This is one of PayrollHero’s biggest releases this year. You can view the original post here:

In a nutshell:

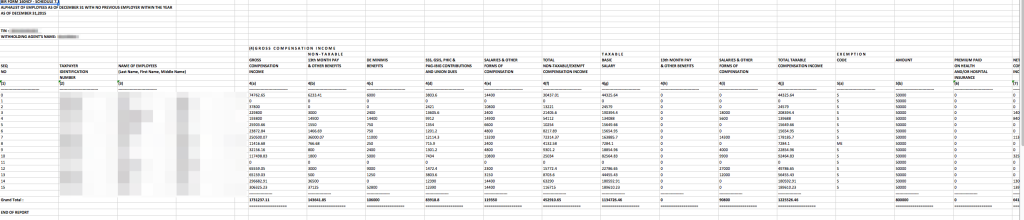

- Updated 2015 Alphalist

- Alphalist DAT Files

- Updated Multi-Inserts for Previous Employer and Additional Dependents

- BIR 2316 Forms (New)

What’s new this release?

- For 2015, the BIR Exemption amount has been increased to Php 82,000.00 of the total amount of exclusion from gross income for 13th month pay and other benefits. This change was effective from Jan 1, 2015.

- You can now download DAT Files. These files are the upload-version of BIR’s Alphalist.

- You can now add previous employer details so you can generate accurate 7.1 and 7.5 Alphalists. This can be added through the Previous Employer Multi-insert form.

- You can now add additional dependent information to be used in your 2316 forms. Additional dependent information can be added through the BIR Update Multi-insert Tool.

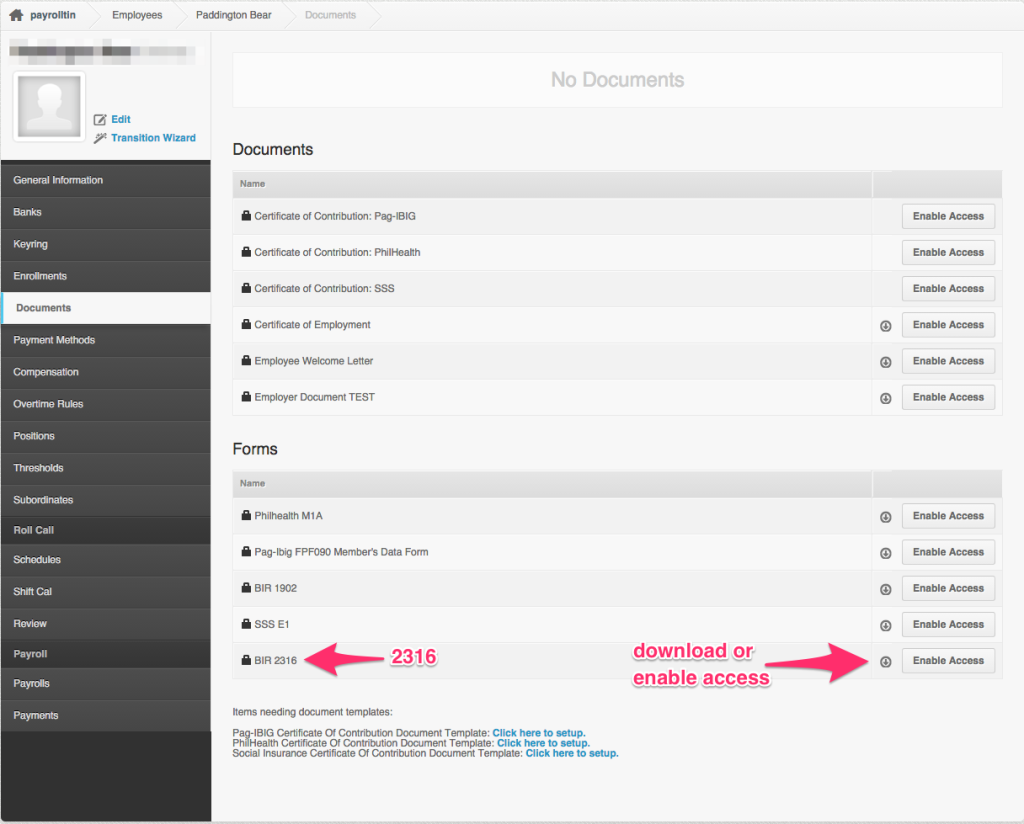

- 2316 forms can now be downloaded individually through the employee profile.

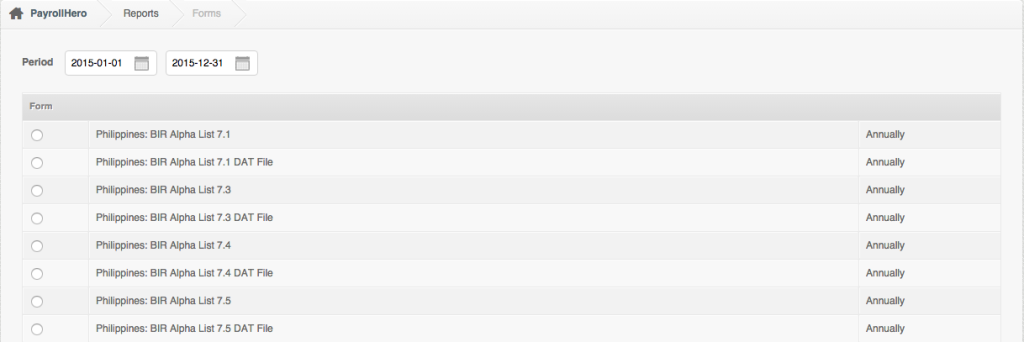

Where can I download these forms?

You can download the Alphalist and the DAT files by going to “Payrolls > Reports > Forms (click view)”. You can allow the employee access or download their 2316 form by going to their “Employee Profile > Documents > BIR 2316”.

What do I need to do?

Accounts that have complete payrolls for 2015 shouldn’t have any issues downloading the Alphalist.

To setup your account for Alphalist and the 2316, please contact our Client Success Team, they would be happy to help!

If you have any questions please let us know by clicking here.