UPDATED: Jan 2018 to reflect TRAIN.

UPDATED: Jan 2018 to reflect TRAIN.

Interested in PayrollHero? Sign up today and get 90 days free! – USE PROMO CODE 90UBABP2018

If you are in HR and Payroll you probably already appreciate how daunting a subject benefits and allowances (B&As) can be in the Philippines. What are you allowed to pay? What benefits are De Minimis or have a tax shield? Why are their multiple columns on the Alpha List for benefits?

It can be even more overwhelming if you are new to Philippine payroll. Whether you’re starting your payroll career, or you’ve recently opened a new business in the Philippines the learning curve can be pretty steep.

At PayrollHero we have a ton of experience helping customers decide what benefits they should give their employees and helping them create the policies that govern them.

What are Benefits and Allowances?

Usually employee benefits are not actually cash. They are the additional non-cash incentives you would provide to your employees over and above their salary compensation. However, in the Philippines the line has been blurred by De Minimis benefits. That said, let’s take a very quick look at the history of De Minimis benefits.

Historically they were in fact incentives provided over and above cash compensation. The rice subsidy was, and still can be, an actual 50kg bag of rice given to the employee each month. Employers can choose to provide uniforms or pay a uniform allowance. At some point, DOLE allowed the cash equivalent of the 50kg bag of rice to be paid to employees instead of the employer having to provide the actual rice.

My guess, they made the change because of the logistical nightmare companies faced trying to distribute bags of rice when operating multiple locations or employing large numbers of people.

As for allowances, they are a type of benefit. They are an amount of money you give to employees for a certain purpose. When we are talking about employees, allowances are always benefits but benefits are not always allowances.

General Best Practices

Before I go on, let me say, if you currently provide B&As to your employees and don’t adhere to the principles below, don’t panic. If it works for you then great! This is meant to inform your policy creation, not dictate it. You will know better than I what is right for you and your employees.

The KISS Principle

Honestly, in my opinion, this doesn’t only apply to B&As but everything in life. KISS stands for Keep It Simple, Stupid. The principle was originally conceived by the US Navy in the 1960s and, yes that’s right, I kind of just called you stupid 😛 .

The US Navy originally created the principle for their design process when creating new seafaring craft. At it’s core, KISS is about removing unnecessary complexity when designing something new.

I get it, you’re probably thinking, “well that’s all good and well, but I’m not trying to design an aircraft carrier.” Of course not, but even though you might not think of your benefits and allowance policies as “design” work we are still creating something new.

I mention this because a lot of employers, and especially new ones, have a tendency to create complex policies for B&As. A great example of this is COLA. COLA stands for Cost of Living Allowance and is a Department of Labour and Employment (DOLE) mandated benefit.

DOLE says that COLA should be paid at 10 pesos a day to non-agricultural minimum wage employees. It should also be paid to the same employees on regular holidays even if they don’t work the holiday, or if they take a paid leave.

To me that’s a pretty simple policy for you to add to your HR manual.

Example: “A Cost of Living Allowances (COLA) of 10 pesos per day will be provided to all minimum wage employees. COLA will be paid on Regular Holidays even if the employee is not scheduled to work. COLA will also be paid to any minimum wage employee on paid leave.”

However, a lot of employers try to incentivize or penalize the benefit. They want the amount to fluctuate if the employee is late/early to work, get extra if they work overtime etc. So, why is this a bad thing?

First of all, penalizing COLA might actually mean you are not following the rules DOLE have outlined. It clearly states you need to pay 10 pesos of COLA a day to minimum wage employees. There is no provision in the handbook that says “You can pay less if the employee is late to work.” So from a compliance angle this may cause you problems.

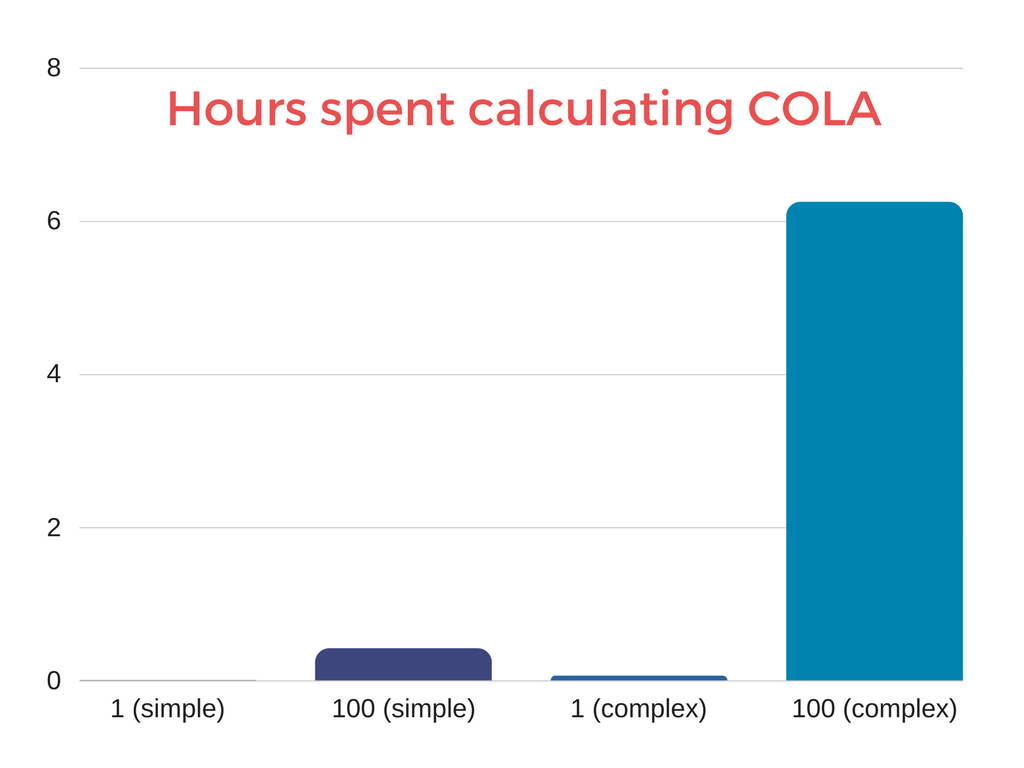

Secondly, you are creating additional administrative work for your payroll department. It’s a much easier for them to count the amount of days an employee has worked, than have to look at the attendance of each day and calculate individually what amount they need to pay. The former is 1 calculation per employee per payroll, the latter is 15 per employee.

Now, this might seem insignificant if you are just starting a company, but it will become more apparent at scale. Let’s say that the calculation takes 15 seconds for your payroll department to compute, and you have 100 employees. For the simple COLA calculation that would take your payroll team 25 minutes to compute. Whereas the complex calculations could take a little over 6 hours.

Even if you never plan to have a lot of employees, wouldn’t your employees time be better spent focusing on higher value work?

You might be reading this article as an existing HR or Payroll Admin. Have you been trying to figure out why your payroll process is taking you so long to complete? Think about your current payroll process, do you have unnecessarily complex policies that require you to do a ton of manual computations?

And sure, you could get a system like ours that allows you to automate a lot of your allowance calculations, however there is still an overhead required in having to support these policies with your employees. Overly complicated policies create more questions. If an employee sees an amount on their payroll that they don’t understand they are going to call your HR team to try and understand how you arrived at that amount.

ContactBabel conducted a study of services calls to contact centres in the US. The average call duration was 6 minutes per call. Even if only 10% of your employees are confused that’s potentially two hour of lost time per payroll or 52 hours per year. How did I arrive at those numbers? Remember, an internal phone call requires two of your employees to be on the phone. If your employees have to call HR that’s lost time that they could have spent focusing on working on your business.

More is Less

So how do we practice KISS but still provide a comprehensive benefits package to our employees? We can do this by providing more simplified benefits to employees. Let’s revisit the complex COLA above.

We wanted the COLA amount to fluctuate if the employee is late/early to work, get extra if they work overtime etc.

This might surprise you but there is potentially 3 different policies here, and one of them isn’t a benefit!

- Fluctuate if the employee is late: This should be a separate attendance policy (it’s not a benefit) that states how you penalize employees for not arriving to work on time.

- Fluctuate if the employee is early: It would be best to have a separate policy that stipulates how you reward employees for arriving on time.

- Get extra if they work overtime: You may want to update your overtime policy to have a clause for minimum wage employees or a separate overtime policy for minimum wage earners.

This will make your HR policies easier to understand for everyone. This means training new HR and Payroll team members will take less time, there will be less questions from employees and your HR policies will be easier to maintain.

I’m in no way saying give less to your employees, I’m advocating to structure it in a way that is simple and makes sense. It will lead to better transparency and happier employees. It will also be a lot easier to scale.

De Minimis Benefits

Ok, so now we’ve outline what benefits are, and the general rules for creating the policies around them. Let’s take a quick look at the specifics of what the government already stipulates for you in the Philippines.

The government consider the following to be De Minimis benefits:

- 10 days monetized unused vacation leave credits;

- Medical cash allowance to dependents of employees not exceeding P750 per semester or P125 per month;

- Rice subsidy of P1,500.00 or one-sack of rice per month;

- Uniforms and clothing allowance not exceeding P5,000.00 per year;

- Medical benefits not exceeding P10,000.00;

- Laundry allowance of P300 per month;

- Employee achievement awards in the form of tangible personal property other than cash or gift certificate, with an annual monetary value not exceeding P10,000 received by the employee under an established written plan;

- Flowers, fruits, books or similar items given to employees under special circumstances, e.g. on account of illness, marriage, birth of a baby, etc.

- Daily meal allowance for overtime work not exceeding 25% of the basic minimum wage.

The De Minimis Benefits are a great place to start if you are trying to figure out how you can reward your employees over and above their standard salary package. This is because the government endorses these benefits and provides tax shields specifically for them.

Taxes

Why do we need to discuss taxes? I’ve already included the exemption amounts above right? Yes, if you keep your allowances below the amounts above you will have no complications calculating taxes, but there is a bit more to how taxes and benefits work together. As with most aspects of Philippine payroll it’s not completely black and white.

In the Philippines the De Minimis Benefits are the only benefits that are allowed to be provided to employees tax free. Any employer can provide these to their employees and not deduct taxes up to the amounts mentioned above.

However, employees in the Philippines also have a general tax exemption for “13th month and other benefits”. Currently you are allowed to pay employees 90,000 pesos a year under 13th month and other benefits without deducting taxes.

Contrary to popular belief the “other benefits” is not a blanket catch all for any other benefits you decide to give to your employees. It’s actually for the De Minimis Benefits mentioned above.

Let’s use an example to illustrate this. Timmy is our Rank and File employee. The company he works for gives him 2,500 a month as a rice subsidy and he received 25,000 pesos for his 13th month this year.

When we are doing Timmy’s end of year benefit tax calculations they might look like:

Government Rice Allowance: 1500 x 12 = 18,000

Rice Allowance paid to Timmy: 2500 x 12 = 30,000

Rice Allowance overage: 30,000 – 18,000 = 12,000

De minimis Benefits = 18,000

Non-taxable 13 month and other benefits = 25,000 + 12,000 = 37,000

However, let’s say Timmy actually received 80,000 in 13th Month and the same 2,500 a month in rice subsidies. His calculations would look like:

Government Rice Allowance: 1500 x 12 = 18,000

Rice Allowance paid to Timmy: 2500 x 12 = 30,000

Rice Allowance overage: 30,000 – 18,000 = 12,000

General Tax Shield overage = 92,000 – (80,000 + 12,000) = -2,000

De minimis Benefits = 18,000

Non-taxable 13 month and other benefits = 90,000

Taxable 13th month and other benefits = 2,000

Timmy will have to pay tax on the 2,000 pesos that he received over his 90,000 general tax shield.

Now in our example Timmy was a rank and file employee. This means he only pays the regular income tax rate on any benefits that exceed his 90,000 tax allowance. If Timmy was a managerial employee he would be subject to a fringe benefit tax. Currently the fringe benefit tax is 32%.

What is best for your employees?

As I mentioned at the beginning, you need to make decisions about your compensation package that is right for your business and it’s employees. Different employees have different needs. A 30 year old mother of two has far different needs to an 18 year old fresh grad. Ultimately, you want to make sure you are listening to what your employees want and juggling that with the resources you have at your disposal.

My hope isn’t that this article will change the benefits that you offer your employees, but it will alter your approach when structuring them. Just remember:

- Simple policies are easier to maintain, deliver to employees, easier to process and will save time & resources.

- Instead of having fewer complicated benefit policies try and have more simpler ones.

I think if you adhere to these two rules when creating your compensation packages you will be able to provide your employees with everything you want to, but in a way that makes the administrative aspects far easier to maintain.

Please let me know if you have any questions in the comments below. Thanks!