Last week, Kieran our Head of Client Success, conducted training sessions for the new PayrollHero team members in Singapore as well as a few clients. We got some hands on experience with the app, which helped us gain a deeper understanding of how the product works. As an intern who has been here for a few weeks, my knowledge about the product came from speaking with team members, listening to sales pitches and reading about the product online. So it was an interesting experience to use the product on a demo account and view it from the perspective of a payroll administrator. All new PayrollHero team members get certified on the platform so that they know exactly what the platform can do.

Last week, Kieran our Head of Client Success, conducted training sessions for the new PayrollHero team members in Singapore as well as a few clients. We got some hands on experience with the app, which helped us gain a deeper understanding of how the product works. As an intern who has been here for a few weeks, my knowledge about the product came from speaking with team members, listening to sales pitches and reading about the product online. So it was an interesting experience to use the product on a demo account and view it from the perspective of a payroll administrator. All new PayrollHero team members get certified on the platform so that they know exactly what the platform can do.

Kieran took us through every aspect of the product. My first thought when I was told about the training was, “Wow, a two and a half day training session? But I already know everything about it!” Which, as you may have guessed, turned out to be highly overstated. Within the first two hours of training, I came to the conclusion that the product was far more powerful than I had expected.

The first day was about Human Resources Information Systems (HRIS). The next day was spent on generating payroll and the final day was dedicated to understanding time, attendance and scheduling using the app.

The interesting part about the app is its customization capabilities. A human resources (HR) administrator can record the company’s organizational chart. The hierarchy allows you to identify employee types and positions. Thresholds allow you to set rules on what kinds of notifications you get based on the activities of employees under you in the hierarchy. The thresholds have multiple permutations and combinations that, once customized, help you prioritize information that you need instantly versus information that can wait till a more suitable time.

It didn’t stop there. Customization extended to how you segment payroll: employer contributions (CPF, SDL, FWL), bonuses, vacation payments, advance payments, claims that need to be redeemed. Any kind of payment outside of the basic calculation of an employee’s hourly wages can be segmented and customized so that all a payroll administrator has to do, is enter which segment the payment should go into. The app can take care of debiting/crediting the amount to the required account. It will notify you when the account is hitting a pre-recorded limit. The flexibility of the app went as far as allowing you to import data from a spreadsheet, allowing the app to automatically fill in employee details.

It didn’t stop there. Customization extended to how you segment payroll: employer contributions (CPF, SDL, FWL), bonuses, vacation payments, advance payments, claims that need to be redeemed. Any kind of payment outside of the basic calculation of an employee’s hourly wages can be segmented and customized so that all a payroll administrator has to do, is enter which segment the payment should go into. The app can take care of debiting/crediting the amount to the required account. It will notify you when the account is hitting a pre-recorded limit. The flexibility of the app went as far as allowing you to import data from a spreadsheet, allowing the app to automatically fill in employee details.

While all of this might seem like a rather dry topic to train on for nearly three days, Kieran managed to make the whole session more interesting by throwing in quizzes and having interactive sessions. Every demo account had characters from Kieran’s favourite fiction series. Homer Simpson got a bonus for his outstanding work (let’s pretend like that is EVER going to happen), Sherlock Holmes got promoted to the next level on the org chart, Buffy Summers asked for a change in her schedule for the next 3 weeks and Harry Potter recorded coming in early to work consistently. All these characters were a part of the certification exercises, which made the entire process not only informative but also engaging.

The time, attendance and scheduling part of the course was done through an online training portal on the PayrollHero website. Again, I was pleasantly surprised by how detailed the app was and how customizable the entire process of scheduling was. It was impressive that the app was user friendly and flexible with creating, adjusting or removing schedules based on timing, location and type of work: whether it was a routine desk job or a part time job that required changing schedules often. The app, as was intended, was perfectly designed for retailers and restaurant owners who deal with employees who have erratic schedules which require constant adjustments.

The exercises and quizzes were effective in understanding how much we grasped from the lessons. It was clear that working with app required you to be consistent and methodological with the processes for entering data, giving system permissions, organizing the company’s hierarchy and setting customized options especially since the data that the system works with is sensitive. Finally, the certification undoubtedly served its purpose: it gave us a complete picture of how the app works and how a payroll administrator can benefit by using all its features for time, attendance, scheduling and payroll.

Learn more about PayrollHero Certification in the Philippines and Singapore.

Last week, Kieran our Head of Client Success, conducted training sessions for the new PayrollHero team members in Singapore as well as a few clients. We got some hands on experience with the app, which helped us gain a deeper understanding of how the product works. As an intern who has been here for a few weeks, my knowledge about the product came from speaking with team members, listening to sales pitches and reading about the product online. So it was an interesting experience to use the product on a demo account and view it from the perspective of a payroll administrator. All new PayrollHero team members get certified on the platform so that they know exactly what the platform can do.

Last week, Kieran our Head of Client Success, conducted training sessions for the new PayrollHero team members in Singapore as well as a few clients. We got some hands on experience with the app, which helped us gain a deeper understanding of how the product works. As an intern who has been here for a few weeks, my knowledge about the product came from speaking with team members, listening to sales pitches and reading about the product online. So it was an interesting experience to use the product on a demo account and view it from the perspective of a payroll administrator. All new PayrollHero team members get certified on the platform so that they know exactly what the platform can do. It didn’t stop there. Customization extended to how you segment payroll: employer contributions (CPF, SDL, FWL), bonuses, vacation payments, advance payments, claims that need to be redeemed. Any kind of payment outside of the basic calculation of an employee’s hourly wages can be segmented and customized so that all a payroll administrator has to do, is enter which segment the payment should go into. The app can take care of debiting/crediting the amount to the required account. It will notify you when the account is hitting a pre-recorded limit. The flexibility of the app went as far as allowing you to import data from a spreadsheet, allowing the app to automatically fill in employee details.

It didn’t stop there. Customization extended to how you segment payroll: employer contributions (CPF, SDL, FWL), bonuses, vacation payments, advance payments, claims that need to be redeemed. Any kind of payment outside of the basic calculation of an employee’s hourly wages can be segmented and customized so that all a payroll administrator has to do, is enter which segment the payment should go into. The app can take care of debiting/crediting the amount to the required account. It will notify you when the account is hitting a pre-recorded limit. The flexibility of the app went as far as allowing you to import data from a spreadsheet, allowing the app to automatically fill in employee details.

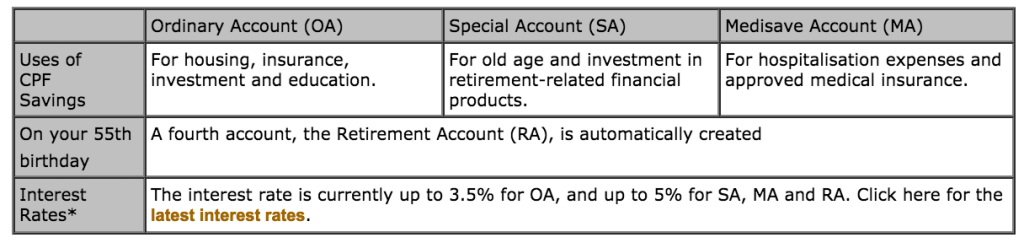

e restricted to Singaporeans and PRs only. There are 4 major accounts that CPF contributions go into: Ordinary Account (for retirement, housing finance, investment, education), Special Account (for old age and special contingencies), Medisave Account (for hospital bills) and Retirement Account (this account is opened once the employee turns 55). Check out these links to find out contributions

e restricted to Singaporeans and PRs only. There are 4 major accounts that CPF contributions go into: Ordinary Account (for retirement, housing finance, investment, education), Special Account (for old age and special contingencies), Medisave Account (for hospital bills) and Retirement Account (this account is opened once the employee turns 55). Check out these links to find out contributions

It is important to note that Singapore companies are required to pay Foreign Worker Levy (FWL) for the Work Pass and S Pass holders. This levy is imposed by the Singapore Government to regulate foreign workers numbers in the country.

It is important to note that Singapore companies are required to pay Foreign Worker Levy (FWL) for the Work Pass and S Pass holders. This levy is imposed by the Singapore Government to regulate foreign workers numbers in the country.

As Singaporeans live longer, there is a need for a reliable stream of income to meet living expenses. Statistics have shown that today, 1 in 3 Singaporeans aged 65 is going to live to age 80 and 1 in 2 is going to live to age 90 and beyond.

As Singaporeans live longer, there is a need for a reliable stream of income to meet living expenses. Statistics have shown that today, 1 in 3 Singaporeans aged 65 is going to live to age 80 and 1 in 2 is going to live to age 90 and beyond.