Thirteenth Month is a mandatory benefit that all employers in the Philippines need to provide to their rank and file employees who have been employed at their company for longer than one month. I put rank and file in bold as it’s fairly common practice to pay it to all employees, but that’s not mandated by the government. However, it has become traditional for employers to pay the benefit to all employees.

The Labor Code in the Philippines stipulates two distinct employee types. Managerial or Rank and File. The DOLE handbook says:

The Labor Code, as amended, distinguishes a rank-and-file employee from a managerial employee. A managerial employee is one who is vested with powers or prerogatives to lay down and execute management policies and/or to hire, transfer, suspend, layoff, recall, discharge, assign, or discipline employees, or to effectively recommend such managerial actions. All employees not falling within this definition are considered rank-and-file employees.

The above distinction shall be used as guide for the purpose of determining who are rank-and-file employees entitled to the thirteenth month pay.

It’s a pretty easy definition to digest. Anyone who makes managerial decisions or has the managerial powers described would be considered a managerial employee. Anyone who doesn’t is rank and file.

There’s three components to thirteenth month you should be aware of.

- How much to pay

- When to pay it out.

- Over what period to calculate

In this article I’ll explain a bit about all three, and some ways you could consider approaching your thirteenth month calculations.

How much you should pay

The name does hint at what you should be paying. Your thirteenth month pay is roughly equivalent to your normal monthly take home. However, it’s not exactly the same. It’s also important to be careful if just paying out one month is your current formula. There is one scenario where this would mean you’re not compliant with the rules of 13th month, I’ll go into this below.

It’s also important to remember that the DOLE formula is the minimum amount you can pay. If you have a formula that pays your employees more than this, great! Looking after your employees is awesome, and having better benefits differentiates your company from others. This should ultimately help you attract the best talent.

The DOLE Formula

DOLE states that thirteenth month pay shall not be less than 1/12 of the total basic salary earned by an employee in a calendar year. Which is as simple as it sounds as long as you know what constitutes basic salary.

Basic salary is not base pay. Base pay is the monthly, hourly or salary rate that you detail in an employee’s employment terms. If you are not familiar with these terms, please read about the four components of payroll. It’s important to know what base pay is. Although they are not the same, it will be a key component of your calculation.

Let’s say you have a monthly paid employee who is contracted to earn 20,000 pesos a month. They work for your company for the entire year. That means their base pay for the year was 240,000 pesos. Even if your employee was absent during the course of the year, their base pay is still 240,000 pesos.

However, basic salary does adjust based on what you actually paid the employee. If the employee was absent one month, and you only paid them 15,000 that month their basic salary would be 235,000. You also would not include the following:

- Benefits

- Vacation Leave and Sick Leave paid out (these are a benefit)

- Allowances (including COLA)

- All Multipliers including overtime, night differential, holiday pay etc.

There is a caveat for this though. If you do include these as part of your basic salary through any agreements or company policies you should be including these in your 13th month calculations.

The Steps

- Figure out the basic salary for each month.

Base pay for the month – any absences or base pay deductions = basic salary - Repeat for each month

- Add all of the basic salaries for each month together

- Divide the total amount by 12

The Gross Pay Formula

As mentioned above, as long as you pay your employees the DOLE minimum you will be covered from a compliance angle. However, there are better formulas you can use for both your payroll process and your employees. The gross pay formula is probably the easiest and fairest.

Gross pay is your base pay + any additional multiplier pay – absences and any other base pay deductions. Why this is so easy is because you already calculate this every payroll. Why this is good for your employees, is that although you are deducting their absences you’d also be giving them a portion of any multiplier pay as well.

The Steps

- Add all of the gross pays for the year together

- Divide the total amount

The Base Pay Formula

If you read my post about understanding benefits and allowances you will know that I believe simplicity in your payroll processes and policies is crucial to an streamlined payroll process. So the base pay formula is my personal favourite.

As you are not deducting any absences or base pay deductions you’ll be paying better than the DOLE minimum. It’s simple because there is only one step to this calculation.

The Steps

- Divide the contract value of the employee’s base pay by 12.

Employee’s Most Recent Salary

I mentioned this briefly before, but some companies do just pay an additional one month’s salary to their employees. This is usually completely fine, and generally won’t cause you any problems.

If the employee earned the same amount of money each month during the year this is exactly the same as the Base Pay Formula mentioned above. If your employee received a promotion, and you pay them their most recent month’s salary you’ll be paying them more than a 1/12 of their year’s base pay.

The only time you need to be careful is if you were to give an employee a demotion or reduce their salary. Let’s say you’re employee earned 20,000 a year but in November you reduced their salary to 15,000. You then paid them 15,000 as their thirteenth month.

If that employee earned 20,000 for 11 months their base pay is at least 220,000 pesos for the year. If you divide that by 12 it would equal 18,333.33. Which means you will have underpaid your employee for their 13th month and not be compliant with what’s mandated by DOLE.

Other than that this is a perfectly acceptable way to calculate your 13th month.

The Steps

- Pay your employee an additional month’s pay

Manually calculating or using excel

If you are not using an automated payroll system like PayrollHero and use, or intend to use, one of the calculations above that require you to calculate or the track a monthly amount. I would advise doing this calculation each month. It will save you a ton of time in the long run.

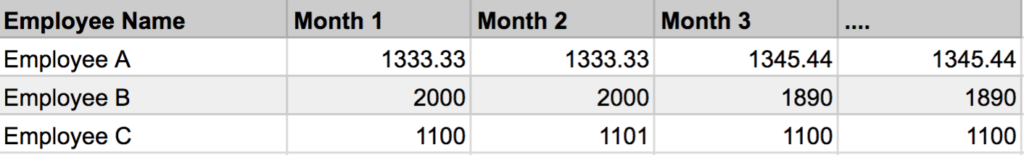

If you use excel, you will probably want a separate spreadsheet or sheet to track these amounts in. It doesn’t need to be complicated, just a simple tracker like the one below

If you intend to use multiple spreadsheets, check out the =importrange formula. You could have the 13th month amounts on your main payroll calculator spreadsheet for each month, and use this formula to make them appear in your 13th month tracker.

When to pay 13th Month

When to pay dictates the period you should be calculating for. This is why we need to clarify this point first. The DOLE handbook is explicitly clear about when you need to pay it out.

“The thirteenth-month pay shall be paid not later than December 24 of every year. “

Example, if your pay period is the 1st – 15th, 16th – 31st and you pay out 15 days after the pay period ends. You would need to pay this out no later than the 16 – 30 November payroll.

Why? Because the payout date for 1 – 15 of December would be the 30th of December, which is 6 days past the deadline.

So be careful, it’s not the pay period that matters here but when your employee receives the money that’s important.

You are also allowed to pay out the 13th month twice a year. Instead of paying the value of 12 months in December you could pay the value of 6 months twice.

What period should be used for calculating?

This is probably the part that causes most companies problems. You’re supposed to pay 13th month for the previous year, and the DOLE handbook does use the term calendar year when describing the 13th month.

But how can you pay 13th month accurately for the calendar year if the year isn’t even finished? Remember we have to pay it out on the 24th of December, which in a best case scenario is at least one payroll before the end of the year. You can’t, it’s not possible.

But, most companies do pay 13th month based on the calendar year of the current year. So what this means is they guess the last part of the year. You should not guess when it comes to payroll.

So what do we do instead? We need to pay for the calendar year and it has to be out before the 24th of December. Don’t worry, the important part here is that the DOLE handbook actually says a calendar year.

So let’s say your pay period is 1st – 15th and 16th to 31st. You pay out your payroll on 7 days after the pay period ends. In this scenario you could pay out your 13th month on the 1st to 15th of December payroll as it would be received by your employees on the 22nd of December.

If this was the case, the calendar year you should be using is 16 December of the previous year to 15 December of the current year. This means you will never be guessing with your 13th month pay out.

Maybe your dates are different than the ones I mentioned above. To figure out the period you should use just apply the following:

The day after the end of the pay period you payout of the previous year to the last day of the pay period you pay out of the current year.

Separated and Resigned Employees

It is quite shocking how many employers aren’t aware that they are liable for the 13th month an employee has accrued during their employment. Regardless of whether an employee still work for you at the end of the year or not, you still need to pay their accrued 13th month.

The important word their is accrued. You should pay them 1/12 of their basic salary for that period. If you use the base pay or gross pay formulas mentioned above, these will still work with no change required.

How to payout 13th month

The last thing I have to say on 13th month is about how you pay it out. So many companies pay it out separately to the their usual payroll cycle. This is totally acceptable but an unnecessary complication.

The only thing DOLE says about paying it out is the deadline on which it is received. I’d thoroughly recommend paying it out as part of your usual payroll cycle. Doing otherwise will usually lead to more resources being spent on payroll than necessary, and more bank charges for transferring the payment. If you think about the amount of time and effort that goes into one pay cycle, by removing the off-cycle element of 13th month you will free up your team to focus on more important items.

In Closing

Thirteenth month doesn’t need to be complicated. Use a simple formula, use a reporting period that is based on facts, and pay it out on time as part of your normal payroll. If you do this, you’ll remove a lot of the headaches and stress from your payroll process, and save a ton of work around the year end.