In Singapore, there a government fund call the CPF of The Central Provident Fund. It is a social security system that enables working Singaporeans and Permanent Residents (PR) to set aside funds for later in life. It also has a healthcare, home ownership, family protection and asset enhancement portion.

In Singapore, there a government fund call the CPF of The Central Provident Fund. It is a social security system that enables working Singaporeans and Permanent Residents (PR) to set aside funds for later in life. It also has a healthcare, home ownership, family protection and asset enhancement portion.

How does the CPF system work?

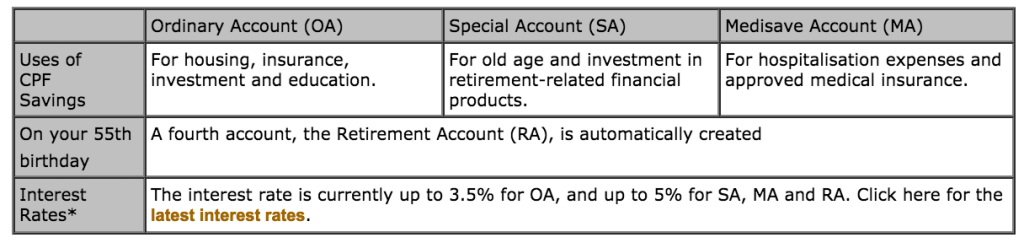

Both employees and employers make monthly CPF contributions. These contributions go into three accounts:

As Singaporeans live longer, there is a need for a reliable stream of income to meet living expenses. Statistics have shown that today, 1 in 3 Singaporeans aged 65 is going to live to age 80 and 1 in 2 is going to live to age 90 and beyond.

As Singaporeans live longer, there is a need for a reliable stream of income to meet living expenses. Statistics have shown that today, 1 in 3 Singaporeans aged 65 is going to live to age 80 and 1 in 2 is going to live to age 90 and beyond.

To learn more about CPF check out their website.

Pingback: The New Employer's Guide to CPF