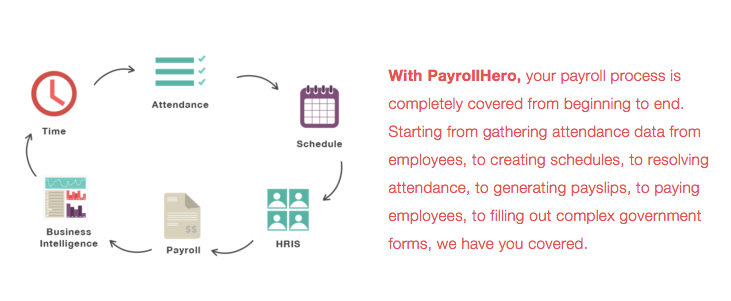

If you’re reading this, you’re probably aware that we are a time, attendance, and payroll solution that meets your company’s needs. That’s true.

But let’s move away from that for a while and let’s look deeper into what PayrollHero truly is.

You see, PayrollHero is a cool app that lets you clock in to work with a selfie, and generate payroll with just a few clicks. That’s one of our biggest selling points, and one of the biggest reasons why our clients love us.

But that’s not why our product is genuinely enjoyed by some of the best companies in the Philippines and Singapore.

The real reason why our product is valuable to your business is because we save you time.

Time Management Redefined

Beyond the #selfie clock ins, facial recognition, leave management feature, and many more, what PayrollHero wants more than anything is to give you back the time you lose from outdated time, attendance, and payroll methods.

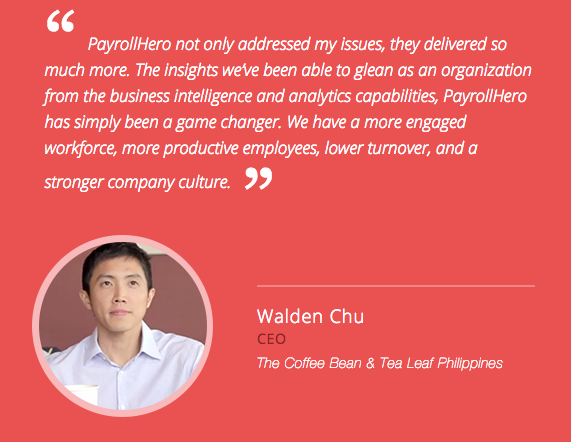

One of our clients, The Coffee Bean and Tea Leaf Philippines, shared their experience on how PayrollHero makes their payroll processes faster and more efficient.

Here’s a snippet from CBTL’s CEO Walden Chu:

“We wanted a payroll solution that was cloud based and built for the Philippine business environment, PayrollHero was exactly what we were looking for and took our payroll processing time for 700 employees from 16 days to 5 minutes” – Walden Chu, CEO, The Coffee Bean & Tea Leaf Philippines

WATCH: Walden Chu’s Testimonial on How PayrollHero Helps Their Business

16 days to 5 minutes.

That’s 144 working hours (or more, due to OT) brought down to just 5 minutes. I don’t know about you, but that’s A LOT of time saved.

And that’s not all… The time that our ridiculously efficient product saves results into a world of other benefits for businesses.

Time Saved Results to Happier Employees

Because time, attendance, and payroll becomes easier to do, employees who act as primary stewards of these processes are taken a huge load off of their shoulders.

It’s not a secret that HR staff, payroll administrators, and accounting / finance employees are the ones that are most affected by the hassles of traditional payroll processes.

With PayrollHero, these employees can relax and focus on other important aspects of their work such as recruiting and employee engagement (for HR), and internal audit / accounting for those in Finance.

The system was not made to replace these employees, but rather, to help them become more efficient and less stressed with the rigours of traditional payroll. A more streamlined, easy, and hassle-free payroll solution can make these employees less stressed and happier at work.

Happy Employees are Good for Business

It has long been proven that happy employees are the best brand ambassadors you can ever have.

The happier your employees are, the more energized and motivated they are to work; and those little things eventually add up. Your customers will notice how happy and engaged your employees are, and this in return, causes them to love your brand even more.

Word of mouth referral goes a long way in growing your business. So the happier your employees are, the more customers you will attract. It’s a domino effect that you can take advantage of.

Beyond Business

Of course, making employees happy isn’t just done to boost your profits. As an employer, it’s important to always put a premium to your employees’ happiness.

With PayrollHero’s selfie clock in, we are able to help your employees start the work day with a smile.

Check out this video of how employees clock in and out of work using PayrollHero’s TeamClock App:

Not only do employees start the work day with a smile, they also clock out happily as they get ready to come home to their loved ones.

The overall mood of employees skyrocket, and because of this, their personal lives improve as well.

Right Person. Right Place. Right Time.

Not only does PayrollHero save you time; we also save you money.

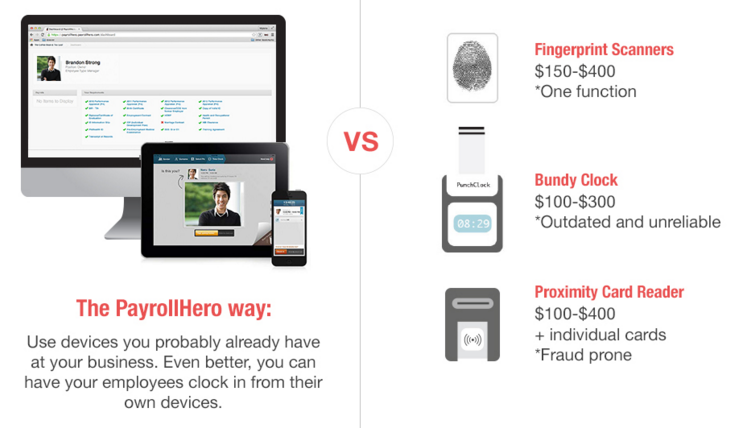

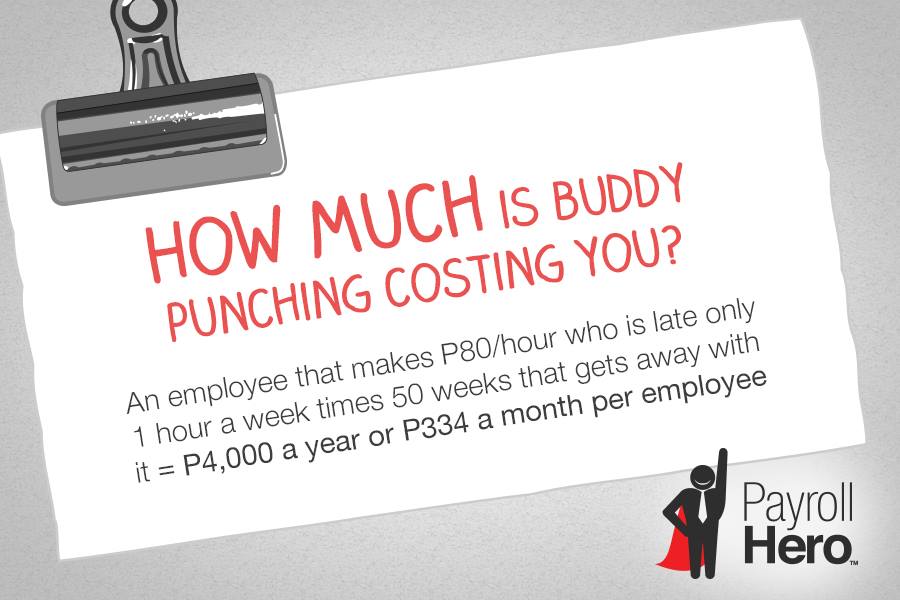

Biometrics and time cards for time and attendance can be tricky. For one, it can easily be gamed by dishonest employees. There’s the case of buddy punching and ghost employees that is pretty much prevalent in the Philippines.

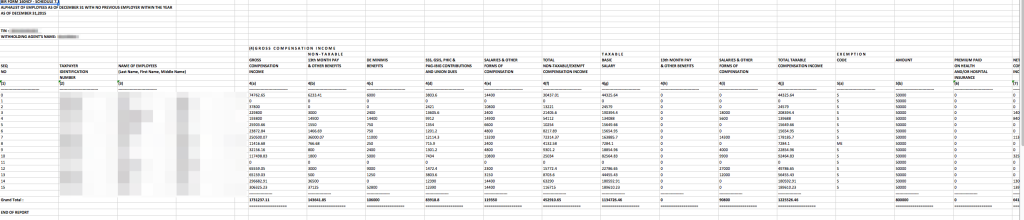

Take a look at how much money you can lose just because of buddy punching:

Even if you only have 1 buddy punching employee (which is very unlikely), you’ll be losing P4,000 a year! Now, in most cases, for companies with a very unreliable time and attendance process, buddy punching is more common.

If you had 500 employees, and 10 of them are regular buddy punchers, you could lose as much as P40,000 a year.

With PayrollHero, you are LITERALLY free from buddy punchers because our system makes sure that the right person clocks in at the right place, at the right time.

You can learn more about Selfies vs Biometrics in this post.

Time to Make a Change

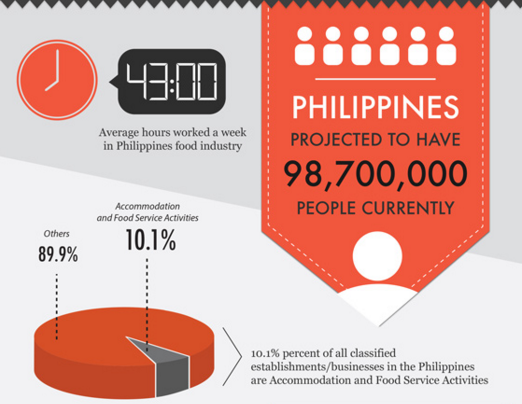

If you’ve made it this far down, then I can only assume that you are considering PayrollHero for your business. Whether you are running a restaurant in the Philippines, or a retail store in Singapore; or even any business in Asia, there’s just so much PayrollHero can offer for you.

Handling time, attendance, and payroll for your business will never be the same once you go for PayrollHero.

It’s time to make a positive change for your business. Let us help you save money, and most importantly, save precious time for you and your employees.

If this is something that you’re interested in, we’d love to chat with you. You can contact us at sales@payrollhero.com or visit any of our websites: Philippines, Singapore, Global, to learn more.