I asked David Elefant to contribute a guest post to our blog about doing business in the Philippines. David owns Dayanan Business Consultancy which assists individuals and foreign companies of all sizes in setting up their business operations in the Philippines.

I asked David Elefant to contribute a guest post to our blog about doing business in the Philippines. David owns Dayanan Business Consultancy which assists individuals and foreign companies of all sizes in setting up their business operations in the Philippines.

Doing Business in the Philippines

Guest Post: David Elefant

Why setup a business in the Philippines?

The top reasons are the friendly English speaking low cost labor and the warm weather.

Your employees are your number one asset. In the Philippines you will find employees who are loyal, trainable, warm and caring, have good work ethics and are team players. Take good care of them and they will take good care of the company.

For larger operations there are tax incentives such as a four year exemption from corporate income tax extendable up to eight years, with the option to pay a special 5% tax on gross income in lieu of all national and local taxes after the tax holiday and exemptions from duties and taxes on imported capital equipment.

The Philippines is well situated in South East Asia with just a few hours flight time to 15 countries.

What to expect when setting up in the Philippines

Entrepreneurs have various legal entities to choose from to setup their business. The choice will depend on the kind of business and where your clients are situated. Due to the many restrictions on foreign ownership, export enterprises are the easiest for a foreigner to establish. An export enterprise does not have any limitations on foreign ownership or require a high paid-up capital (Philippines’ regulations impose minimum paid-up capital depending on the nature of the business).

Entrepreneurs have various legal entities to choose from to setup their business. The choice will depend on the kind of business and where your clients are situated. Due to the many restrictions on foreign ownership, export enterprises are the easiest for a foreigner to establish. An export enterprise does not have any limitations on foreign ownership or require a high paid-up capital (Philippines’ regulations impose minimum paid-up capital depending on the nature of the business).

The Philippines bureaucracy has a love affair with paperwork.

Applying for any permit or business registration usually requires multiple copies of every document or permit you obtained at another government office and numerous visits. It can easily take up to two months to obtain all the necessary permits to legally operate a business. After receiving a certificate of incorporation or a license to transact business from the SEC, the next step is to obtain Barangay Clearance and Mayor’s Permit (many steps involved), then off to the Bureau of Internal Revenue followed by registering with the Social Security System, PhilHealth and Home Development Mutual Fund.

It is very important to understand the labor laws to correctly prepare employment contracts and employee handbooks. The courts will rule in favor of the employee on any clause which is not clearly stated.

Those who can do without every single modern amenity can find office space outside of the larger agglomerations and save on rent. Rent in Metro Manila is not cheaper than most North American mid-sized cities. The real savings is on the workforce if you know how to manage them.

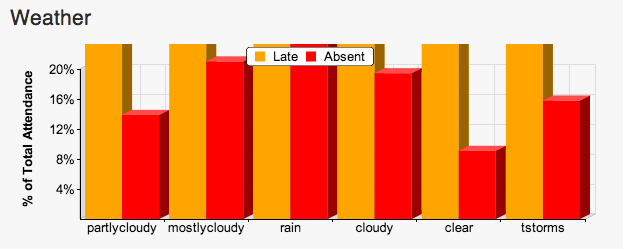

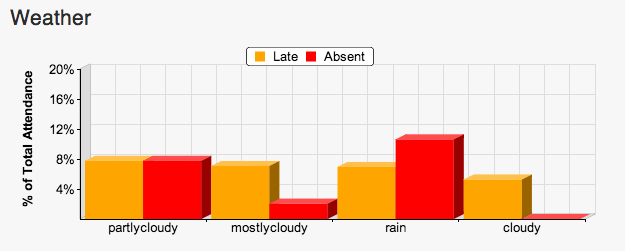

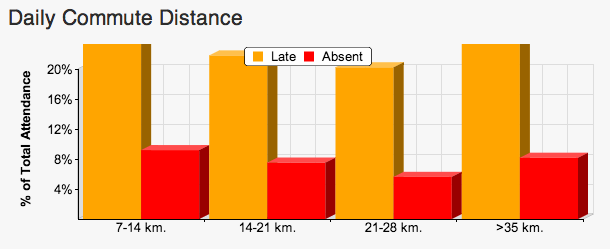

Location, location, its important to find an office space that will allow your employees to reach work easily during bad weather especially during the typhoon season. Make you sure your office building has a generator. Other very necessary nearby amenities are restaurants and convenience stores.

Internet is not cheap and a backup connection is a necessity.

In the Philippines, the set up is slow but once everything is in place you will have found the right place to do business.

David Elefant, Consultant

www.DayananConsulting.com

—

If you have any questions about setting up in the Philippines, feel free to reach out to David. Let him know PayrollHero sent you. 🙂