Restaurants and retails stores usually generate payroll by multiplying their employees’ hourly rate with the number of hours worked by each employee.

The number of hours worked is measured by a time sheet that employees punch in, a biometric device or (if you’re one of our awesome clients) the PayrollHero app that lets your employees take selfies to clock in and out.

We get a lot of questions about why businesses should change from biometrics to anything else. Some say that the biometrics system is already ideal… that it’s fast and accurate. While all of this might be true, we have a strong argument for why biometrics may not be the best option for your business.

The PayrollHero app – an all in one solution

Biometric devices work as a standalone system. You need to get a whole new software for processing information from the device and integrating it into the software that calculates attendance. Often, you need another system to monitor scheduling, manage leaves and generate payroll.

On the other hand, PayrollHero’s TeamClock / MyClock app records all the information you need to know about your employee on the cloud. It is an end-to-end solution that relieves you of the hassle of integrating multiple systems together.

The only device you will ever need is either of the following: iPad, smartphone (Android or iOS), or a computer (PC or Mac). PayrollHero’s apps are compatible with these devices so you are assured to have a streamlined process from start to finish.

Wear and tear

The biometric device is subject to wear and tear. If you have hundreds of employees using a couple of biometric devices, you are more likely to face this issue. However, MyClock or TeamClock are is accessed within an iPad / smartphone (or computer), which is less likely to undergo the kind of wear and tear that biometric devices are prone to.

Software updates

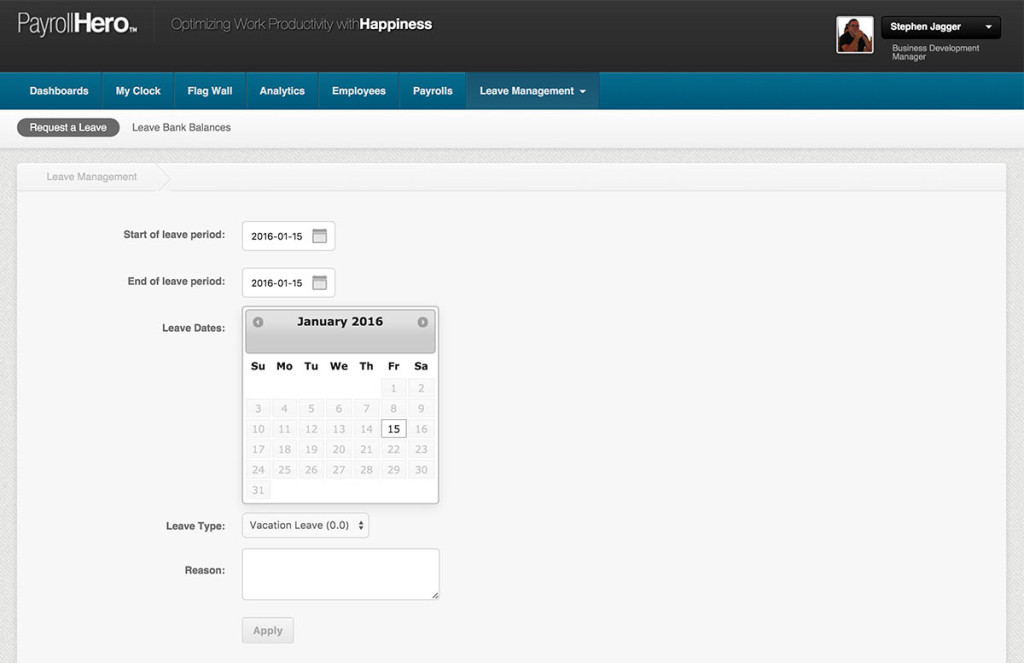

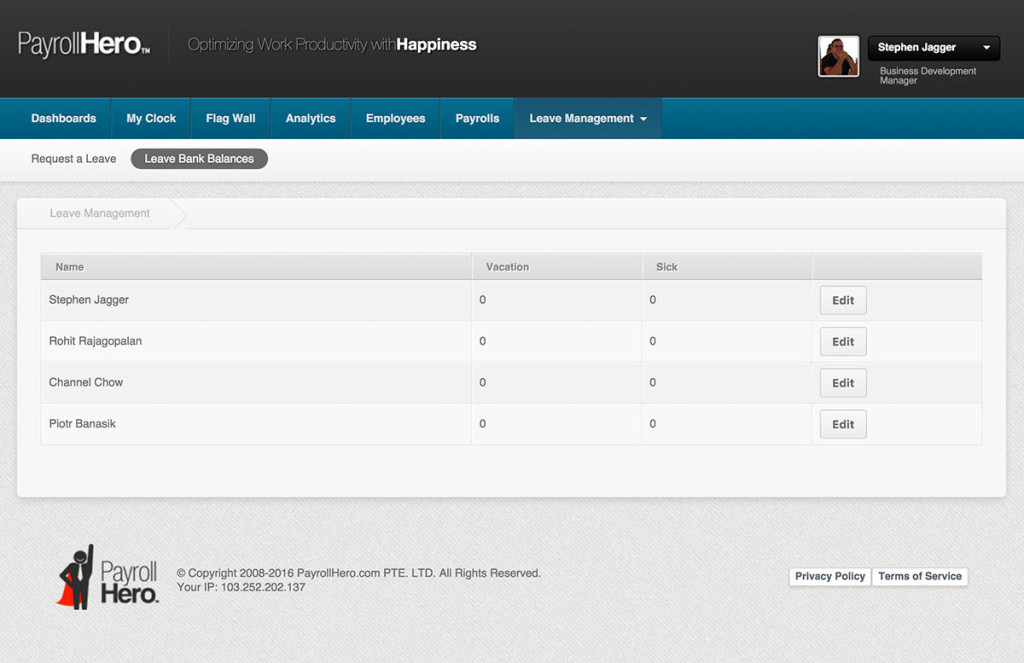

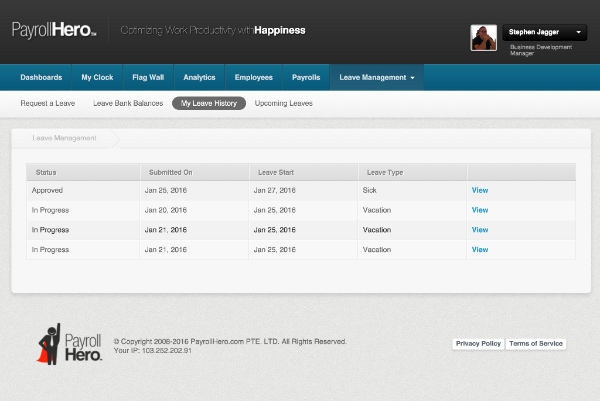

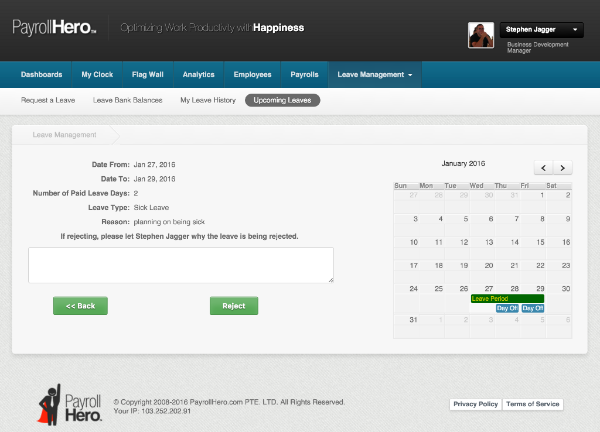

The PayrollHero app updates from time to time to give the user a better experience and introduce new features (for example, we have just introduced leave management! Check it out). The app is always improving and finding ways to make time and attendance easier for businesses, whereas the biometric device can only go so far in it capabilities.

There are other issues with the biometric device too. Biometric devices lead to manual calculations when there are minor infractions where employees come just a couple of minutes early or late.

We handle this problem by implementing thresholds within which these infractions are excused. This frees up time for your HR manager to do more important things, like finding the best talent for your company and managing employee relations.

Altogether, the biometric device may be faster in recording clock ins, but the time wasted by the HR manager in fixing the inefficiencies in the device is far more.

So if you’re ready to let go of your biometric device and embrace the selfie clock in, contact us at sales@payrollhero.com or visit our website to learn more.

I had the pleasure of sitting on a panel at the latest

I had the pleasure of sitting on a panel at the latest  There were four panelists including myself. The other three were;

There were four panelists including myself. The other three were;

The PayrollHero MyClock has been available on

The PayrollHero MyClock has been available on