This February 2016, we all get 1 extra day thanks to this being a Leap year. And since we’re getting one extra day, it’s high time that we all use it to grow our business and make it count.

Because we want you to make the most out of your year, we decided to push out 29 Ways to Grow Your Business in the Philippines.

Yes – 29!

This is quite a long read, but if you can just use some of these tips, you’ll have a great chance to make a tremendous ‘leap’ this year.

Okay, enough with the puns and let’s get started!

29 Growth Tips for your Business

#1 Take Social Media Seriously

Having a dormant Facebook account for your business, and an egg account on Twitter won’t cut it.

2016 is the year where Social Media is evolving at such a rapid state that if you still aren’t taking it seriously, you will be very much left behind.

We’ve written about how you can leverage social media to grow your business this 2016 to help you get started.

If you’re running a restaurant or retail store, now’s the best time to establish a presence on Social Media. The best platforms to use for restaurants and retail businesses is Facebook and Instagram.

Set up your accounts if you haven’t already, and check out our blog post to help you get your social media presence in the Philippines’ space up high.

#2 Embrace Technology

Tech can be intimidating, especially for non-millennials. But it can’t be denied just how much technology makes everything easier for your business.

READ: Embrace Technology, Grow Your Business

Imagine going from manually sending emails one by one to automating everything using tools like MailChimp. Or sharing worksheets easily with teammates using Google Sheets rather than using Excel – saving the doc – sending an email to your colleague – editing the doc – sending back to you.

There are so many ways for you to get ahead and embrace technology. We’ll be discussing them in more detail in other items.

#3 Leverage Customer Reviews

Whether you’re running a restaurant in the Philippines, a hotel, retail store, or a startup, one thing that you can’t ever have enough of is positive customer reviews.

For restaurants, Zomato is one of the biggest apps in the Philippines for food reviews. If you’re not on Zomato’s radar, you need to be on it ASAP.

More than that, you should consider giving incentives to your customers to write a positive review on Zomato. Ask them to share their experience on Zomato, so that when others view your restaurant in the app, they’ll be more enticed to dine at your restaurant.

For hotels, the same works with Agoda, TripAdvisor, and similar sites.

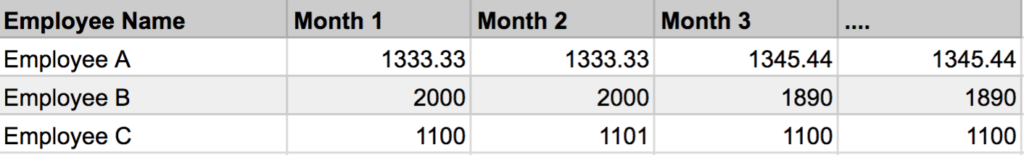

#4 Know Your Numbers

If you’re not the type of business owner who is a certified Math Wiz, then I’m sure you’ll agree that sometimes keeping everything organized ‘numbers-wise’ can be quite tricky.

But for your business to truly take off to the next level, you must know your numbers. Whether it is your internal stats like Google Analytics for your website, or your financial numbers (sales, costs, etc.) you have to be on top of it.

Here’s a quick guide to get you started.

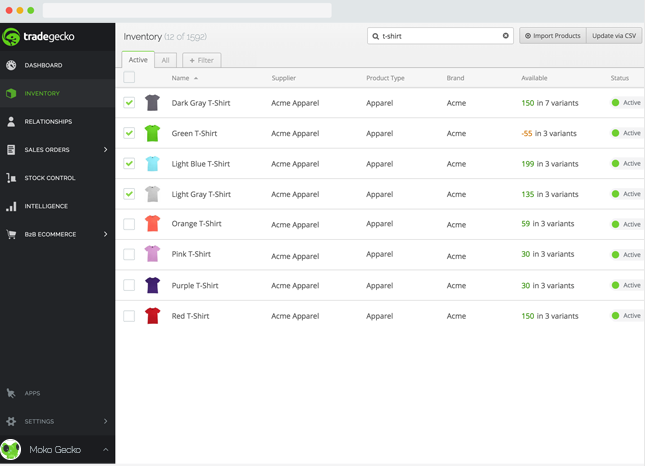

#5 Better Inventory Management

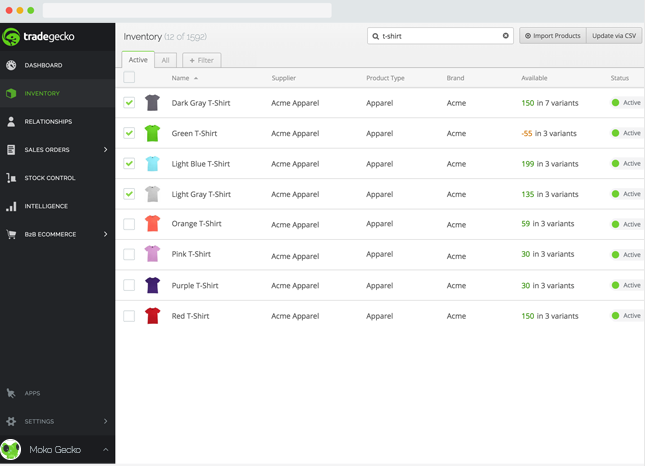

Sample Dashboard of TradeGecko

A small business owner should keep close track of inventory in relation to seasonality because inventory costs can run up to exorbitant amounts despite the fact that it can be managed.

TradeGecko is an app that can help you with that. The cool thing about this app is that it gives you real time data on your phone. You can access your inventory data from anywhere in the world with a few clicks.

It’s highly important that you monitor your inventory because being prepared is always best for business. It might not seem like a powerful way to grow your business, but sometimes even the dirty work that you don’t love to do is key to get ahead.

#6 Cut Down on Meetings

Another quick growth hack for your business is to clearly evaluate the time spent on meetings. Here’s an excerpt from one of our earlier blog posts:

Meetings can often be directionless and unreasonably lengthy. You may find yourself spending an entire day running from one meeting to the next and ending the day having done nothing significant at all.

Whether the meetings are with your subordinates, potential clients or investors, it’s worth pressing the pause button, going through the goals for the meeting and deciding whether they warrant a meeting at all.

It’s important to cut these meetings down if most of the time is spent going back and forth on decisions that have already been made.

A good way to do this is to outline the goals of the meeting beforehand and go back to these goals at the end of the meetings and check if they have been met.

The more time you save on dodging or cutting down irrelevant meetings, the more time you have to actually do things that scale to grow your business.

Read here for more ‘time management hacks’ for business owners.

#6 Keep Your Employees Happy

One of the biggest business secrets in the world is also the most obvious.

Happy Employees = Good for Business

That’s one simple equation that can literally make or break your business. Virgin’s CEO Richard Branson seems to agree.

And because we love you, we’ve made a quick guide to help you crack the formula in making your employees happy. Check it out!

#7 Learn from your Peers

The best way to scale your business is to learn from others who’ve done it. You can achieve this by reading articles from influencers in your space.

Medium is a really nice platform where you can find articles that is related to your industry.

If you want to get started right now, we’ve compiled a list of 16 Entrepreneur Interviews that can give you inspiration and further knowledge to grow your business.

#8 Build a Website for your Business (skip to #9 if you have one)

Did you know that even a completely fake business that has a nice looking website looks more legit than a REAL business that has no website.

Seriously — read this story on how a completely fake business that had no product / real service attracted ready-to-pay customers.

That’s how powerful having an online presence is nowadays. People are more likely to trust a business that has a website and active social media pages than a brand that has no online presence.

So if you’re one of those who still don’t have a website for your business, it’s about time you get one built.

You can head over to Upwork or find a local freelancer if you want to outsource everything. You can find really talented people who are willing to work at an affordable rate.

Go get your website done now!

#9 Build an E-Mail List

Now that you have a website, it’s time to use it to generate more SALES for your business.

Have you checked your email inbox lately and saw tons of emails from Zalora or Lazada, or some restaurants you like? You’re getting their newsletter and promotional emails because at some point in time, you signed up to their email list.

Believe it or not, these businesses are generating a lot of revenue via email marketing — and the best part is that you too can join in on the fun!

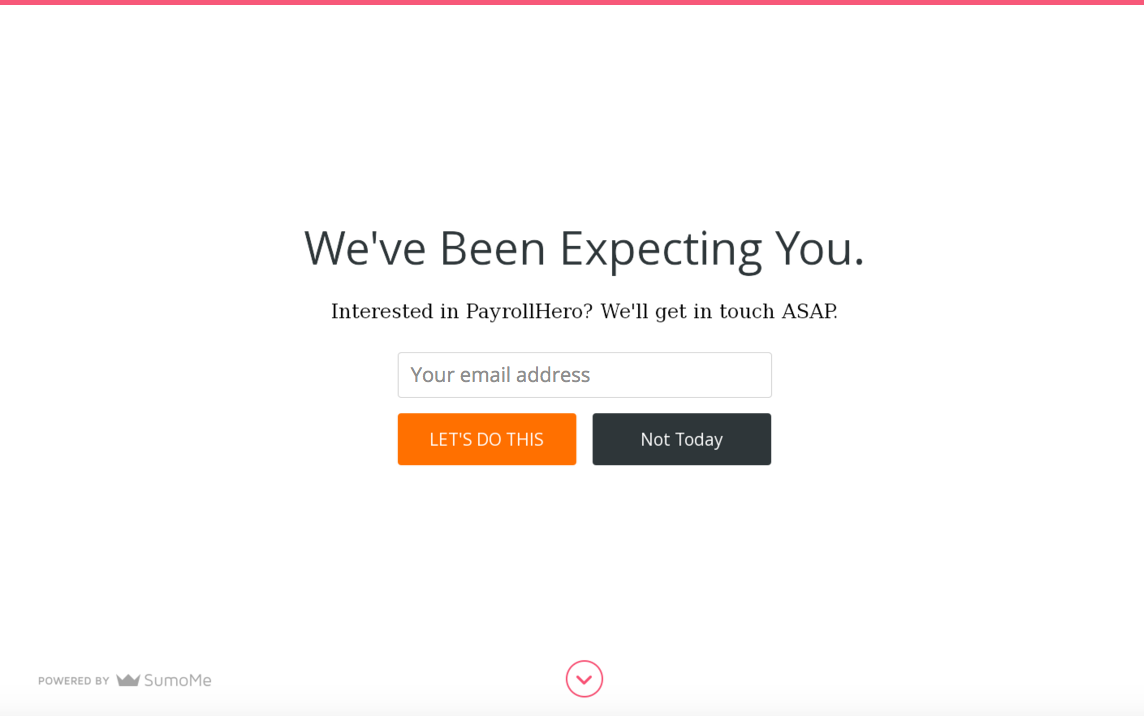

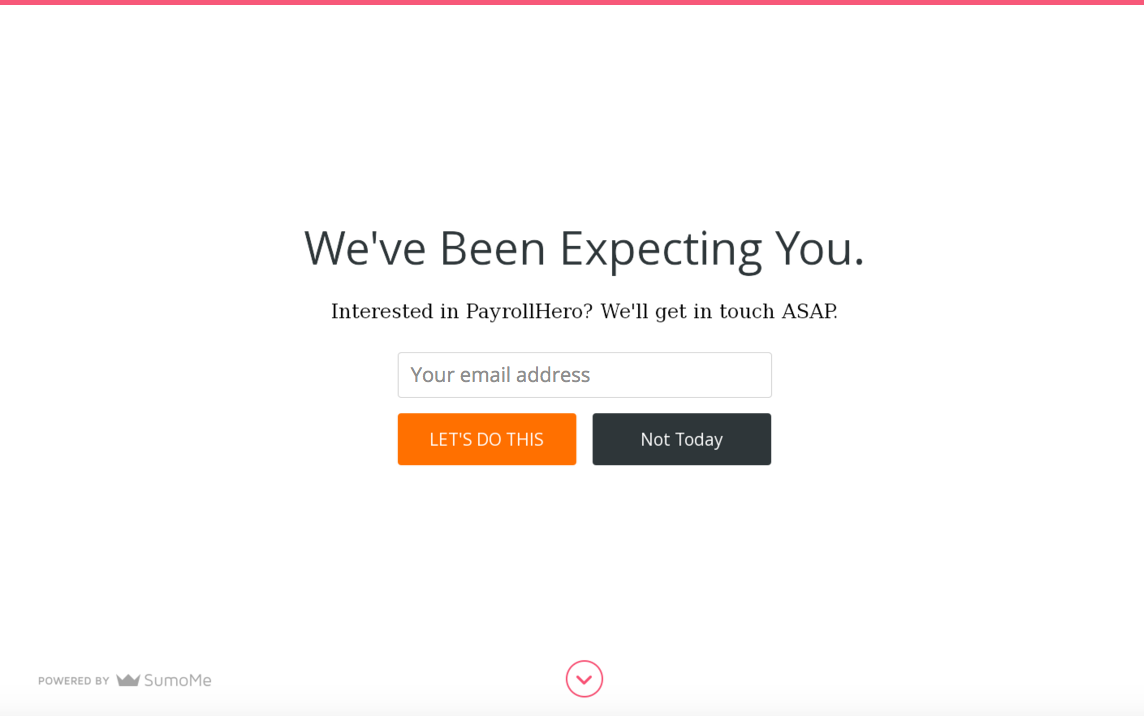

You don’t need technical skills to have it set up on your website. Just signup with SumoMe, a free suite of tools that can help you get more emails. It’s 100% free to use, but for more power, you can always upgrade to their PRO version.

With SumoMe, you can start building email up your email lists. You can set up a Welcome Mat just like one of the few that we use in one of our PayrollHero websites.

Here’s a sample:

There are more variations that you can use to collect more emails using SumoMe. Once you’ve built up a list, you can then send strategic emails to market your product and drive more sales.

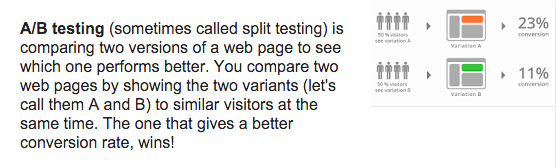

#10 Start A/B Testing

Okay… now this is a term that isn’t usually thrown around in brick and mortar businesses. It’s much more common in the tech space, but that doesn’t mean you can’t A/B test in your business.

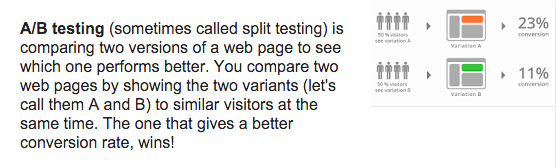

Before we go deeper, here’s a quick snippet on what A/B Testing means.

Yeah, it says ‘web page’. But A/B testing can be done in literally anything you can imagine.

You can A/B test your restaurant menu, your window display, your Customer Support replies on Twitter; the list goes on!

The objective of doing an A/B testing is to make a data driven decision to grow your business. Whether it’s to generate more sales, or to improve how you treat your customers, the main objective is to get the best possible iteration and stick with it.

If you’ve been using the same menu in your restaurant for years, you can start mixing it up and put out new menus. Just distribute a few pieces and observe how your customers react to it. You can conduct a survey on what they think of your new menu to give you more context.

Obviously, the more data you can get, the better. But you can start testing out small things, and eventually you’ll be able to appreciate what it can do to boost your business.

#11 Use Slack

Here @ PayrollHero, we use a ton of tools at work. Aside from email, one of our main communication tools is Slack.

If you haven’t heard of it, check out their website to learn more. But basically, Slack is a communication platform where you and your team can start conversations, share files easily, and host meetings. The true power of Slack though is through it’s various integrations.

You can have a bunch of tools integrated with Slack to help streamline many of your day to day business processes. Here’s a short article on how we use Slack at work to give you a better idea.

If you’re thinking that Slack may not be a fit for your business, then let me tell you that I’ve personally seen a local barbershop using Slack. I was surprised at first, then I realized that it’s just a really powerful tool that allows businesses that operate in multiple work locations to be able to communicate and work together.

Try it out and improve your team’s productivity!

#12 Run Social Media Contests

Remember Tip #1? If you’ve invested enough time building your brand pages and community on Social Media, you can start giving back to your fans.

Who doesn’t want a freebie? Everyone does, and social media platforms are the perfect venues to hold a contest. If you’re kinda on the fence about social media contests, these statistics from Hubspot prove that contests are a huge boost to customer engagement and carving out a loyal following:

- Contests can increase new audiences by 34 percent on average

- A third of entrants don’t mind receiving email updates from participating brands

- Running your contest on mobile increases the number of entrants by eight times

- Sweepstakes (e.g. Instant Win apps) is the most effective way to hold a contest if your goal is to increase fan base (entrants can turn into subscribers) while photo contests work best if you wish to boost customer engagement.

By and large, a social media contest can provide you with these two game-changing benefits:

- Whether you get 50 or 500 entries, contests will generate buzz and drive people to your restaurant’s social media page.

- Once you have this people’s attention, you can collect valuable data (such as email addresses for future newsletters or mobile phone numbers for weekly special reminders) from the entries. Be careful not ask for too many details though.

Running social media contests for your business is a great way to boost your following, increase brand awareness, and attract more customers to your store. You should definitely try it!

READ: Here’s One Cebu Restaurant Who Is Nailing It On Social Media

#13 Organize / Attend Meetups

A quick way to attract more customers to your business is by networking.

Events such as conferences, industry meetups or seminars is a great avenue for you to meet other people and network.

By building relationships with likeminded individuals, you’ll be able to share experiences with each other and learn new strategies to growing a business. You can even take things a notch by collaborating with other business owners in launching cross-branding promos and the like.

A good way to get started is by downloading Meetup. It’s an app that helps you connect with groups / individuals in your space. You’ll be able to attend regular ‘meetups’ and meet new people in the process.

#14 Give, Give, Give, for FREE

In the words of the very successful entrepreneur / marketer Gary Vaynerchuk, you have to ‘Jab, jab, jab, right hook’.

This means that as a business, you have to give, give, give, before you ask. Giving away something valuable for free can go a long way in building customer loyalty. You can’t expect customers to just buy from you all the time if you don’t provide them value.

For restaurants / hotels, this could mean giving out discount coupons, or better yet, giving away free accommodation or a romantic dinner for two. If you can build excitement and give back to your customers, you’ll definitely get some positive reviews online and the word will spread quickly.

And when people start talking about your business in a positive light, you’ll be attracting more and more customers.

So yes — don’t be afraid to give out something for free because you’ll reap the rewards later on.

NOTE: We’re practitioners of this concept, which is why we always do our best to create valuable content and tools that we give away to our valued readers for FREE.

You can check out our Restaurant Knowledge Kit here, and our Service Charge tool here. All yours for FREE!

#15 Exercise Regularly

Seriously.

A study shows that entrepreneurs who exercise regularly are more likely to be successful. So don’t take it for granted and start allocating 30 minutes up to an hour a day for exercise.

You can hit the gym, or take a 30 minute swim; whichever you prefer. The healthier you are, the better decisions you make at work.

#16 Use Snapchat

Snapchat is one of the fastest rising social media apps of all time. It hasn’t reached Facebook’s level in the Philippines yet, but Snapchat is trending upwards quickly.

Snapchat users are primarily teens up to 26 years old. If your business is targeting this age range, then you should be making efforts to market your business on Snapchat.

In the Philippines, Snapchat isn’t widely used by brands yet, so you have a chance to be one of the top pioneers of Snapchat marketing in the Philippines. It’s definitely worth a try.

#17 Attract Top Employees

If you want to grow your business in the Philippines, then you definitely need a huge dose of talent to help you get there.

We made a blog post on how to attract top employees for your business. Be sure to check it out and apply some of the tips when you start hiring people.

Speaking of hiring… One of the best ways to do that right now is through Kalibrr.

Hiring top talents is made easy with Kalibrr. You can get started and post your first job for FREE.

Try it out and watch the applications come in.

#18 Ask your Employees for Advice.

Ha! Why would a manager do that? Isn’t it supposed to be the other way around?

Social psychologist and author of Influence: The Psychology of Persuasion Robert Cialdini offers one seemingly counterintuitive yet effective suggestion to making your employees like you: Ask them for advice. This could range from personal advice like book recommendations to professional advice such as asking their opinion about social media platforms that they deem are ideal for your digital marketing campaign.

By and large, this gives the impression that you, as a manager, value their opinions. Bonus points if you follow their advice and update them that you’ve done one of their suggestions!

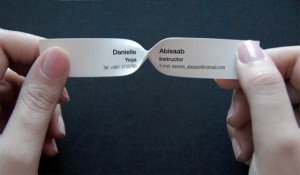

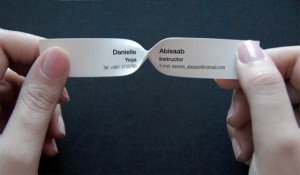

#19 Business Cards – Give and Receive

It’s 2016 and yes, business cards are still a thing. Although there are now apps that can house business cards in the cloud, the act of giving and receiving physical business cardsare still appreciated by entrepreneurs / execs.

The idea of business cards stem from networking. Building relationships is still a very important part of growing a business. You can’t expect to take off and grow at a rapid scale without having built strong business relationships along the way.

Image from – http://www.cardfaves.com

Now… how exactly can this help you? First, you have to make sure that you have a healthy stock of them.

Next, make sure your employees have business cards too!

They have lives outside of work — they go out for drinks and meet people. Wouldn’t you want them to hand out a business card with YOUR LOGO and YOUR BUSINESS NAME to new people they meet? It could open up a door of possible opportunities for your business.

Isn’t that much better than just having yourself do the networking for you?

We’ve prepped up a nice little guide to help you make your business card stand out.

#20 Empower Your Employees

There’s no better brand ambassador for your business than your employees. Make sure that they are heard and empowered in your company.

Motivate them, understand them, and hear them out. Sometimes employees aren’t as engaged and focused because they don’t feel that you trust them or they’re not being given a chance to showcase their skills.

READ: 3 Reasons Why Employees Get Bored

The best you can do is to talk to them and motivate them. Ask them what you can do for them.

Once you know what’s on your employees’ mind, you can then help them reach their full potential. Sometimes, growing your business should start from within.

#21 More Days Off

This applies for both you and your employees.

Now, before the pitchforks start coming in, understand that in order for you to be at your best, you also need to unwind and relax a bit.

You can’t keep up the 24/7 grind and not burn out. The same goes for your employees.

So if you want to grow your business this year, you MUST take vacations.

You can even organize a company-wide retreat so you and your employees can bond, relax, and clear their minds. After that, you can expect a more vibrant and rejuvenated team that’s ready to work harder than ever!

VIDEO: PayrollHero Leave Management in Action

#22 Sponsor Events

Depending on what industry you’re in, you might want to consider hopping into Events Marketing.

Here in the Philippines, there are more and more rave parties and events happening almost every day. There are beach parties, club parties, you name it.

If you’re a fashion brand in the Philippines, you should consider being one of the main sponsors for such events. This can give your brand huge exposure from potential customers. Not only that, you can also generate sales in these events because most event organizers will allow you to put up your own stall in the event venue.

You can easily recoup whatever amount you spent to get into the event just on on-the-ground sales alone. And after the event? You can expect more prospects checking out your page / website thanks to the exposure you got.

#23 Maintain a Record of Expenses

As mentioned in tip #4, you can’t grow your business if you don’t know your numbers. This is why it’s very important to maintain a record of your expenses.

All too often, we start the year enthusiastically, taking not of expenses and filing them meticulously to find ourselves a month later struggling to keep up with our expense records.

It is easier with some help. Apps like Expensify or Mint help you keep track of your accounts, expenses and income. If you are a small business owner, these apps are a good place to start.

Of course, as you grow bigger, you will have to move to accounting software that can keep up with the growth of your business.

#24 Join the Conversation on Twitter

Twitter is a great platform to learn more about your customers. If you use it right, you can really take advantage of its powerful search tool.

You can join any conversation on your space and attract potential customers.

Imagine an angry customer of Restaurant X. The angry customer didn’t enjoy the super expensive burger he ate. Now, as a burger chain yourself, you can then hop right in and tweet the said angry customer — offer him a free burger if he visits your store on the same day.

Doing that not isn’t only good for publicity… You can also potentially earn a loyal customer for life!

That’s just one way of using Twitter for growing your business. We’ll go deeper into this in future blog posts.

#25 Use Chat Apps for Customer Support

It’s 2016, and by now you should be more accessible to your customers more than ever.

People naturally hate waiting, so a displeased customer isn’t too happy waiting for an answer to their concerns via email.

A good way to make your business more accessible to customers is by using Chat apps. You can either set up a Zopim chat box on your website, or use Facebook Messenger so that customers can chat with you in real-time.

If you don’t really have staff who can man the Chat account 24/7, you can use Twitter instead.

#26 Automate Your Internal Processes

If there’s anything at all that your company is still doing manually, it may be time to reevaluate your processes.

Thanks to technology, a lot of internal processes can now be streamlined and automated. So if there’s still something in your business that takes up too much manual labor, such as doing payroll, it’s best to outsource it or simply use a service to make your life easier.

PayrollHero offers a complete end-to-end solution to your time, attendance, HR, and payroll processes. We help businesses grow by giving them back one of the most important assets they have.

PayrollHero offers a complete end-to-end solution to your time, attendance, HR, and payroll processes. We help businesses grow by giving them back one of the most important assets they have.

#27 Trimming the Fat

No, I’m not urging you to lose weight…

What I mean is that you should start re-evaluating your company from top to bottom. This doesn’t mean you have to fire your employees left and right. What you should be doing is really taking time to look into the different challenges that your employees are facing.

Are some of them doing work that they’re not supposed to do? Should you be cutting down on a few tasks that can easily be outsourced? Is there someone who is unhappy in your organization?

You have to wear the HR hat and clean things up because there might be something going on internally that is hindering your company from getting to the next level.

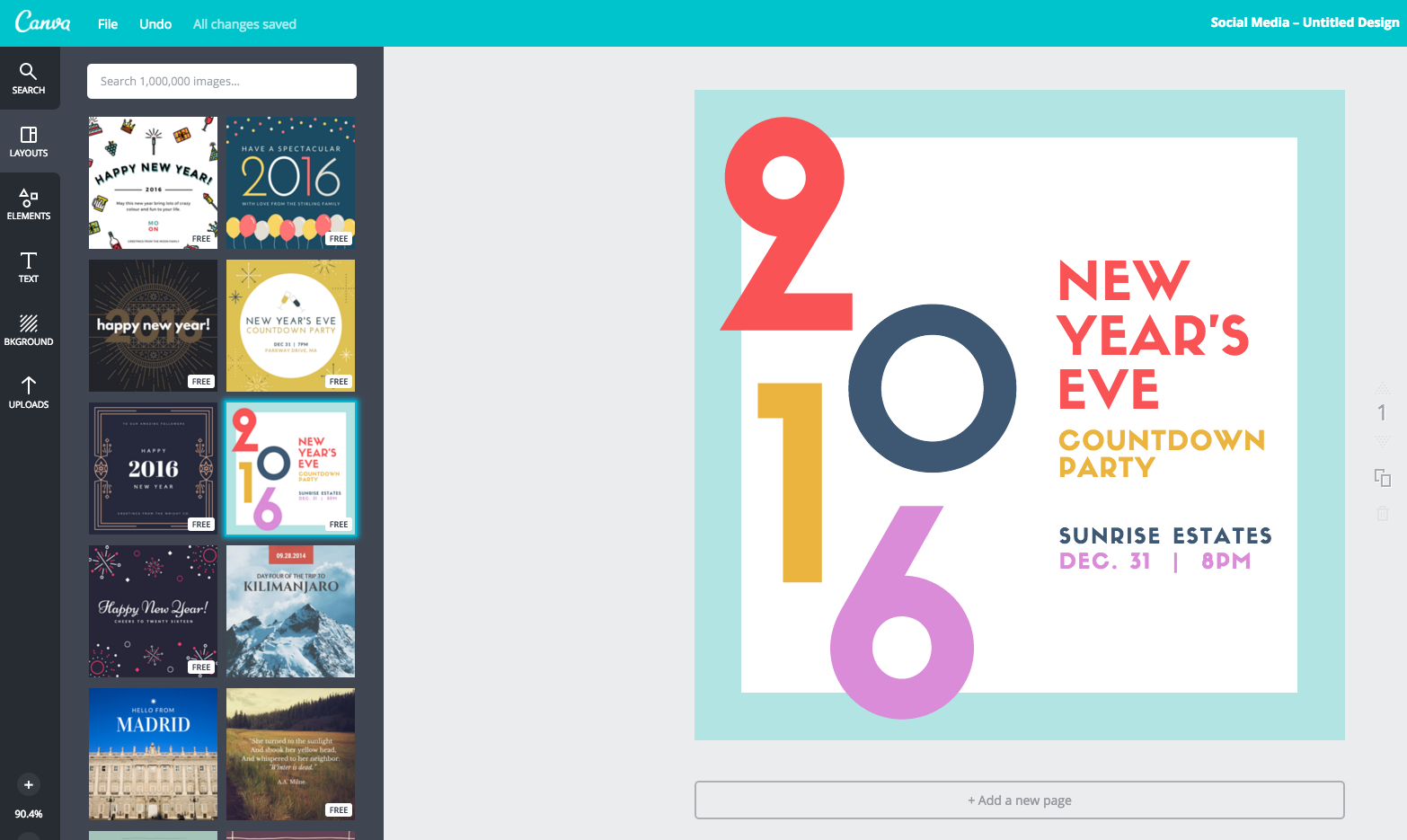

#28 Incorporate Great Graphics using Canva

For your business to stand out this year, you need to produce more visually appealing content.

Thanks to Canva For Negosyo, you don’t need elite photoshop skills or a Graphic Designer on your payroll to produce high quality and visually appealing images.

Canva in action.

As you can see in the image above, there are lots of free templates to choose from. You can also upload your own image, and add your own caption with tons of fonts to choose from.

Here’s me adding a caption to an image I uploaded. It’s simple and easy, you can do it in less than 5 minutes!

And the best part is that all of that is 100% FREE. Canva does offer a paid business version if you want to take things up a notch, so do check out their website for more details.

#29 Take Action

Reading through this blog post won’t get you anywhere unless you take action.

One bad habit of people is that we tend to consume too much content, but get lost in the shuffle at some point. We either don’t follow through and take action, or we simply forget it altogether.

Now for you to truly grow your business in the Philippines, you must learn how to act fast and take action. This doesn’t just apply to following the tips laid out in this article, but moreso in making business decisions.

You have to be decisive, smart, and ready to get your feet wet. The only thing that’s standing between you and success is not taking action.

So go out there and take that leap you need to help your business grow!

Okay, that’s the last pun I promise!

Please tell us your thoughts on this! We’d love to hear from you.

Good luck with your business and may you make the most out of this 1 extra day of February 2016!

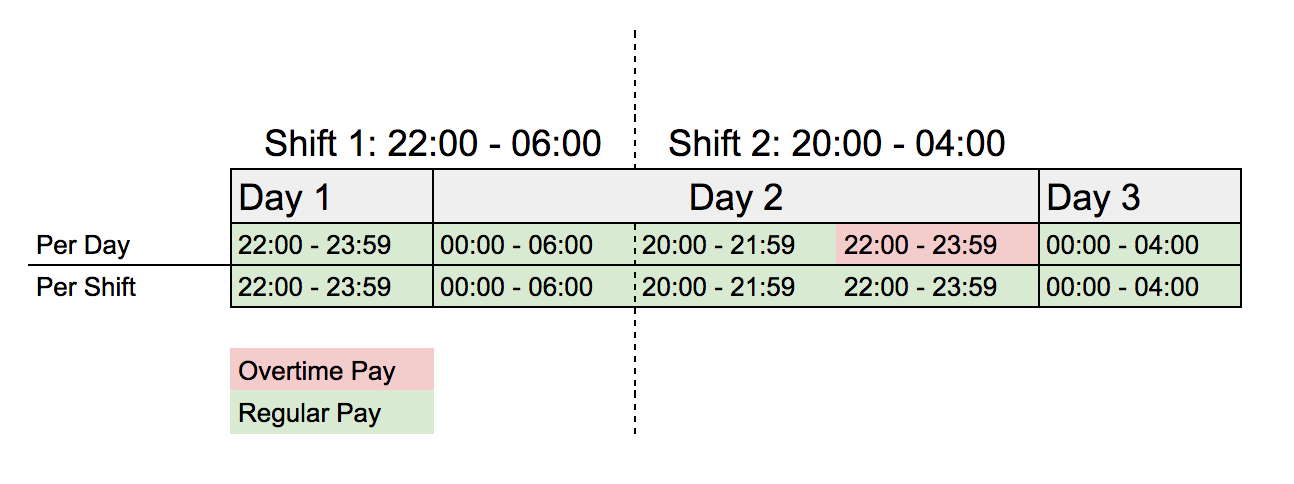

We have rolled out a new feature that will come in very handy for our BPO (Business Process Outsourcing) clients – per shift overtime.

We have rolled out a new feature that will come in very handy for our BPO (Business Process Outsourcing) clients – per shift overtime.

PayrollHero offers a complete end-to-end solution to your time, attendance, HR, and payroll processes.

PayrollHero offers a complete end-to-end solution to your time, attendance, HR, and payroll processes.