As part of a new series on this blog we will be profiling PayrollHero users to learn more about them, their business, where they go to learn and best practices.

Nick Sinclair is the President of the Outsourced Accountant. The company is a BPO in the Philippines that helps accounting firms in Australia and New Zealand improve their client value added services. We spoke to Nick about his experience in the Philippines.

Nick Sinclair is the President of the Outsourced Accountant. The company is a BPO in the Philippines that helps accounting firms in Australia and New Zealand improve their client value added services. We spoke to Nick about his experience in the Philippines.

- Tell us about your company.

The Outsourced Accountant is dedicated in helping Australian and New Zealand Accounting firms identify their current workflow blockages and employ the right team on a full-time basis to help them become proactive in client value added services. We are a BPO focused solely on this niche and our offering is unique and not like traditional BPO offerings.

- How and when did you realise the need for Australian businesses to outsource accounting?

I visited Manila for an Entrepreneurs Organization board conference approximately 3.5 years ago and I went and spent the day with Mike O’Hagan and saw his operation there, as well as a range of other businesses. This then got my mind racing and I then thought how I could flip my accounting and financial planning business to become more efficient and allow my Australian team to actually add value to clients. This then grew into a business when others in my industry saw what we were doing and didn’t want to reinvent the wheel so we started an outsourcing business based on what frustrated us most with the providers we used in Manila. I understand that most accounting firms are buried in paperwork and process-driven tasks, causing them to lose focus on adding value to clients. We want to help these firms get back to client facing work by having an offshore team who can take care of all the compliance and administration work.

- Where are you headquartered?

Our office in the Philippines is situated in Clark Freeport Zone, while our headquarters in Australia is located in Queensland.

- How many locations do you have in the Philippines? Why did you choose this location versus other locations that are perceived more conventional (i.e: why Clark over Manila)?

Just one inside Philexcel Business Park in Clark.

I prefer Clark over Manila because it’s a lot quieter and less congested environment. A lot of our team members who live within the region have already worked in Manila, since it’s obviously one of the biggest work environments in the Philippines, but they wanted to come home and live with their families. Here in Clark, it’s easier to get to work as people will not be sitting in traffic for hours. We’re very much about work-life balance with our team over here so we want them to spend more time with their families.

Moreover, Clark is accessible to expressways, has its own international airport, and enjoys a variety of amenities and government incentives. We also have a talent pool of close to 8 million people with very little competition (compared to Manilla and other regions).

- What was the biggest roadblock to establishing yourself in the Philippines?

The biggest roadblock was the time that I had to spend being in the Philippines, being away from the family and missing out on school events of the kids as I was constantly away.

The biggest roadblock to setting up in the Philippines is the legislation and getting the right advice as it isn’t straight forward and you need to register with multiple departments and each department needs the others approval. There are lots of experts who charge anywhere from $1500 to $10,000 AUD to provide this advice but a lot of the time they dont know what they are talking about. We struggled until we found a local lawyer, who is well connected and has a wealth of experience and endless connections. The other challenge is no one tells you all the things you need to have to even operate, things like Workplace health and safety approval, fire approval, a company nurse when you hit certain levels of staff. There is a lot more involved then get an office, hire some staff and your off.

6. Was there an unexpected outcome (positive or not) from moving into the Philippines?

The business we now have was an unexpected outcome. We originally did this to service our own firm’s needs, but we have since grown to 180 team members in less than 18 months and I have now sold my accounting and financial planning business to focus on our outsourcing business.

- How do you see this industry changing over the next few years?

I believe the industry is going to go through continued growth, but more BPO’s will start to niche in specific industries rather than be generalist BPO’s as this market is starting to become flooded with new BPO’s.

- What were your evaluation criteria before you chose the Philippines? Were there any other countries you were considering?

We had tried outsourcing in India, Vietnam and in Australia (and failed in all). The Philippines wins hands down.

The Philippines has a strong english culture, a strong accounting workforce and an even better number of accounting graduates coming out each year (its one of the main degrees Filipinos complete). The time zone suits perfectly as its only two hours behind for all Eastern states of Australia and the same time zone for Perth.

- What do you read to keep yourself up to date with your industry and the clients you are serving?

I don’t get too caught up in the BPO industry information, I focus on what is happening in the accounting industries in Australia and New Zealand. We focus on knowing our client, and talking to them regularly so we can continue to tailor our offering to meet there needs. We aren’t a traditional BPO. We also read a lot of industry information, specifically from industry thought leaders like Rob Nixon.

- What advice would you give a businessman moving into the Philippines, that you wish you knew before moving to the country?

It isn’t as easy as some people make it out to be (or it looks to be). I have had so many people say that we have had massive growth and made it look easy, but they don’t see all the work that goes on behind the scenes to deliver what we do. The Philippines isn’t a straight forward place to operate, its very paper based and not technology based which makes it hard. I also would say don’t employ an expat that hasn’t had experience managing a business the size you want to grow to. I have seen many expats that couldn’t manage 50 people in Australia but are managing more than this in the Philippines and failed due to lack of experience. There is plenty of local talent that have significant experience, so look locally (we just hired a gun Country Manager that has over 20 years’ experience managing large operations and he is a gun).

- What results that you delivered to your clients are you most proud of?

The growth of our business is testament that we are on the right track. 60% of our current growth is from existing clients putting more people on. We have plenty of case studies on it working for our clients. The comment we get regularly is our team are world class and pick it up quicker than our clients expect them to.

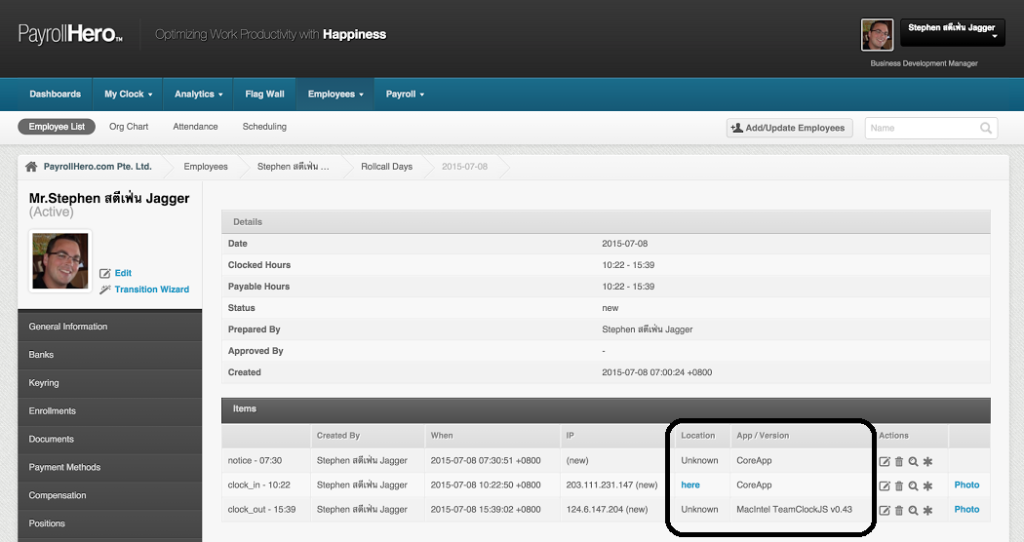

- How has PayrollHero helped streamline your business?

First of all, it made timekeeping more convenient. It has let us process calculations accurately, and kept us compliant with tax regulations. It also made it easy to manage and generate reports for government statutory benefits since the required forms are already provided and automatically filled.

The big benefit is our leadership team can login to the system, anywhere in the world to see the stats at a quick glance. The system has allowed us to focus on time and attendance and manage this as one of our business’s key strategic goals, and with tardiness being less than 1% late per day and attendance at 98% average for the year to date it is working (compared to the industry average).

- How did you run payroll before you found out about PayrollHero?

Before, we used biometrics door access control system for timekeeping, and we did payroll processing with excel spreadsheets. PayrollHero has certainly sped the process up and made it significantly more trackable and accurate.

14. What convinced you to choose PayrollHero over other payroll software vendors?

The unique TAS (Time, Attendance and Schedule) feature wherein team members have to take selfie photos to clock-in and out plus the good client experience (contact persons are accommodating; quick response time on queries raised) from inquiry to sign-up stage made us decide to go for PayrollHero.

Continue reading →

Horst von Wendorff founded Virtual Knowledge Workers Inc. in 2009. VKW Inc helps companies outsource scheduling, customer service, telemarketing, social media management and more. We asked Horst about his experiences while operating a BPO in the Philippines.

Horst von Wendorff founded Virtual Knowledge Workers Inc. in 2009. VKW Inc helps companies outsource scheduling, customer service, telemarketing, social media management and more. We asked Horst about his experiences while operating a BPO in the Philippines.

2. What are you top 5 favourite restaurants and why?

2. What are you top 5 favourite restaurants and why?

Nick Sinclair is the President of the

Nick Sinclair is the President of the

Over the last 10 years, business process outsourcing (BPO) centres have cropped up all over Asia. Two countries have emerged as leaders in the BPO sector: India and the Philippines. While Bangalore city in India ranked first in 2014 for

Over the last 10 years, business process outsourcing (BPO) centres have cropped up all over Asia. Two countries have emerged as leaders in the BPO sector: India and the Philippines. While Bangalore city in India ranked first in 2014 for Our

Our

Today, there are a mind boggling number of channels to use while searching for the best candidate to join your team. In Singapore, the number one channel for recruiters to hire employees is through an online jobs portal. The other Southeast Asian nations are catching up to the trend. Which means, not only do you have to post in multiple online portals, you also have to stand out from every other company in your industry because everyone is using the most popular channel. We want to help you with that. Here we have a list of jobs portals, both conventional and specialized, for restaurant and retail owners to recruit staff.

Today, there are a mind boggling number of channels to use while searching for the best candidate to join your team. In Singapore, the number one channel for recruiters to hire employees is through an online jobs portal. The other Southeast Asian nations are catching up to the trend. Which means, not only do you have to post in multiple online portals, you also have to stand out from every other company in your industry because everyone is using the most popular channel. We want to help you with that. Here we have a list of jobs portals, both conventional and specialized, for restaurant and retail owners to recruit staff. Kalibrr

Kalibrr