Although industry leaders like Western Union, PayPal, and Moneygram have been dominating the money transfer scene to the Philippines, several startups are giving the incumbents a run for their money. Technology has gradually stripped these companies off of their long-held dominion of cross-border money transfers. These seismic changes, according to the World Bank, has saved developing countries such as the Philippines as much as $16B/year.

If you’re looking to transfer money to the Philippines, you have plenty of options now.

So… What’s the Cheapest and Fastest Way to Send Money to the Philippines?

The straight answer is: IT DEPENDS.

When considering what’s “best” or “cheapest” or “fastest” way to send money to the Philippines, several factors come into play. They include the following:

- your current country of origin

- the amount of money you’re sending out

- your recipient’s preference of receiving the money\s currency (dollars, euros, peso or Bitcoin)

- personal preferences of both sender and recipient (turnaround time, accessibility, pickup methods, costs, and customer service)

The crew behind Time Doctor created well laid-out tables comparing hidden fees, currency conversion costs, and the average processing time if you’re sending money from the US, UK, Australia, and Europe.

Your Options in Transferring Money to the Philippines

Whether you’re an overseas Filipino employee who’s looking for the best way to send money to your family back home, a foreign entrepreneur outsourcing local web developers in the country or a foreign firm with a local entity in the Philippines, you can explore the common money transfer options below.

The list is a mix of the most popular to newcomers in the money transfer scene in the country.

PayPal

PayPal is extremely popular in transferring money from anywhere in the world to the Philippines because creating an online account is intuitively simple, fast, and of course, free. Having your account “frozen” for certain “suspicious” reasons is one possible drawback if you’re sending money through this route.

Also, keep in mind that not all banks in the Philippines support fund transfer from PayPal. It could take 2 to 4 business days for the funds to appear in the recipient’s bank account. Lastly, be on the lookout for the additional (often hidden) fees.

A Php50 fee will be deducted from the total amount for transfers to bank accounts of Php 6,999 and below, while it’s free for remittances of Php 7,000 and above.

Coins.ph

Ron Hose, Founder of Coins.ph

Another efficient way for Philippines money transfer is Coins.ph. They make money transfer to the Philippines frictionless and accessible to everyone, even through the use of a smartphone! Based in Manila, Coins.ph is one of the easiest, and most convenient way to send money in the country.

Here’s what Founder Ron Hose has to say:

“With Coins.ph, employers can save up to 70% when paying oversea employee salaries by avoiding wire fees and costly forex charges.

They can send funds over web and mobile to all major banks in the Philippines and Thailand, as well as cash pick-up across 10,000+ retail locations.

With cash deposit facilities via partners across 30 countries, employers can conveniently add funds to their Coins.ph wallets and send payments directly to employees in their own local currency.”

Whether it’s for paying your employees in the Philippines, or for sending monetary gifts to loved ones, Coins.ph is a platform you can explore.

Rebit

Banking on the fact that “no single corporation or entity owns the Bitcoin network”, Rebit offers low transmission fees when transferring money to the Philippines. Their how-it-works page provides an in-depth look of their rates and turnaround times.

In a Reddit post, one of the developers behind the Bitcoin-based money transfer method emphasized:

One important thing that we are doing with Rebit.ph is that we will not be making money off of the USD to Peso exchange rate and will be using the fairest published rate available in the market.

One of Rebit’s advantage is that their prepaid cards make Bitcoin withdrawal a breeze. If you want an easy and hassle-free method of transferring money to the Philippines, Rebit.ph is a good pick.

Transferwise

Taavet Hinrikus, co-founder and CEO of TransferWise

With backing from elite entrepreneur Richard Branson and developed by the same people who built Skype, Transferwise boasts of their extremely low transfer rates – 1% for transfers from the US in USD, 0.5% for most other transfers, and 1% for the Philippine Peso. This is definitely game-changing when pitted against other medium such as PayPal whose extra fees can go as high as 4.5% (currency conversion rates included).

According to Taavet Hinrikus, co-founder and CEO of TransferWise:

“When you transfer money internationally, banks and brokers often hide the real cost so you end up paying more than you thought you were going to. They might say it’s ‘free’ to send your money, but they’ll then apply a mark-up on the exchange rate that they often don’t tell you about.

At TransferWise, we’re always completely transparent about the total charge and we make that as low as we can. We use peer-to-peer technology to get rid of hidden charges entirely, making us much cheaper and faster than using a bank.

We’re making sure that it’s our customers that benefit and not the banking system.”

Xoom

As another web-based money transfer player, Xoom allows your recipient to receive the funds you send through its partner banks in the country ( BPI, BDO, MetroBank, and PNB) and payment centers. They also offer door-to-door delivery or cash pick-up.

Payoneer

With Payoneer, your recipient gets a branded prepaid MasterCard and can withdraw the money on ATMs minus the steep bank fees. You can check their info page for businesses who are looking into paying remote employees. Like Paypal, we recommend verifying for hidden fees (for both sender and recipient.).

Western Union

This option is ideal if your recipient wants to withdraw the funds instantly (money-in-minutes option). Additionally, with roughly 8,000 locations in the country, withdrawing funds is convenient. Money transfers (done via online transaction or in person by visiting agent locations) can be possibly sent to a bank account, Western Union location, or mobile wallet. Fees for each transaction will vary on the amount of money sent and your turnaround time preference.

Final Thoughts

As a business owner, there are many ways to transfer money to the Philippines. Thanks to the ever-advancing technology, plenty of online platforms allow money transfer Philippines to be done with ease.

What other money transfer methods have you used in the past to send money to the Philippines? Why did you choose that option? We’d love to know more about these options (and the rest of our readers as well!) so share ‘em in the comments.

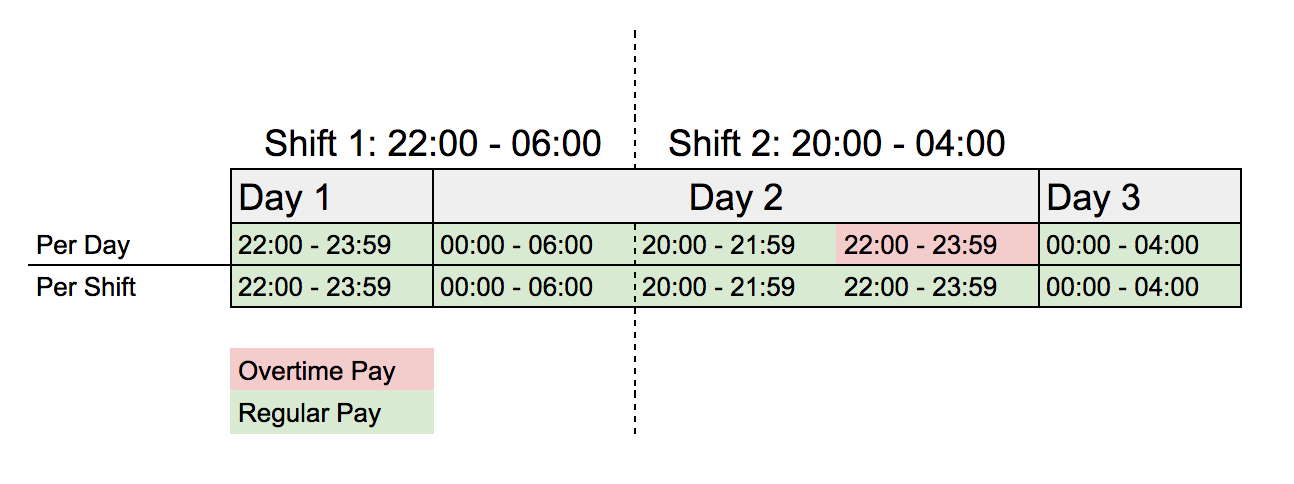

We have rolled out a new feature that will come in very handy for our BPO (Business Process Outsourcing) clients – per shift overtime.

We have rolled out a new feature that will come in very handy for our BPO (Business Process Outsourcing) clients – per shift overtime.

Today, we bring you accounting and payroll BPO executive Stefan Vermeulen, CEO of

Today, we bring you accounting and payroll BPO executive Stefan Vermeulen, CEO of

Nick Sinclair is the President of the

Nick Sinclair is the President of the

Last week we spoke with

Last week we spoke with  2. Tell us about Wint and Kidd?

2. Tell us about Wint and Kidd?  13. What were you doing before PayrollHero (for your hr tools) and how is it now with PayrollHero?

13. What were you doing before PayrollHero (for your hr tools) and how is it now with PayrollHero?  We spoke with David Elefant a while back about

We spoke with David Elefant a while back about