Not having enough time is a struggle that many small business owners deal with.

It’s that overwhelming feeling of trying to tackle everything in your to-do list but you feel like time is racing against you too. Before you know it, dusk has settled in (or dawn if you’re a night owl) but you have nothing tangible to show for it.

Where did all the time go?!

Working long hours to accomplish each task you’ve set yourself for the day is not the solution. We outline three science-backed, actionable steps to leverage the 168 hours you’re given in a workweek.

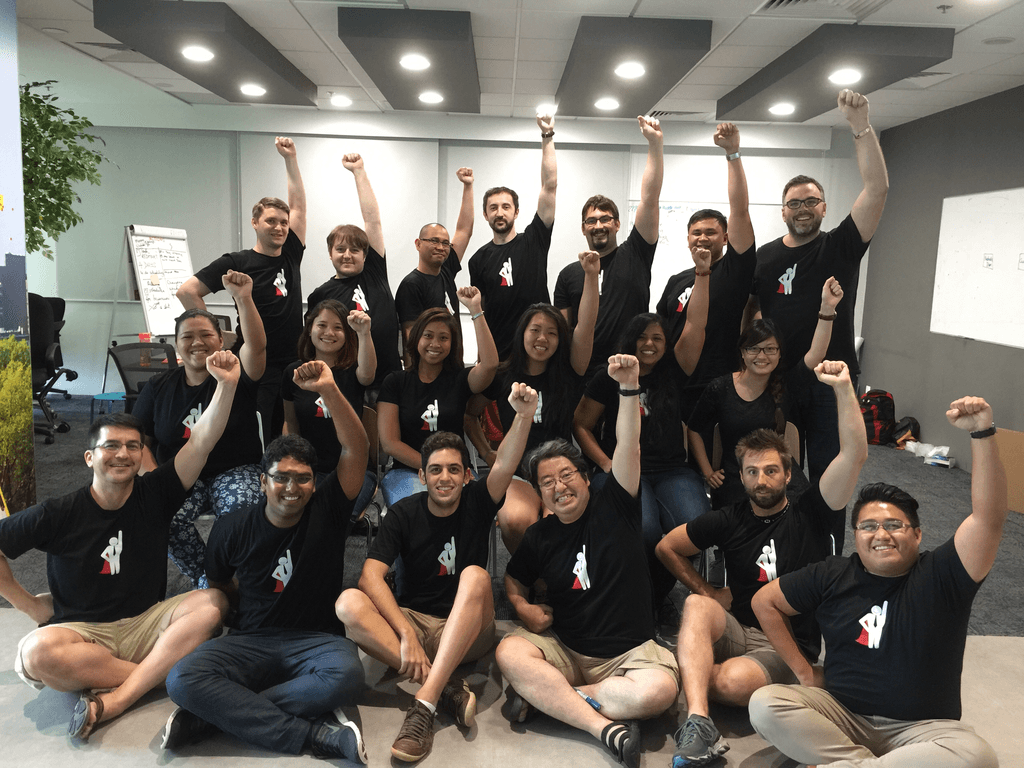

With this, you can stop feeling you don’t have enough time, and eventually get things done. NO SUPER POWERS REQUIRED!

Forget about managing time. Focus on your energy instead.

This may sound counterintuitive at first. Yet there’s actually a science to it. Tony Schwartz, CEO and founder of The Energy Project and co-author of The Power of Full Engagement: Managing Energy Not Time suggested a different approach to productivity in this Harvard Business Review article.

“The core problem with working longer hours is that time is a finite resource. Energy is a different story,” Schwartz pointed out.

Working on The Energy Project, Schwartz and his team consulted with business leaders and owners, and evaluated their time-management efforts in parallel with their productivity. In their findings, they found out two fine points that are actually hurting one’s productivity:

- Multitasking

- Infrequent breaks within the day

Multitasking, according to Schwartz, slows you down. “A temporary shift in attention from one task to another—stopping to answer an e-mail or take a phone call, for instance—increases the amount of time necessary to finish the primary task by as much as 25%.”

Instead, he recommends taking ultradian sprints – being fully focused for a specified amount of time and taking breaks in between these specified time blocks.

This approach is grounded on human physiology. Psychophysiologist Peretz Lavie referred to it as “ultradian rhythms,” or natural cycles that take place within the 24-hour sleep wake cycle. In a nutshell, humans have 90 to 120-minute cycles during which we gradually shift from a high-energy state into feeling burned out. This is why taking frequent breaks are crucial.

In another Harvard Business Review post last year, author Ron Friedman examined why foregoing breaks at work is a recipe for disaster:

Studies show we have a limited capacity for concentrating over extended time periods, and though we may not be practiced at recognizing the symptoms of fatigue, they unavoidably derail our work. No matter how engaged we are in an activity, our brains inevitably tire.

Still not convinced? Ferris Jabr of The Scientific American laid out several studies in this in-depth look of how frequent breaks can actually help you regain attention, be more creative, and improve your decision-making skills.

The Action Plan

Devote all your attention and focus to a specific task for a certain time block such as responding to emails or crunching out your team’s current payroll. Figure out what works for you – experiment on 30, 60, or 90 minute intervals – and ride the waves of your own ultradian rhythm rather than go against the flow.

Next, step away from your work to do non-work related tasks for a specific period of time too. Logging in to Facebook doesn’t count! Why not have a short chat with one of your employees? Or play foosball with the team?

In hindsight, not all hours were created equal. Therefore, it is best to schedule your tasks based on when you are feeling the most energetic and engaged!

Sketch out your ideal work week.

As a small business owner, planning things ahead is most likely second nature to you. Yet apart from scheduling meetings or outlining what needs to be done for the entire work week, have you thought about designing your ideal week?

Michael Hyatt, author of the New York Times bestseller Platform: Get Noticed in a Noisy World wrote in this short yet succinct post:

Sure, you can’t plan for everything. Things happen that you can’t anticipate. But it is a whole lot easier to accomplish what matters most when you are proactive and begin with the end in mind.One of the ways I do this is by creating a document, I call “My Ideal Week.

The Action Plan

Hyatt suggested that it’s like drafting your weekly budget, but instead of allocating your finances, you are planning out how you will spend those 168 hours you have in a week.

But structures are supposed to hinder creativity, right? Well, it turns out that small business owners like you need a system in place to empower yourself into regaining focus.

Georgetown University professor Cal Newport who runs a blog on productivity has this response:

Sometimes people ask if controlling time will stifle creativity. I understand this concern, but it’s fundamentally misguided. If you control your schedule: (1) you can ensure that you consistently dedicate time to the deep efforts that matter for creative pursuits; and (2) the stress relief that comes from this sense of organization allows you to go deeper in your creative blocks and produce more value.

Newport further explained:

A 40 hour time-blocked work week, I estimate, produces the same amount of output as a 60+ hour work week pursued without structure.

By and large, you are less likely to get frazzled once Monday kicks in because you have already made the decision by designing time blocks (including the breaks in between) in your calendar within the week

Delegate and automate.

You can be the most awesome small business owner in the world but this doesn’t necessarily mean that you’re also the most prolific blogger, most proficient accountant, or the most welcoming receptionist.

In a survey of small businesses, it turns out that “day-to-day store operations” is the most time-consuming task identified by the owners and managers.

So how do you go about your mission to gain new customers or forge meaningful relationships with your existing clientele if you’re busy with the day-to-day store operations? Impossible, right?

The Action Plan

Do more of the things that you are good at and quit wearing multiple hats. You can either delegate accounting functions to an independent contractor or start automating payroll and inventory management tasks.

It all boils down to embracing newer technologies to find more time for the things that truly matter to your small business.

The Bottom Line

The key takeaways to getting everything done in your small business are to manage your energy rather than time, sketch out an ideal week, and consider delegating and automating repetitive tasks.

What time management tips are currently working in your favor? Which ones didn’t work?

Share your thoughts in the comments or join the conversation on Twitter. We’d love to hear from you!

We recently announced that PayrollHero can generate employee happiness reports for our clients. What does that really mean?

We recently announced that PayrollHero can generate employee happiness reports for our clients. What does that really mean?