If you’re reading this article, I’m pretty sure you’re not hoping to find out what the next Candy Crush app is. If you are, we’ll have a different blog post for that soon!

For now though, I’m assuming that you are an entrepreneur on-the-go. Or a busy CEO juggling through multiple hats at work.

You can also be a high level executive who’s embracing tech and the convenience it brings.

The good news? PayrollHero rounds up a few of the best apps for busy CEOs this 2015. This is part 1, and we’ll feature more apps real soon.

Let’s dig in!

Best Apps for Busy Entrepreneurs

We’re not saying classic notebooks are useless at this day and age, but leaving home without one is more and more common these days.

But you know what you never forget when you leave home? Your mobile phone.

And this is where Evernote shines.

An app that you can use in the comfort of your own phone, Evernote takes note-taking to a whole new level.

Whether you need to jot down quick notes during a meeting, or you’re attending a conference and you’re trying to take note of key points, Evernote gets the job done perfectly.

You can literally take note of anything you want. Even writing a new campaign strategy, or projections for the coming quarter can be done with this productivity app.

Not only does it sport a user-friendly interface, it also syncs smoothly with your other devices. You can access Evernote in your laptop, PC, or tablet as well. So whatever progress you’ve made on your mobile phone, you can see it updated and syncing in real-time with your laptop.

Pretty fun stuff, huh?

Evernote is FREE, but if you like it so much and you want all your employees using it as well, you can consider their premium or business plan.

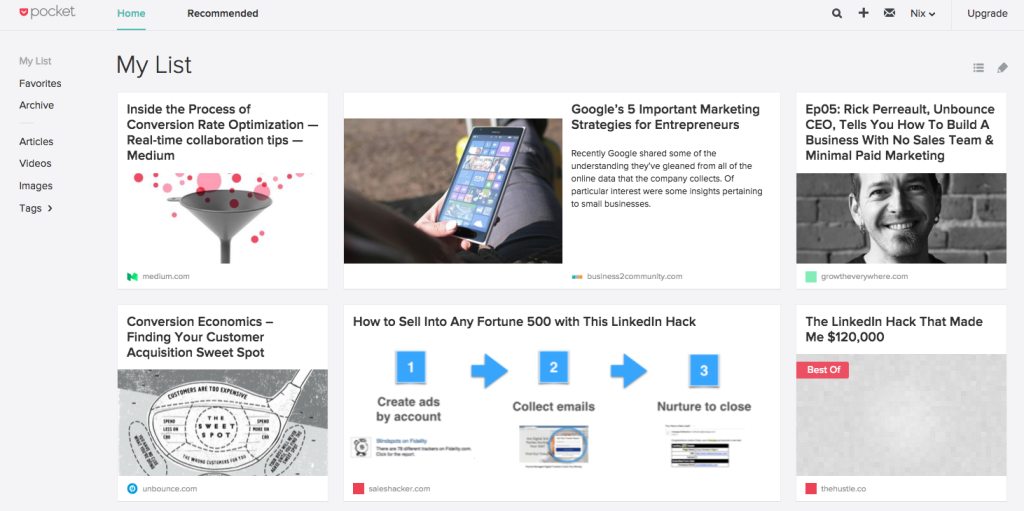

Now this is a personal favorite of mine (author). Imagine your browser’s bookmark tool… on STEROIDS.

That’s how Pocket functions! Any article or content you read from your favorite websites, blogs, Twitter, Facebook, or even YouTube can easily be saved to your pocket.

It’s a bookmarking tool that saves any form of content (webpages, articles, videos, tweets, etc.) so that you can read it later, OFFLINE.

Anything you save to your Pocket, you can read later on even without internet.

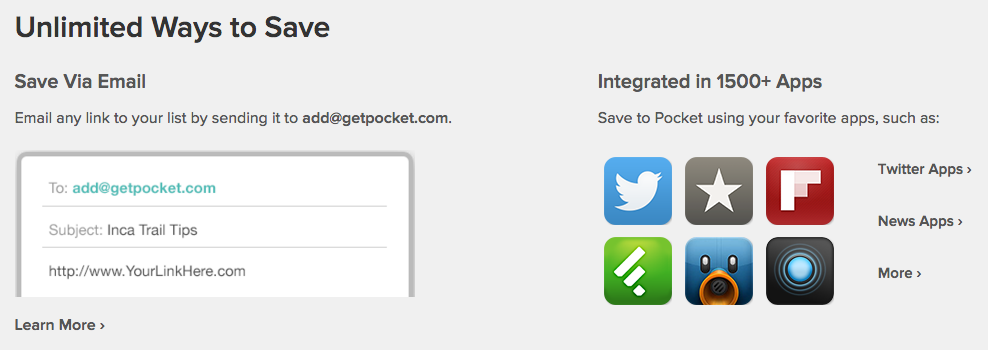

The best part is that Pocket integrates with so many other apps you use such as Twitter, and even via Email.

Now, how awesome is that?

I’ve been using Pocket for almost a year now, and it’s one of the apps I can’t live without. It’s free, and syncs with all your devices. You can “pocket’ an article using your mobile phone, then finish reading it later on your laptop – or vice versa.

I’m having a hard time convincing people that I’m not being paid by Pocket to promote them, because I find myself tweeting about how awesome they are every once in awhile.

@nixeniego Thanks for the major shoutout, Nico!

— Pocket Support (@pocketsupport) November 4, 2015

Try it out and see for yourself.

HINT: Pocket this blog post for future reference. 😀

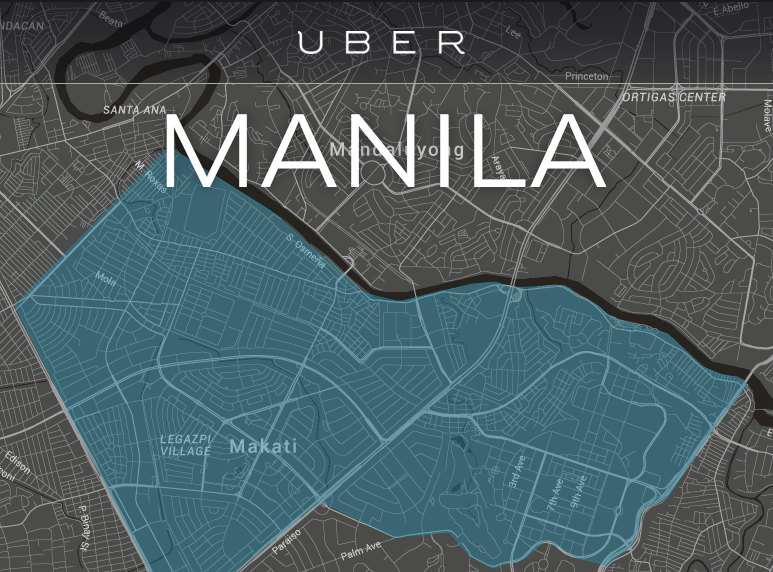

Need to rush to a business meeting? Or are you just too tired to drive back home after a long day at work? Well, thank your lucky stars for Uber.

One of the top apps in 2014, Uber has disrupted the transportation scene in the Philippines. For a very affordable price, you get to enjoy a comfortable ride, with your own private driver, to literally anywhere you want.

If you’ve been living in Manila for a while, you’ll know how difficult it is to hail a cab or get around the metro through public transportation vehicles. But with Uber, all you need is a few clicks on your mobile phone and your vehicle will be arriving in just a few minutes.

Driving to your preferred destination isn’t always an ideal choice, so Uber proves to be a convenient way to go anywhere you prefer.

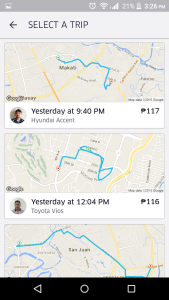

The PayrollHero team loves Uber, and I personally use Uber at least 2-4 times a week.

With courteous drivers, affordable rates, and very friendly customer support, Uber is definitely one of the top apps for ANYONE, entrepreneur or not.

If for some reason you haven’t tried Uber yet, now’s the time. Go for it, and tweet us how your first ride goes.

Transitioning from Microsoft Word to Google Docs isn’t always easy, but it’s a jump I’m more than happy I made a few years ago.

With Google Docs, you can write any document and it auto-saves instantly. You literally never have to press “Save” again.

As you’re usually always on the go, it’s inevitable that you do forget to save your document from time to time. This won’t be an issue anymore with Google Docs.

What makes it awesome though is that it syncs with your entire Google account (Google Drive). So all you really need is a Gmail account, and you can use Google Docs (as well as Google Sheets), anytime.

Google Docs is free, in the cloud, and very easy to use. Give it a go today!

Of course you need to unwind somehow! Spotify is a great way to just relax and enjoy good music.

Spotify is FREE, although there’s a premium plan if you don’t want to be bothered with ads. You can also use the offline mode if you avail of the premium plan.

With Spotify, you get access to a boatload of music, from almost any genre you can think of. Unless you’re a Swifty, there’s no way for you not to enjoy Spotify.

Even busy entrepreneurs deserve some good music!

CONCLUSION

That rounds up our top apps for busy entrepreneurs list. I hope you make good use of some (if not all!) of the apps listed here. Become more productive, and more awesome with these must-download apps!

Keep checking our blog for more of these as we’ll come up with part two of the best apps for busy entrepreneurs in the coming weeks!

Today, we bring you accounting and payroll BPO executive Stefan Vermeulen, CEO of

Today, we bring you accounting and payroll BPO executive Stefan Vermeulen, CEO of