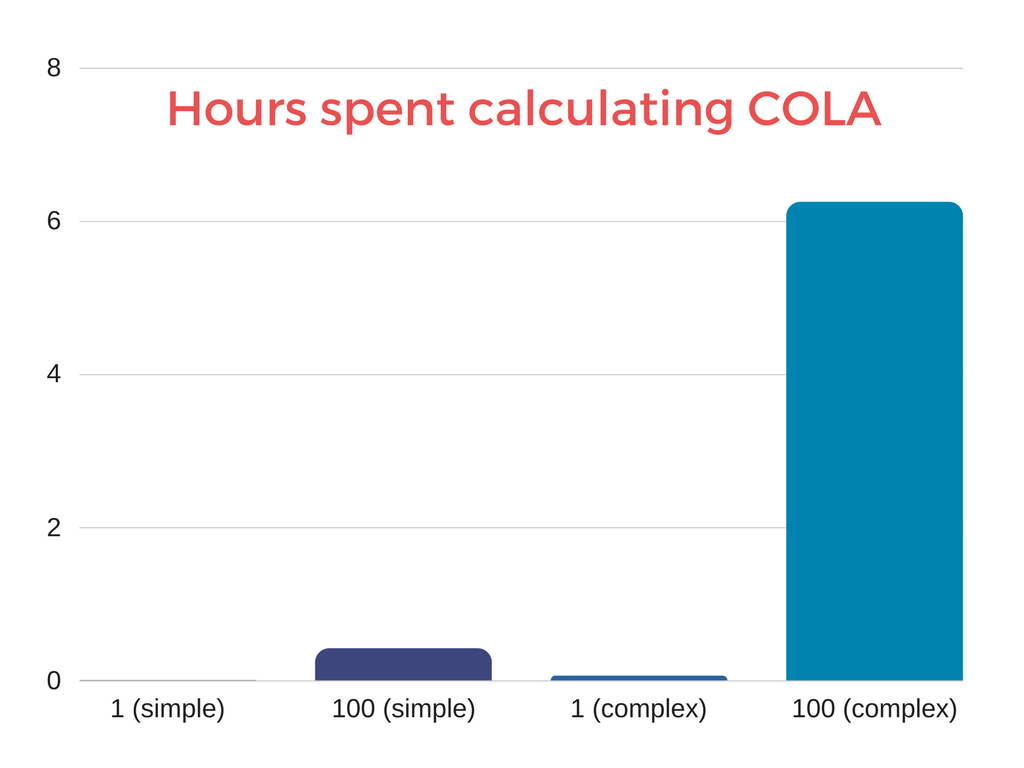

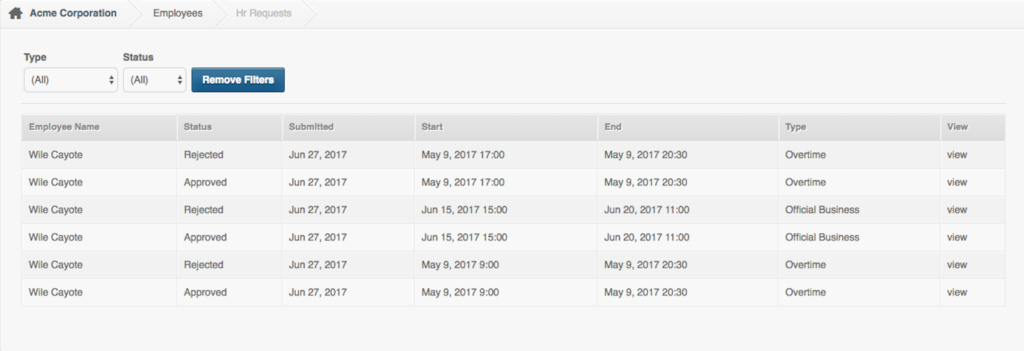

The argument put forward is that it takes two traits to be an effective boss. You must challenge directly and care personally. She uses a great example in the book of someone to illustrate the diagram above.

Imagine you walk into a crowded room with your trousers undone. If someone cares and is willing to challenge you directly they might take you aside and say “Hey, I just thought you’d want to know your fly is open.” You can then discreetly solve the problem. This is Radical Candour.

Imagine you walk into the same room and someone who doesn’t care but is willing to challenge you directly says something instead. They shout across the room “Hey your trousers are undone.”

Everyone hears and looks at you. You’d probably be a bit embarrassed but you are now able to solve the problem. The person could have handled the situation in a more compassionate way, but at least the matter is resolved. This is the a**hole boss right here. They might be an a**hole about how things get done but they get done. This is called Obnoxious Aggression.

Now imagine that you walk into the same crowded room and someone does care but they don’t want to challenge you directly. They “don’t want to upset your feelings.” Your fly stays open and everyone notices. Everywhere you go for the rest of the day people notice. The problem never gets resolved and when you do finally realize you think “why didn’t they tell me.” This is Ruinous Empathy. They are trying to protect your feelings but it’s actually to your detriment.

Last of all we have the people who don’t care and don’t challenge directly. They are the ones that tap a friend on the shoulder and say “hahaha look at that person they left their fly open.” That’s called manipulative insincerity.

Hopefully this analogy makes sense as it made a ton of sense to me. It really shows why challenging directly, even without caring, is way more effective than caring without challenging. Yet none of us, I hope, want to be obnoxiously aggressive.

So how do we achieve radical candour? It’s really simple, you have to care about your employees. If you read that sentence, want to manage people and think that’s not within the realms of possibility for you; please seriously reconsider your chosen career path. 😃

If you read that sentence and think “well no sh*t Kieran” or “yes that’s something I can do” then awesome! You are a considerable part of the way to being a good manager.

Communication and understanding is critical

The challenge directly aspect comes down to how you provide feedback and understand the needs of your employees. Ultimately that means having structures in place to allow you to communicate with your staff on a frequent basis. This should be a two way street. You want to provide feedback about performance in a timely fashion whilst the feedback is relevant and you want to stay up to date with what’s important in your employee’s lives.

Imagine your employee drops the ball on a certain task. If you wait until their quarterly review they could keep making the same mistake and create more issues. You may have lost 3 months where they could have been getting better at that task and not just compounding the issue.

Why is it important to know what’s going on in an employees lives? Context. Imagine if an employee’s performance is slipping. You know that they have a sick relative, maybe you’ll give them some time off to deal with that and understand the reason why they are not meeting your expectations or goals. Alternatively, an employee finds out they are expecting a child. Their career goals might shift fundamentally in the short/medium term and you will want to adjust with them to support.

Key takeaways

Whilst I strongly recommend reading the book to get a good grasp on of the framework. Here are some immediate actions you can take in your business today that I took away from the book.

- Create weekly feedback structures for your employees.

It’s important for employees to have a regular feedback loop with their direct superior. One to Ones are a great avenue for you to course correct and provide feedback. The lack the formality of a quarterly or annual review. If you don’t have these in place at your company start today. They don’t need to be complicated.I don’t use the exact structure they advise in the book. We have a spreadsheet where the employee or myself can write down agenda items. We then meet for 20-30 minutes once a week and we discuss the most important items on the list.

- Limit the number of direct reports any manager has.

If your managers are responsible for a team of 100 employees how can you expect them to care on a personal level with each employee and still carry out the operational aspects of their role? You need to create capacity for your managers to manage. - Create a growth management plans for all of your employees.

Knowing what your employees want to do in life allows you to help them fulfill on their dreams. You can align the goals of the company with their own and create mutually beneficial situations that encourage win/wins. - Be specific.

Whether you are providing praise or criticism you need to focus on exactly what you want the employee to know. Think about a time when your boss has said to you “good job.” It doesn’t land on you as praise. You’re often left thinking “for what?” When you point out what you are praising it allows the employee to keep refining that good work.Being specific encourages growth instead of sounding like a vague platitude.At the same time for criticism it allows the employee to focus on the problem and work to improve it. If you just tell someone “that sucks” it generally leaves them feeling demotivated and disengaged. You want to encourage the people who work for you and being specific can help do that.

- Promotions are not the only reward for good performance.

A lot of companies cultures have evolved to encourage the best performers to take management positions as the only way for them to increase their compensation packages. The best players rarely make the best coaches.We should have opportunities in place that encourage people who want to lead to do so. At the same time, we should allow people who are amazing at what they do and love doing it to keep doing it. Career progression doesn’t just mean getting a promotion.

- Don’t make it personal

Regardless of whether you are giving praise or criticism don’t make it about the employee. “You are terrible” is a vastly different statement than “Your work is terrible.” Whilst I would never encourage either statement the former attacks the person whilst the latter acknowledges you are only referring to a certain piece of work they have done.

It’s amazing how taking on the points made in this book can transform your work environment. It creates a culture of collaboration and transparency. It allows a top down approach to removing politics from your organization. Your employees will never have to second guess what’s going on in their managers head. It is one immediate access to creating lasting positive changes to your company culture.

If you do read the book or try to implement any of the points above I’d love to hear about it in the comments below!

UPDATED: Jan 2018 to reflect TRAIN.

UPDATED: Jan 2018 to reflect TRAIN.