As a business owner, you are bound to look towards expanding your business at some point. In which case, you will have multiple offices at different locations. While you are in one worksite, you will want to stay in touch with employees in your other store locations. Staying connected is essential when your employees are spread out over the map. It’s even more important if your employees work remotely and do not often physically meet you or other employees on a regular basis.

Apps

At PayrollHero, we use a number of apps to facilitate remote work. These apps tie our employees together. We use the apps for face-to face interactions and for quick chats instead of spamming employees’ inboxes. The following apps might be useful for your company too:

Slack: This is the center of all our communication through different departments and offices. Slack allows you to create chat rooms and invite people to them. We use this feature to separate different functions of the team: engineering, business development, etc. Slack is also our metaphorical grapevine. We have chat rooms for random news, general musings and articles or books that anyone wants to share with the team. Slack also allows for private chats, thereby removing the need for emails to coordinate work. Slack is flexible in the sense that it has a number of integrations: Twitter, Mailchimp, appear.in.

Appear.in, Skype, Google Hangouts: Teams can’t function without face-to-face meetings. Bosses benefit from meeting their employees face-to-face in order to gauge their emotional state and general well-being. The app features and video quality differ but essentially they help you conduct online meetings.

Asana, Trello: To ensure that all tasks are tracked and accountable to the relevant employees, we use Asana. These apps are built to suit remote work. Asana allows you to assign tasks in a checklist format whereas Trello breaks down work in the form of projects in which tasks are outlined using cards. Both apps can be accessed online. So you or your employee can work from anywhere in the world and still stay on top of things.

Google Drive, Dropbox for Business: Keeping track of all the documents and sheets created by multiple departments across different worksites is essential. These apps are tailored towards businesses’ storage needs. With a subscription fee, you have access to unlimited storage, data analytics (for Google) and more. Both apps allow you to track who is editing files and what kind of access you want your employees to have for each file or folder.

It’s More Than Just Apps

Making remote work successful is more than having a suite of apps at your disposal. It requires a shift in the way you and your employees think about work. It requires trust in your employees to work even if you’re not monitoring them at the office. We have inculcated some practices that help maintain discipline and structure even when employees work at different locations across the work. Here are some that have helped us:

Morning catch ups: Every morning, at a time suitable to your employees in their respective time zones, each employee summarizes their work in 60 seconds. The format is: what they accomplished yesterday, what they couldn’t complete, what they will do today and roadblocks to completing their work. From the head of the team down to the entry-level employee must be able to summarize their work in under a minute. The meeting is helpful in understanding where the team is going and what can be done to remove roadblocks.

Handbooks: For new employees, or employees that have changed departments, it is hard to catch up to how things are done when the entire department works remotely. Writing down the steps to each task in a handbook and storing it in Google Drive/Dropbox cuts down on confusion and time wasted in connecting with the employee who knows how to do the required task. Handbooks remove any misunderstandings or errors. It is a fool-proof way of ensuring that the business continues in case someone is not available to lend a helping hand.

Using Slack to integrate the team: While Slack can be used to create chat rooms and do work, it is often a great tool to include everyone on the team and talk about common interests. Our chat-rooms like #random and #general are great spaces for employees to share ideas and talk about things outside of work. It is a place to plan outings over the weekend or share movie reviews. These conversations pull the team together and allow for cross-departmental interaction; something that could be missing while everyone is focusing on work.

Using Slack to integrate the team: While Slack can be used to create chat rooms and do work, it is often a great tool to include everyone on the team and talk about common interests. Our chat-rooms like #random and #general are great spaces for employees to share ideas and talk about things outside of work. It is a place to plan outings over the weekend or share movie reviews. These conversations pull the team together and allow for cross-departmental interaction; something that could be missing while everyone is focusing on work.

Finally, making remote work possible is about using apps to their maximum capacity and reviewing if they work or not. Managers need to be more mindful of their employees. Employees in turn need to make a conscious effort to stay on top of their work because remote work often results in the blurring of personal and professional life. Altogether, making remote work work is hugely beneficial to employees. All it takes is a little tweaking of the way things are usually done.

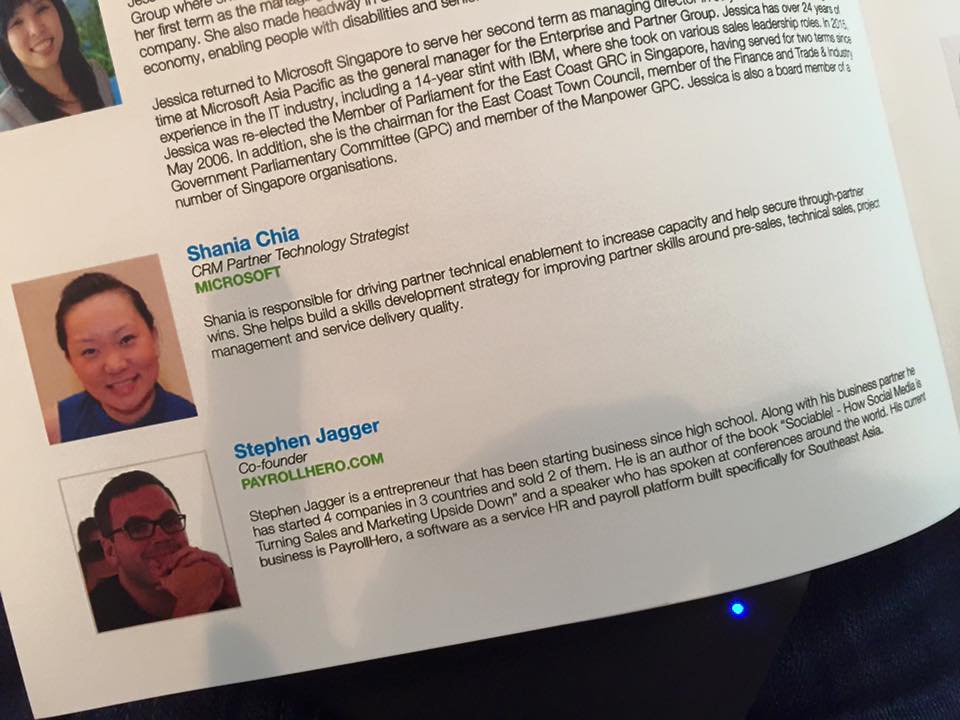

I had the pleasure of sitting on a panel at the latest

I had the pleasure of sitting on a panel at the latest  There were four panelists including myself. The other three were;

There were four panelists including myself. The other three were;