Category Archives: Uncategorized

Instant access sign up is now live

When building PayrollHero we knew the complexity of Philippines’ payroll intimately. Our co-founders Mike and Steve were running a BPO in the Philippines at the time and were experiencing the pains of running payroll first hand.

They asked their network of business owners who operated businesses in the Philippines how they dealt with payroll. It turned out that they experienced the same problems!

Mike and Steve knew there had to be a better solution. So, having a background in building successful software companies, they decided to build an internal tool to solve the problems they were experiencing.

A few months later, the same people they’d reached out to before started asking how they had solved their payroll problems. Our founders showed the new tool to their friends and the reactions were overwhelming positive. Thus PayrollHero was born.

So we built PayrollHero from the ground up to deal with the complexities of DOLE, and it’s unique rules. We understand that different businesses have different approaches to generating payroll, and our software has a level of customizability that is rivalled by no other to deal with this.

“Not every business needs complex payroll software … our new plan provides a very simple solution at a very affordable price.”

But, we also realize that not every business needs complex payroll software. So we have spent a considerable amount of time creating a simplified version of our application.

The new plan is ideally suited for

- If you require your employees to clock in/out for work

- The attendance of your employees directly effects their payroll

- You follow DOLE for managerial and rank and file employees

- Currently waste time transcoding biometric data or manual time cards for payroll processing

- You would like a centralized database for tracking employee’s personal information

Simple payroll with an enterprise level engine

Although we have made it simpler to use as setup, you can still harness all of the powerful features that we have built for the system. Including our brand new and improved 13th month feature, overtime & official business requests plus loads of other great features. Our new plan provides a very simple solution at a very affordable price.”

Our leave management add on integrates seamlessly, and our HR A.I. assistant comes free for all of your employees.

If you’re interested you can learn more about our product here.

Try it now and get 90 days free!

To celebrate our new plan we are giving all new customers 90 days to try it and pay nothing. All you need to do is sign up using the code BP90102017 to receive your extended trial.

SSS Contribution Increase 2018: Why It’s Actually Good for You

In early 2017, the Social Security System (SSS) announced that it intends to increase the contribution rate for the national pension fund. According to the agency, the contribution per SSS member will pay 15 percent more than the usual amount, which is around Php15 to P240 extra every month.

In early 2017, the Social Security System (SSS) announced that it intends to increase the contribution rate for the national pension fund. According to the agency, the contribution per SSS member will pay 15 percent more than the usual amount, which is around Php15 to P240 extra every month.

At the moment, the implementation of the SSS contribution increase was postponed until 2018. If the implementation went according to plan, you would have seen the effect on your payslip last May. SSS president and chief executive officer Emmanuel F. Dooc said the agency wanted to wait for the tax reform to be implemented first so pension fund members can use the money saved on taxes to offset the contribution increase.

With the impending contribution increase, you’d probably wonder if this will have a real-life effect on your take-home pay. Here are 5 things to know about the SSS contribution increase and why it’s s actually a good thing for you.

1. The contribution increase will help extend the life of the SSS fund.

Why is this important: You are ensuring there’s enough money for SSS to pay your pension when you’re eligible to claim it.

Before we delve into this further, let’s brush up on what the SSS fund is exactly.. The SSS fund functions as a source of funding to provide social benefits, including your pension, that supports its contributing members.

In order for the account to not run out of money, the group needs to:

- admit new members who are willing to contribute to the account, and/or

- increase the contribution collected from existing members

As members claim their payout from the SSS fund, there’s also a possibility that the account will run out of money sooner than expected.

And we can see this from the actions taken early this year. During his campaign trail, then-presidential candidate Rodrigo Duterte promised to increase the pension receivables of over two million retirees. After winning the presidential election, Duterte approved the contribution hike, resulting in the SSS fund’s life getting shortened from 2042 to 2032. If the increase does not go through, there is a possibility people who will claim or retire after 2032 will not be able to receive their pension.

2. The fresh injection of money means more benefits for you.

Why this is important: Expanded maternity benefits and unemployment benefits.

At the moment, an SSS member can avail the following benefits:

- Cash allowance to cover the number of days absent due to injury or sickness

- Maternity benefit

- Retirement benefit that would come in either a monthly pension or lump sum payment

- Disability cash benefit that would come in either a monthly pension or lump sum payment

- Death and funeral benefits

- Eligibility for a salary or business loan

- Eligibility for financial assistance or mortgage loan

Recently, the SSS has said it is considering to offer more benefits for its members once the increase is implemented. This means expanding the allowed number of leaves from 60 to 120 days (and improved cash benefits), relaxed restrictions on childbirth and miscarriage, and changes to the maximum coverage amount, among other things. Moreover, the new funds from the contribution increase and the agency’s investments could also introduce a benefit that would financially assist members who are recently unemployed. If the contribution increase pushed through back in May, the agency was confident to declare that such additional benefits would have been made available to its members in the same year.

3. The contribution increase could also mean more pension payout.

Why this is important: Who doesn’t want more money for retirement?

To understand why is this so, let’s discuss how SSS computes your pension. Under the current law, SSS computes your pension based on two things:

- The number of contributions you made as a member, and

- the total amount of the contributions that have been paid

The agency then computes the average of all of your contributions from the date of your coverage as a member or compute the average of your contributions in the last five years. Whichever is higher, this will be the amount the SSS will use to compute for your pension.

Some enterprising members opt to contribute the maximum rate as long as they can afford it.

However, there are at least a couple of loopholes in the SSS that allows you to pay a higher contribution amount allowed by law to increase their computed pension amount. For example, a member who earns Php15,000 a month pays Php110 for his SSS contribution monthly. He then decides to increase his contribution six years before retirement to Php1,760 a month. This then leads him to receive a lifetime monthly pension of Php9,900 a month. Unfortunately, this is not something the current proposed laws would address.

4. The increase has a minimal effect on your take-home pay.

Why is this so: Your employer shares the burden of your contribution.

SSS members who are employed only shoulder one-third of the calculated contribution, while your employer shares two-thirds of it.

Once the increase is implemented, the total contribution will climb from 11 to 12.5 percent. The implementation will also see the increase in maximum monthly salary credit from Php16,000 to Php20,000.

Insurance and banking comparison experts GoBear created a computation table. It clearly shows that employers will take the brunt of the increase. When you think about it, the contribution hike essentially forces your employer to invest more in you.

But what if you are a self-employed or voluntary member? Well, it’s not that bad as well. Considering the fact that most of us are really bad when it comes to saving or investing money on ourselves, the SSS contribution increase is simply one way to change our attitude about money.

5. The SSS plans to introduce more increases in the next five years.

This means: Expect more annual contribution increases.

SSS President and CEO Emmanuel Dooc see these annual increases as a good thing for people who are aiming to increase the pension amounts they can claim in the future. Dooc added they aim to increase the member contribution rate from 11 percent to 17 percent over a six-year period.

Although the debate about the increases is still ongoing, let’s note the fact millennials make up a third of the Philippine population, and are expected to make up 75% of the workforce by 2030. Add that to the number of workers retiring, and you have a social services situation that could put a strain on the SSS fund. Budget Secretary Benjamin Diokno himself said earlier in an interview that an adjustment in member contribution rates will allow the fund provide better benefits, higher pension amounts, and services as cost of living and pension and benefit claims increases.

Final Thoughts

The SSS contribution increase ensures the long-term viability of the fund, provide more benefits and increase the pension amount you will receive upon retirement. Even if the increase will be implemented, the proposed collection amount will not really have an effect on your take-home pay, more so when the tax reform will take effect. Moreover, the increase is simply stage one of the SSS’s plans to revitalize the fund and improve the benefits and services it offers to members.

Are you still not convinced why there’s a need to increase the contributions? If you are willing to take on a high-risk, high-return investment like stocks, mutual funds, real estate, and even in a business you don’t understand, why not bet on a sure thing instead? The SSS fund is a government-backed fund that’s mandated by law to support you for a lifetime.

At the end of the day, it might be better to put a little more of your hard-earned money on a secured investment.

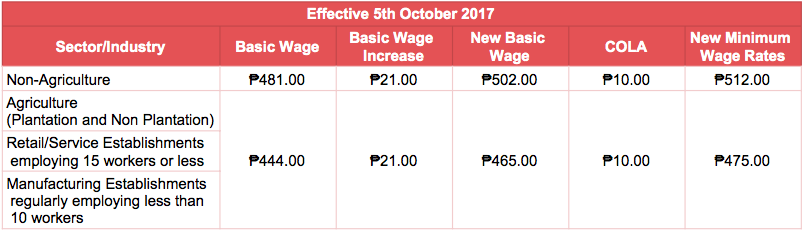

Philippines: Minimum Wage Increase

The Philippine government have recently announced a change to the daily minimum wage rates in the National Capital Region. The minimum wage rate for non-agriculture employers will be ₱512.00. This is an increase of ₱21. No change was made to the cost of living adjustment.

For more information about this update you can check out the wage order at the department of labor and employment website. – http://www.nwpc.dole.gov.ph/pages/ncr/cmwr.html

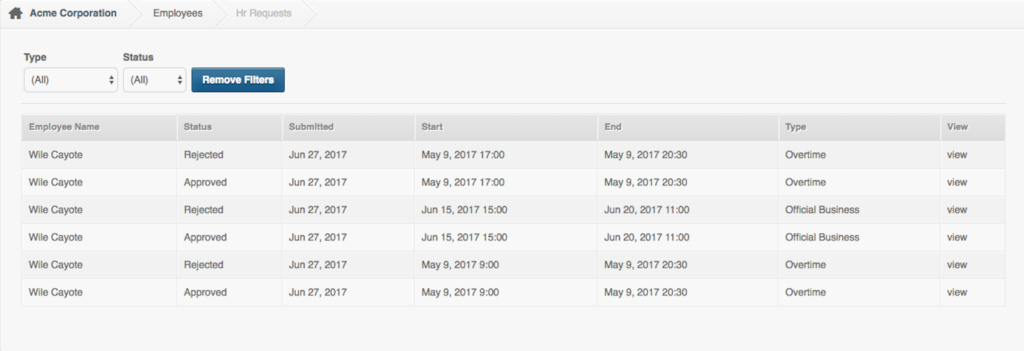

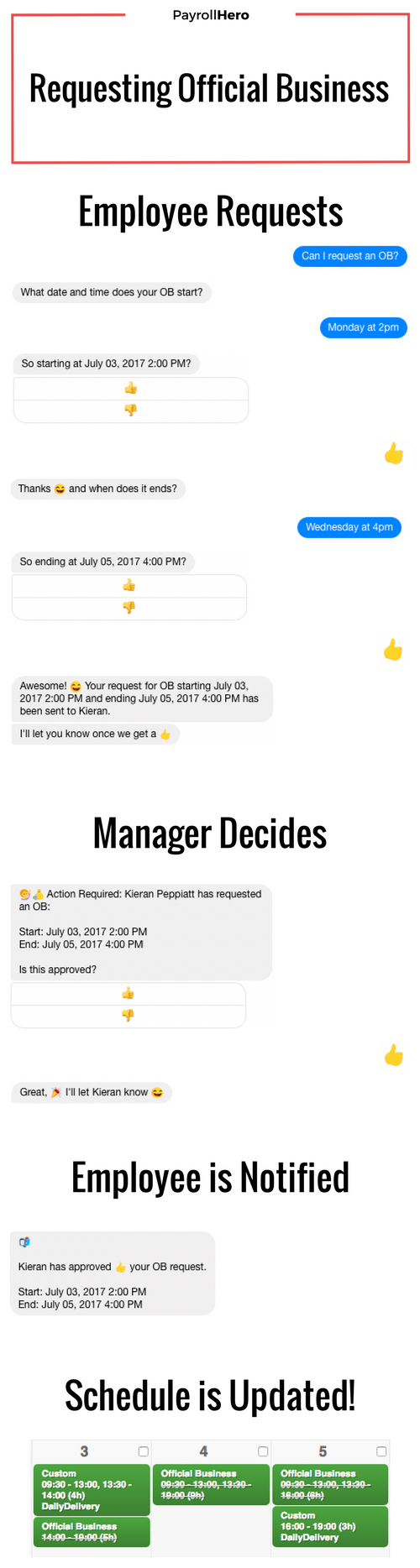

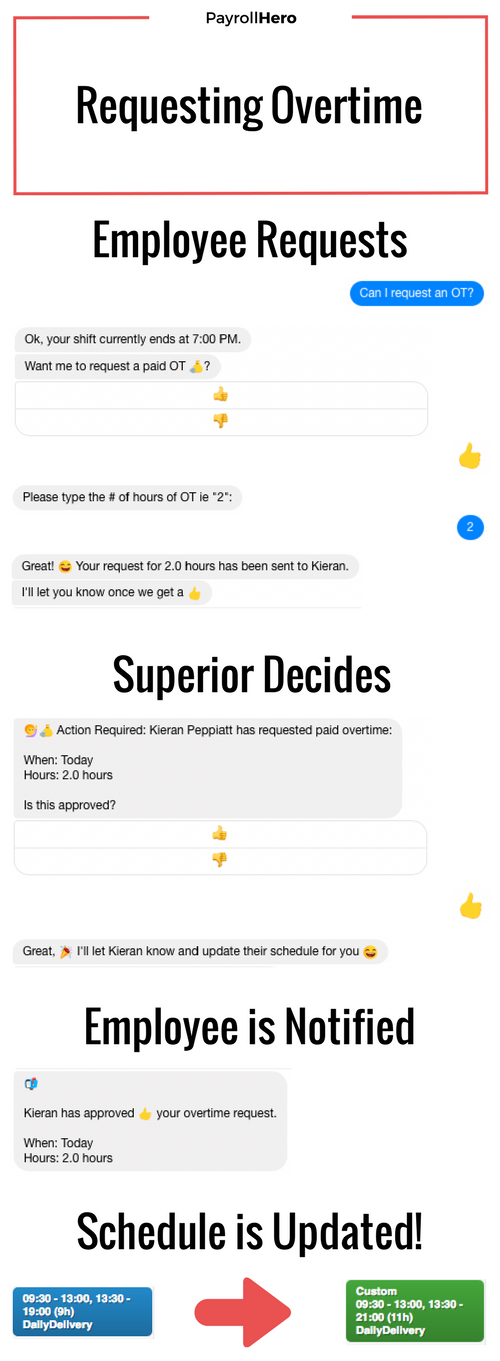

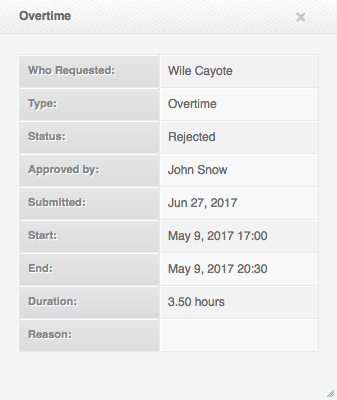

Introducing Overtime and Official Business Requests

Today we’re launching two new features to our customers. Now your employees will be able to make overtime and official business requests, all powered by our new A.I. assistant Lucy.

Click image to enlarge

Lucy and our new features are available to all our existing customers completely free of charge.

To get these features sign up for Lucy and have your employees start talking to her. If you are not using Lucy already you can join our open beta by contacting support@payrolllhero.com or filling in the questionnaire below.

TimeDoctor Integrates into PayrollHero

The team at TimeDoctor has completed an integration into PayrollHero so that you can see more details about what your team is working on once they have clocked in.

The team at TimeDoctor has completed an integration into PayrollHero so that you can see more details about what your team is working on once they have clocked in.

PayrollHero tracks your employees schedules, when they clock in and out, taxes and pays them accurately, but we don’t capture what the employee is doing within the hours they are being paid for.

That is where TimeDoctor comes in. TimeDoctor’s software lets you track what your team is working on within their work day, what sites they are visiting and much more. You can learn more about TimeDoctor here.

That is where TimeDoctor comes in. TimeDoctor’s software lets you track what your team is working on within their work day, what sites they are visiting and much more. You can learn more about TimeDoctor here.

You can see the integration in action in the video below and how to set it up here –

https://www.youtube.com/watch?v=DLEioWeQhCg

Top 3 Toughest Aspects of Payroll in Singapore

Assuming Payroll

Often times, companies generate payroll and pay out an entire month’s wages to an employee before the month has ended. We call this assuming payroll. This is how it works: If payroll is generated an the 25th and paid out on the 27th, the manager pays the full month’s wages, up till the 31st, assuming that the employee will make it to work on the last few days. If he doesn’t, the manager  needs to deduct his wage in the next month

needs to deduct his wage in the next month

Assuming payroll is an inefficient and inaccurate way of paying employees. We’ve come across many business owners who do it in Singapore. Most of the time, it’s because they have been doing it for years and have never thought about changing the rule. We help our clients transition from assuming payroll to regular payroll which saves clients money and time. Here is a blog post on exactly how to transition from assuming to regular payroll.

Irregular Clock-in Timings

When an employee clocks in at 8.57am instead of 9.00am, the biometric device records it to the exact minute. Your HR manager needs to manually correct the irregularity because coming in 3 minutes early does not mean that the employee will get paid for those extra three minutes.

The PayrollHero app has a threshold feature that solves this problem. An HR manager can set a threshold: if an employee clocks in between 8.55am and 9.05am, their clock-in time resets to 9.00am, automatically correcting the irregularity that your HR manager would have had to deal with otherwise.

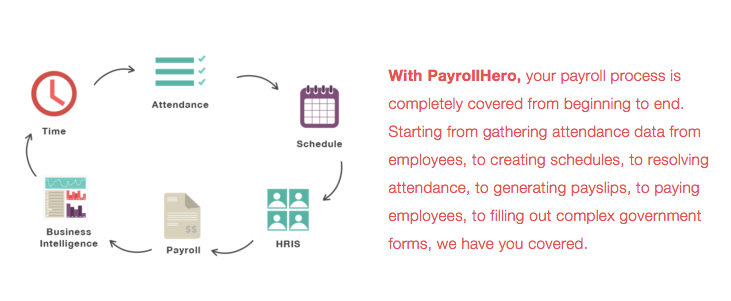

Disparate Systems for Time, Attendance, Scheduling and Payroll

Business owners have multiple systems that deal with different HR problems; a biometric device to measure clock ins, a separate Excel sheet that imports data from the biometric device and generates payroll, another Excel sheet that needs to be updated every week with schedules for each employee and a whole other system that employees use to apply for leave. With so many systems to deal with, no wonder an HR manager barely has any time to engage with employees or find innovative ways to overcome Singapore’s labor crunch.

Business owners have multiple systems that deal with different HR problems; a biometric device to measure clock ins, a separate Excel sheet that imports data from the biometric device and generates payroll, another Excel sheet that needs to be updated every week with schedules for each employee and a whole other system that employees use to apply for leave. With so many systems to deal with, no wonder an HR manager barely has any time to engage with employees or find innovative ways to overcome Singapore’s labor crunch.

An end-to-end solution that removes any need for multiple devices is exactly what an HR manager needs. PayrollHero allows employees to click selfies on their phone or an iPad in the work site when they clock in. This data is stored in the Cloud and used when payroll is generate by the system. The same app is used when applying for leave or checking schedules for the week. An HR manager can use the app on his laptop, phone or any device with internet connection anywhere in the world and have full control over what is going on at his work site.

While these problems are seen as some of HR managers’ biggest in Singapore, they are faced by managers in the Philippines and pretty much any other place too. Some of the other problems HR managers need to deal with are changing tax laws, a labor crunch and laws against foreign workers in the country.

We hope that this post serves as a solution to some of your biggest HR problems. Do let us know your biggest HR problem and how you are currently dealing with it.

What Does It Take To Make Remote Work Work?

As a business owner, you are bound to look towards expanding your business at some point. In which case, you will have multiple offices at different locations. While you are in one worksite, you will want to stay in touch with employees in your other store locations. Staying connected is essential when your employees are spread out over the map. It’s even more important if your employees work remotely and do not often physically meet you or other employees on a regular basis.

Apps

At PayrollHero, we use a number of apps to facilitate remote work. These apps tie our employees together. We use the apps for face-to face interactions and for quick chats instead of spamming employees’ inboxes. The following apps might be useful for your company too:

Slack: This is the center of all our communication through different departments and offices. Slack allows you to create chat rooms and invite people to them. We use this feature to separate different functions of the team: engineering, business development, etc. Slack is also our metaphorical grapevine. We have chat rooms for random news, general musings and articles or books that anyone wants to share with the team. Slack also allows for private chats, thereby removing the need for emails to coordinate work. Slack is flexible in the sense that it has a number of integrations: Twitter, Mailchimp, appear.in.

Appear.in, Skype, Google Hangouts: Teams can’t function without face-to-face meetings. Bosses benefit from meeting their employees face-to-face in order to gauge their emotional state and general well-being. The app features and video quality differ but essentially they help you conduct online meetings.

Asana, Trello: To ensure that all tasks are tracked and accountable to the relevant employees, we use Asana. These apps are built to suit remote work. Asana allows you to assign tasks in a checklist format whereas Trello breaks down work in the form of projects in which tasks are outlined using cards. Both apps can be accessed online. So you or your employee can work from anywhere in the world and still stay on top of things.

Google Drive, Dropbox for Business: Keeping track of all the documents and sheets created by multiple departments across different worksites is essential. These apps are tailored towards businesses’ storage needs. With a subscription fee, you have access to unlimited storage, data analytics (for Google) and more. Both apps allow you to track who is editing files and what kind of access you want your employees to have for each file or folder.

It’s More Than Just Apps

Making remote work successful is more than having a suite of apps at your disposal. It requires a shift in the way you and your employees think about work. It requires trust in your employees to work even if you’re not monitoring them at the office. We have inculcated some practices that help maintain discipline and structure even when employees work at different locations across the work. Here are some that have helped us:

Morning catch ups: Every morning, at a time suitable to your employees in their respective time zones, each employee summarizes their work in 60 seconds. The format is: what they accomplished yesterday, what they couldn’t complete, what they will do today and roadblocks to completing their work. From the head of the team down to the entry-level employee must be able to summarize their work in under a minute. The meeting is helpful in understanding where the team is going and what can be done to remove roadblocks.

Handbooks: For new employees, or employees that have changed departments, it is hard to catch up to how things are done when the entire department works remotely. Writing down the steps to each task in a handbook and storing it in Google Drive/Dropbox cuts down on confusion and time wasted in connecting with the employee who knows how to do the required task. Handbooks remove any misunderstandings or errors. It is a fool-proof way of ensuring that the business continues in case someone is not available to lend a helping hand.

Using Slack to integrate the team: While Slack can be used to create chat rooms and do work, it is often a great tool to include everyone on the team and talk about common interests. Our chat-rooms like #random and #general are great spaces for employees to share ideas and talk about things outside of work. It is a place to plan outings over the weekend or share movie reviews. These conversations pull the team together and allow for cross-departmental interaction; something that could be missing while everyone is focusing on work.

Using Slack to integrate the team: While Slack can be used to create chat rooms and do work, it is often a great tool to include everyone on the team and talk about common interests. Our chat-rooms like #random and #general are great spaces for employees to share ideas and talk about things outside of work. It is a place to plan outings over the weekend or share movie reviews. These conversations pull the team together and allow for cross-departmental interaction; something that could be missing while everyone is focusing on work.

Finally, making remote work possible is about using apps to their maximum capacity and reviewing if they work or not. Managers need to be more mindful of their employees. Employees in turn need to make a conscious effort to stay on top of their work because remote work often results in the blurring of personal and professional life. Altogether, making remote work work is hugely beneficial to employees. All it takes is a little tweaking of the way things are usually done.

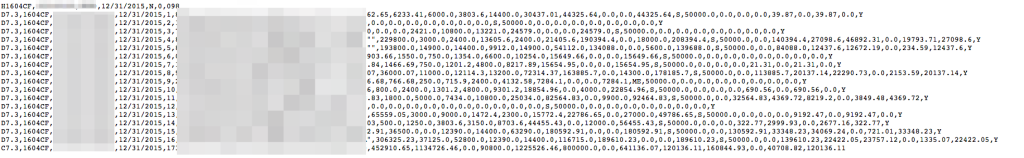

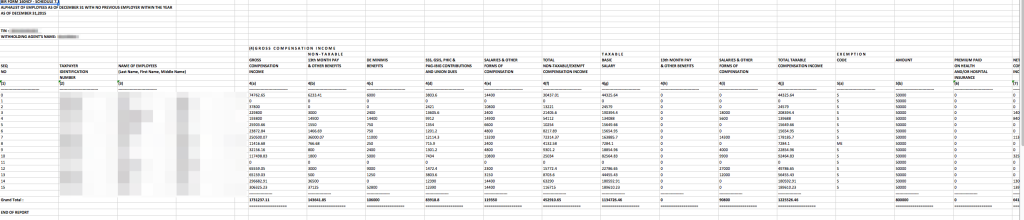

Year End Update – Philippines: Alphalist, BIR DAT Files and 2316 Forms

This is one of PayrollHero’s biggest releases this year. You can view the original post here:

In a nutshell:

- Updated 2015 Alphalist

- Alphalist DAT Files

- Updated Multi-Inserts for Previous Employer and Additional Dependents

- BIR 2316 Forms (New)

What’s new this release?

- For 2015, the BIR Exemption amount has been increased to Php 82,000.00 of the total amount of exclusion from gross income for 13th month pay and other benefits. This change was effective from Jan 1, 2015.

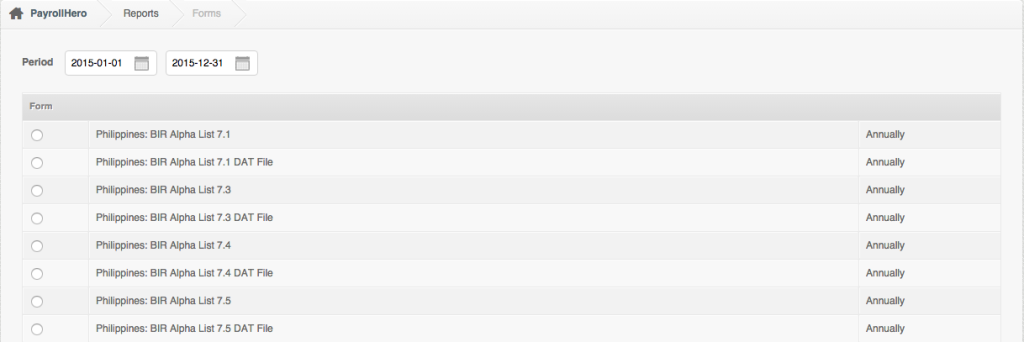

- You can now download DAT Files. These files are the upload-version of BIR’s Alphalist.

- You can now add previous employer details so you can generate accurate 7.1 and 7.5 Alphalists. This can be added through the Previous Employer Multi-insert form.

- You can now add additional dependent information to be used in your 2316 forms. Additional dependent information can be added through the BIR Update Multi-insert Tool.

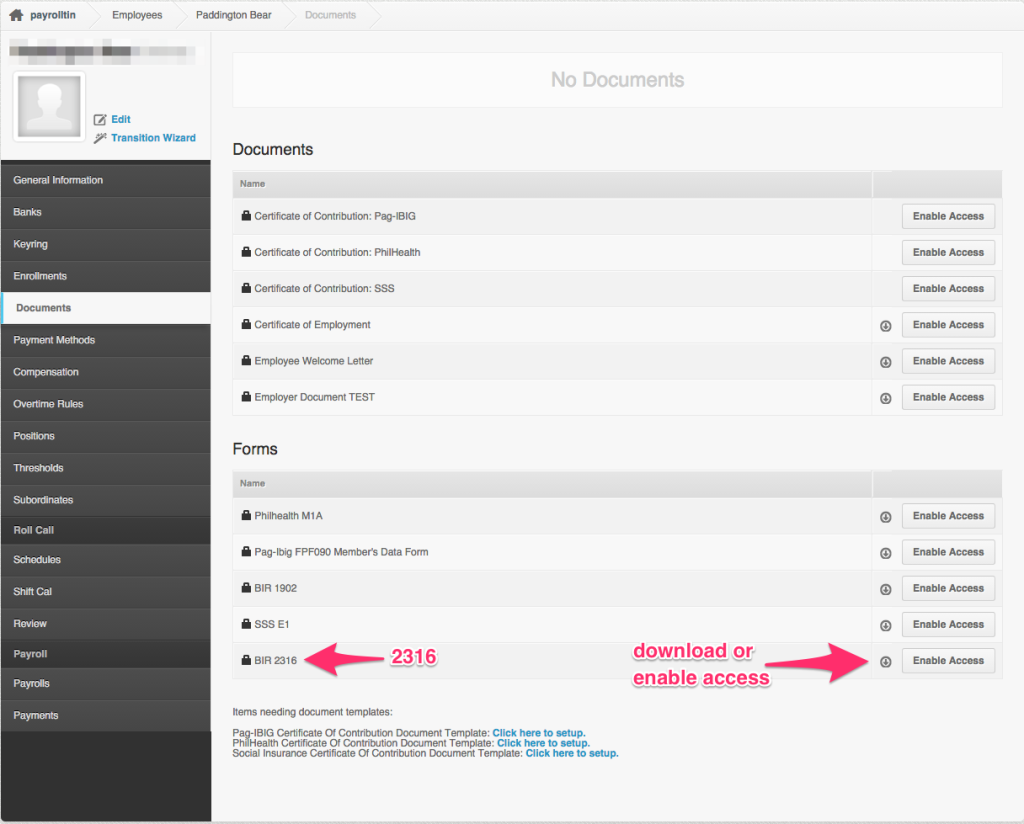

- 2316 forms can now be downloaded individually through the employee profile.

Where can I download these forms?

You can download the Alphalist and the DAT files by going to “Payrolls > Reports > Forms (click view)”. You can allow the employee access or download their 2316 form by going to their “Employee Profile > Documents > BIR 2316”.

What do I need to do?

Accounts that have complete payrolls for 2015 shouldn’t have any issues downloading the Alphalist.

To setup your account for Alphalist and the 2316, please contact our Client Success Team, they would be happy to help!

If you have any questions please let us know by clicking here.

Changi’s Terminal 4: A Traveler’s Escapade

Singapore’s Changi Airport is building its fourth terminal which is scheduled to open in 2017. Terminal 4, now 70% complete, will see 16 million passengers through the year. That’s an estimated total of 82 million passengers once T4 operates in full swing. We are super excited to see what Changi has in store for us, considering Terminals 1-3 have movie theaters, a butterfly garden, a 4 storey tall slide (a.k.a the tallest slide in Singapore) and who knows what else.

Singapore’s Changi Airport is building its fourth terminal which is scheduled to open in 2017. Terminal 4, now 70% complete, will see 16 million passengers through the year. That’s an estimated total of 82 million passengers once T4 operates in full swing. We are super excited to see what Changi has in store for us, considering Terminals 1-3 have movie theaters, a butterfly garden, a 4 storey tall slide (a.k.a the tallest slide in Singapore) and who knows what else.

T4 will be a two storey building and 190, 000 square meters: the size of around 27 football pitches. This S$1.82 billion project is not just exciting for passengers. It is a massive opportunity for retailers and F&B outlets as well. With 17,000 square meters floor space devoted solely towards retail, there is plenty to look forward to. Changi has announced that the retail space will offer the most innovative design, offering customers a differentiated shopping experience.

In fact, everything about Terminal 4 is about giving commuters an enhanced experience at the airport. It starts with increasing productivity through its FAST@Changi concept. Fast And Seamless Travel (FAST) will reduce the need for manpower and increase the speed of check-in and immigration procedures. To facilitate this, Changi will have self check-in, self baggage tagging and automated baggage drop terminals. Facial recognition and biometric technology will reduce the number of security guards employed for manual visual checks at multiple checkpoints. If we haven’t said it enough before, here is another example of how technology is reducing the need for labour, saving time and money, all in one go.

Imagine entering an airport and walking straight to your gate without having to constantly pull out your boarding pass and passport to clear security checkpoints. Or if you’re anything like me, imagine all the extra time you’ve now got at duty free stores because you took just a couple of minutes checking in!

This is exactly what retail and F&B outlets are looking forward to. The FAST concept gets 16 million passengers through the doors of Terminal 4. It also gives these passengers more time on the retail floor to shop and dine. While designing the new concept, Changi switched on its ridiculously client focused side and implemented recommendations from the public on the theme. The design shows off Singapore’s local culture and heritage. The Peranakan-inspired storefront facades are just an example of what the walk – through concept at T4 will look like.

With a year and a half left till T4 opens, we know the retail space is dedicated to 80 outlets. It is still too early to tell which brands will be occupying the space. The amount of traffic that these stores will face in the initial period depends on the number of airlines that T4 will service. Changi has announced 6 airlines that will have access to T4: Cathay Pacific, AirAsia Berhad, Thai AirAsia, Indonesia AirAsia, Vietnam Airlines and Korean Air. In the year 2014, these 6 airlines added a total of 7 million passengers to the airport. A few more airlines will join these 6, resulting in an estimated 10 million passengers in the first year of operations. We’re looking forward to more updates on T4 and will keep you updated about the retail and F&B world inside T4!