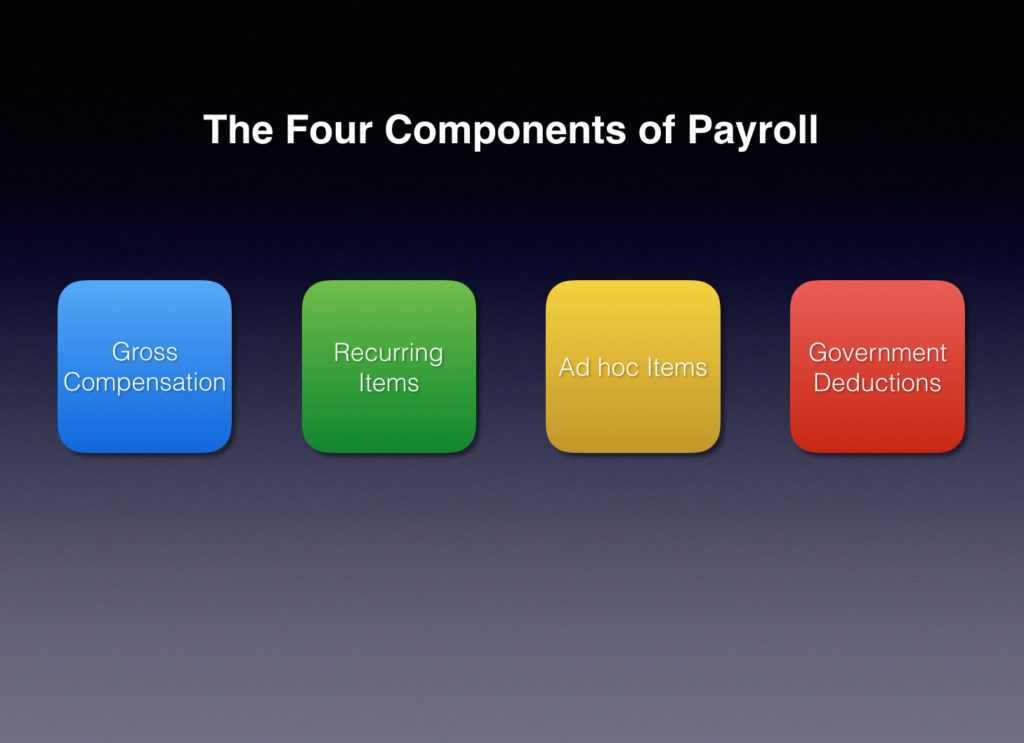

As part of the HR and Payroll 101 series I wanted to take a closer look at the individual parts of the payroll process. Generally, there are 4 components to any payroll process, and this is usually country agnostic.

If you have ever been involved in payroll generation this number probably seems quite low. You could pick up any employee’s payslip and list maybe 10 items from their payroll alone, and your not wrong. However, this is part of the problem.

Most payroll admins structure their payroll process around the tax status of the items being credited or debited, or based on the individual line items themselves. These approaches can work, but they won’t be the most efficient. They will lead to unnecessary repetition, and increased resource requirements to administer. By knowing the four components, and how your payroll items fit into each, you will be able to apply your knowledge to streamline your overall payroll process.

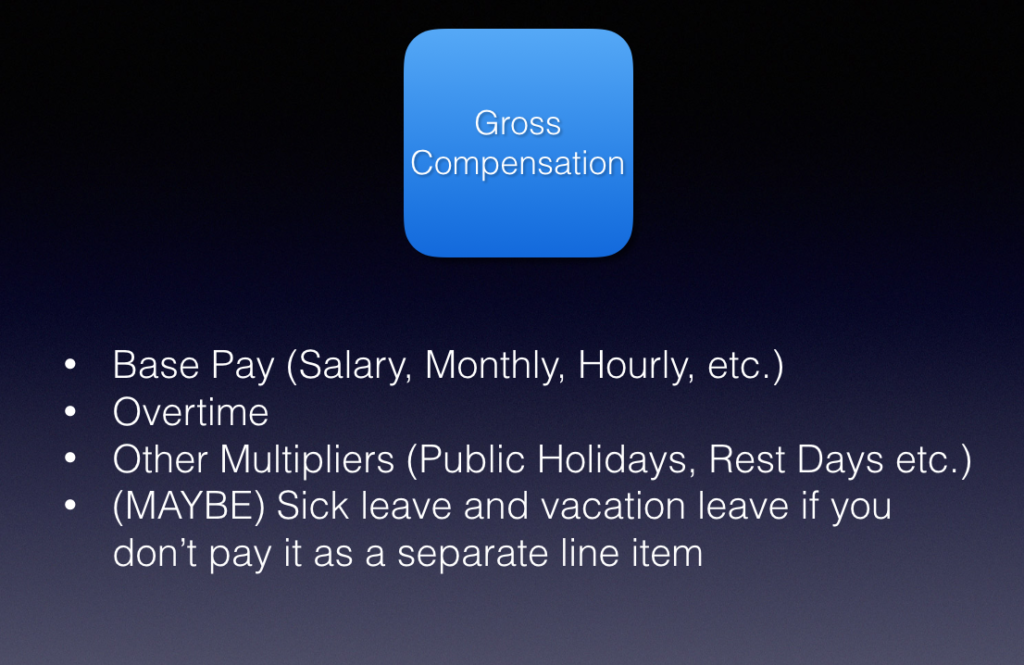

Gross Compensation

Gross compensation is probably the easiest to understand. It’s any item that makes up your employee’s basic compensation package.

The first item is base pay, which is just one aspect of the overall gross compensation. However, this is usually the bulk of any employees payroll. There’s generally 3 main types of gross pay:

- Salary: Employees get paid the same fixed amount each payroll regardless of their attendance

- Monthly: This is similar to salary. Monthly paid employees also get an amount each month but it’s not fixed. It will fluctuate based on their attendance. For example, they may receive less gross pay if they come in to work late and more if they worked overtime.

- Hourly: Employees are paid for the exact hours they work. So if you were being paid $1 an hour and worked 100 hours you would receive $100 as your gross pay.

Other notable mentions for base pay would be daily rates and piece meal. The former being employees who get paid per day and the latter per item they complete.

Overtime is usually paid at a premium to employees. The standard practice is to pay overtime at a certain percentage of the base pay rate. E.g. 125%. So if you were paid $10 an hour and then worked overtime you would get $10 multiplied by 125% which equals $12.50.

For other multipliers, these work in the same manner as overtime but are applied in different scenarios. For example, it’s not uncommon in most countries to provide additional pay to employees if they come into work on a public holiday.

In the Philippines the rate is 200%. So the same $10 base rate would be $20 on a regular holiday. This is also why we call them multipliers, because you multiply the scenario percentage by the base rate.

One thing to note, some companies don’t multiply but actually do addition. In the UK where there is no government mandated rate for working overnight. It’s not uncommon for employers to pay an extra £1 or £2 for work done late at night. These would also fall into this category.

The last one, and this depends on your companies process would be leave pay. If you don’t pay these out as separate line items they will be part of the base pay and so therefore part of the gross compensation. This is far more common with monthly and salary paid employees than any other type.

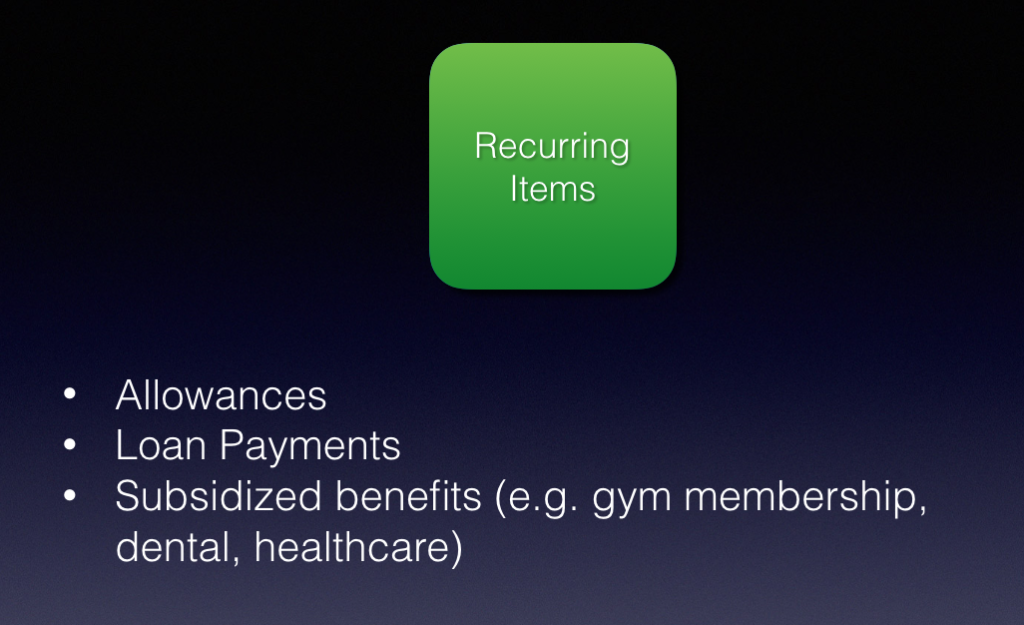

Recurring Items

“The important thing to remember is these items will be credited or debited from an employee on a strict schedule. Either for an ongoing period of time or in perpetuity”

From this point on, the component descriptions I provide are not exhaustive lists. You potentially have other payroll items that you provide that will fall into one of the four components.

Recurring items are those other payments that you credit or debit to employees every payroll. This might be for a preset period of time or in perpetuity.

It’s important to clarify that the amounts of these recurring items may vary from payment to payment.

A great example of this would be the Cost of Living Allowance in the Philippines. It’s a government mandated allowance saying that all minimum wage employees should receive 15 pesos for each day worked. So the amount paid out will always fluctuate based on the amount of days worked in the pay period, but it’s always paid each pay period.

Usually all allowances are recurring items, the frequency may change (either per payroll, per quarter, per month etc.) but they are consistently deducted on the same schedule.

Loan payments are another great example and illustrate how the payment doesn’t need to be deducted forever. Usually, if you give an employee a loan, they pay it back over X pay periods until the original amount is repaid.

Subsidized benefits are a huge catch all. Companies will give their employees certain benefits where the company covers most of the cost. However, the employee needs to contribute some amount. These are consistently deducted every payroll and continue until the employee either leaves or decides they don’t want to avail of the benefit any longer.

As mentioned, this isn’t an exhaustive list. The important thing to remember is these items will be credited or debited from an employee on a strict schedule. Either for an ongoing period of time or in perpetuity.

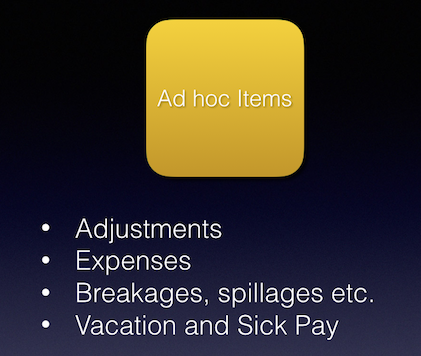

Ad hoc Items

“These items are infrequent, and the amount always vary. They are not deducted or credited to an employee each payroll.”

Ad hoc items are those infrequent payments that you have to make on payroll. Adhoc is a latin phrase that means “for this.” When you are doing something on ad hoc basis you are doing it for that specific case and no other.

Adjustments are a great example of an ad hoc item. Every time you do an adjustment you are making it to fix a specific error or issue. You are making the payment for this specific scenario.

Expenses would also come under this category, every expense payout is done for a particular expense or expense report. These are always handled on a case by case basis.

Sure you may have employees that submit an expense report with some frequency. You might have an employees who do a lot of driving for work and are allowed to claim their miles back on expenses. They may even submit an expense claim form every month.

However, if that same employee ended up working at head office for the entire pay period and didn’t drive any where they wouldn’t receive a mileage expense. Whereas if they received a car allowance, which is a recurring item, they would still receive the amount.

For breakages and spillages, in the food and beverage industry it’s not uncommon to charge the server if they break a plate, glass, etc. Again, these types of payments are always made for the specific incident.

Finally, Vacation Leave and Sick Pay would live here if you don’t include them in the gross pay. This might seem counterintuitive to you, but again think about the format we have established. Employees take leaves on an ad hoc basis, and when you pay their leave pay it’s done for a specific leave request.

Again, this list is not exhaustive and it’s important to note you might and probably do make these types of payments EVERY payroll. However, they usually won’t be to the same employees, and for the same amounts. Don’t get me wrong sometimes an employee might break the same glass or claim the same amount of miles so their amounts are the same, but this is because of circumstance and not because they are recurring items.

Just remember, these items are infrequent, and the amount always vary. They are not deducted or credited to an employee each payroll.

Government Deductions

Finally we have government deductions, and you know what they say; “there’s only two things in life that are certain; death and taxes.” Unless your employees are based in countries that don’t tax lower wage earners this is definitely true.

The other government deductions will vary based on your location. In the Philippines this would be Pag-IBIG, SSS, Philhealth. Singapore have charitable deductions and CPF. The UK has national insurance and Canada EI and CPP etc.

Most, if not all, governments have their own mandated deductions that employers have the responsibility to deduct. It’s vitally important to ensure you make these deductions on time and in line with your local laws.

So that’s the four components. Gross Compensation, Recurring Items, Ad Hoc Items, and Government Deductions. If you are designing your own payroll process, or trying to improve your current one categorize your payroll items into these four areas. Once done, you will be able to create processes for each component that will allow you to streamline your process.

For any questions, please ask in the comments below. Thanks!

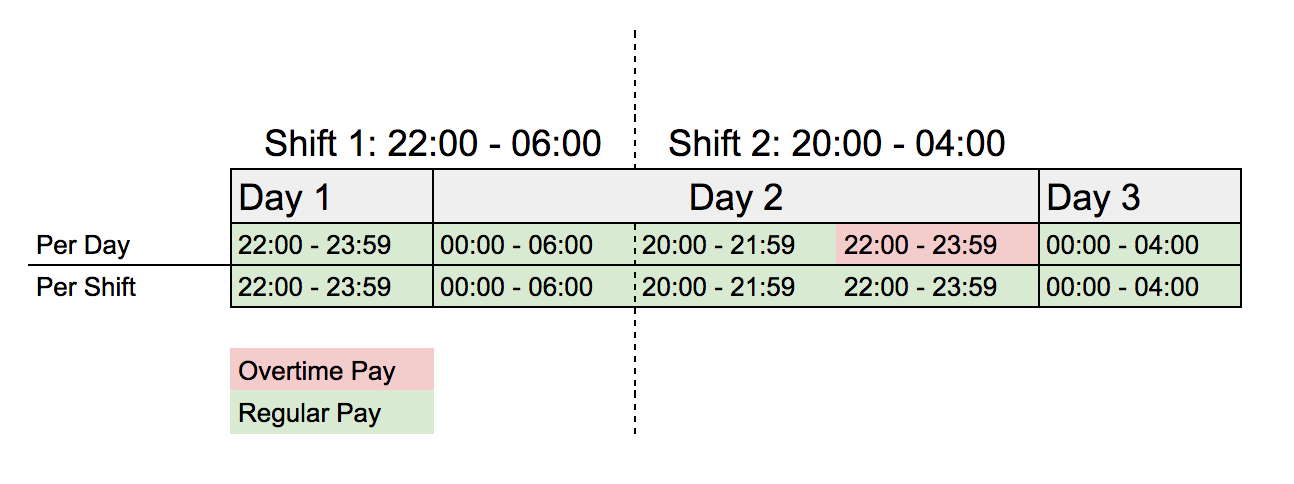

We have rolled out a new feature that will come in very handy for our BPO (Business Process Outsourcing) clients – per shift overtime.

We have rolled out a new feature that will come in very handy for our BPO (Business Process Outsourcing) clients – per shift overtime.

At PayrollHero we are so confident with the payroll calculations of our platform that we have instituted a bug bounty program for any bugs found within payroll calculation feature set.

At PayrollHero we are so confident with the payroll calculations of our platform that we have instituted a bug bounty program for any bugs found within payroll calculation feature set.

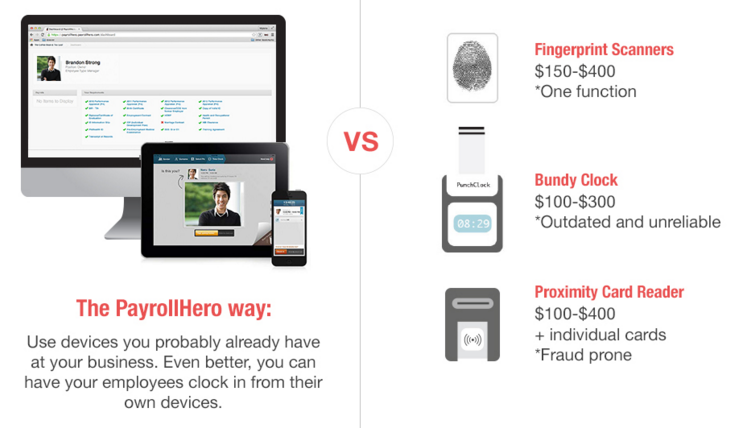

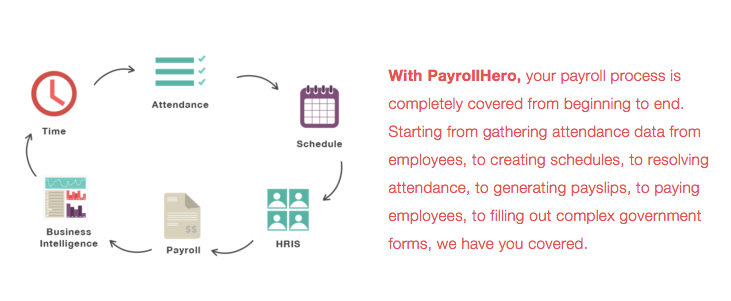

Business owners have multiple systems that deal with different HR problems; a biometric device to measure clock ins, a separate Excel sheet that imports data from the biometric device and generates payroll, another Excel sheet that needs to be updated every week with schedules for each employee and a whole other system that employees use to apply for leave. With so many systems to deal with, no wonder an HR manager barely has any time to engage with employees or find innovative ways to overcome Singapore’s labor crunch.

Business owners have multiple systems that deal with different HR problems; a biometric device to measure clock ins, a separate Excel sheet that imports data from the biometric device and generates payroll, another Excel sheet that needs to be updated every week with schedules for each employee and a whole other system that employees use to apply for leave. With so many systems to deal with, no wonder an HR manager barely has any time to engage with employees or find innovative ways to overcome Singapore’s labor crunch.