The Alphalist Report involves the adjustment of tax withheld to align it with the actual tax owed on an employee’s income throughout the fiscal year. This process is carried out by companies to guarantee that both employees and the company fulfill their tax obligations accurately to the Bureau of Internal Revenue (BIR).

This report also contains information on taxes deducted by employers from their employees’ wages. It also includes the computations for tax refund and tax payable at the end of the year.

- Tax Payable: If total tax due > total tax collected for the year

- Tax Refund: If total tax due < total tax collected for the year

- Break even: If total tax due = total tax collected for the year

Important dates to remember:

By 31 January, employers must provide their employees with a copy of the BIR- 2316 form.

On or before 28 February, the BIR-2316 form must be signed by all employees and the employer. The form and any other details must then be submitted to the Bureau of Internal Revenue (BIR).

What is the BIR-2316 Form?

The BIR-2316 form, commonly referred to as the Certificate of Compensation Payment/Tax Withheld, serves as an official record detailing an employee’s gross income and the corresponding tax withheld by the employer over the fiscal year. It is mandatory for all companies that employed individuals in the preceding year to submit the 2316 form to the Bureau of Internal Revenue (BIR). This form plays a crucial role in enabling the BIR to oversee the company’s adherence to tax regulations.

Why am I receiving large deductions/refunds during the year-end?

Tax deductions are generally determined by calculating the gross taxable salary using the BIR’s tax table. It’s important to note that different tax tables are applicable based on the pay cycle adopted by a company. Additionally, during the tax annualization period, the annual tax table serves as another reference guide.

While both methods will result in identical tax calculations, various factors below may impact these computations:

- An Employee hired in the middle of the year

- Adjustments made in the middle of the year

- Frequent absences or prolonged leaves

- Salary deductions

Hence, adjustments can be anticipated when taking these factors into account. Typically, a refund is applicable under the following circumstances:

• Fails to meet the PHP 250,000.00 cap

• Receives a significant amount of taxable income in the middle of the year

• Is a newly hired employee joining in the middle of the year

On the other hand, additional deductions are probable in the following situations:

• The employee’s taxable income bracket changes for the year

• The employee has a previous employer and submits the 2316 form to the new employer for consolidation.

How to compute Annualized Withholding Tax?

Before computing the annualized tax, employers must:

• Maintain comprehensive records of employees’ earnings throughout the year to ensure accurate calculations.

• Identify taxable and non-taxable income.

• Understand the calculation process for gross taxable income.

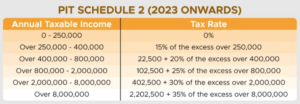

Once the annual gross taxable income is computed, refer to the annual tax table below:

Example: If the gross taxable income tax for the entire year is PHP 545,000, the tax due will be PHP 51,500.

(As 545,000 falls within the range of 400,000 to 800,000, we will refer to the third row in the Annual Tax Table.)

Annual Tax Due:

= 545,000 – 400,000

= 145,000 x 20%

= 29,000 + 22,500

= 51,500

Lastly, deduct the Annual Tax Due from the total Tax Withheld throughout the year. This will determine whether a refund or remaining is due.

Performing tax annualization is crucial for ensuring the accuracy of your employees’ payroll, as mandated by the Bureau of Internal Revenue (BIR). Additionally, given that employers in the Philippines as Withholding Agents, it is essential to guarantee full compliance with tax laws and labor regulations within your company.

Please see details on : How to Generate the BIR Alphalist on PayrollHero? or feel free to get in touch with us by signing up here – https://signup.payrollhero.com/sign_up/business_info