As an HR admin or payroll admin, it is important to understand how employee contributions work for the social security nets that are in place for Filipinos. There are 4 institutions that you should know about for employee contributions:

- Bureau of Internal Revenue (BIR)

- Social Security System (SSS)

- Philhealth

- Home Development Mutual Fund

We will be talking about each of these over the next few blog posts. Let’s start with the first:

Bureau of Internal Revenue

When you are employing someone in the Philippines, the first requirement is to have a Tax Identification Number (TIN) that is registered in the same Revenue District Office (RDO) as your business. The TIN is essential in order to process employee contributions.

- If the employee does not have a TIN, she must file form 1902 at the RDO where your business is registered.

- If the employee does have a TIN but is not registered in the same RDO as your business, then she must fill form 1905 and file it at the RDO where her previous employee was registered in order to cancel it.

- If the employee has a TIN registered at the same RDO as your company’s, then you will have to file form 2305 at the same RDO to update your employee’s information.

Here are all the BIR forms for your convenience.

Social Security Service

All employees in private companies across the country are required to be SSS members. The social security net covers a range of contingencies such as disability, sickness, retirement. Here is a summary of contingencies that the SSS covers. Around 70% of the contribution towards the SSS is made by the employer while 30% is made by the employee. Here is a schedule of contributions based on monthly salary.

First, you need to register your company as an employer in the nearest SSS office by filing Form R1. Along with this, you need to submit a list of employees with their SSS numbers. Note that private companies can only hire employees with SSS numbers. The form that needs to be files is Form R1A. The last form that needs to be submitted is the Specimen Signature Card SS Form L501. With these 3 forms, you will have to submit a sketch of your business address.

You will also have to pay a fee of PHP 160 for an Employer Registration Plate at the SSS or any SSS accredited bank. The list of accredited banks are here (at the bottom of the document). Along with the payment, you need to submit validated Miscellaneous Payment Return – SS Form R6 along with a Special Bank Receipt with this form.

You need to submit Form R1A – the Employment Report – every time a new employee joins. It must be filed within thirty days of the employee receiving the benefits of the coverage. The form must be submitted with the Specimen Signature Card and the 13 digit ER number and business address.

If there are changes to business operations, you need to file an Employer Data Change Request. This way, you will be billed correctly by the SSS.

Now that you know what these institutions are and what forms need to be filled, here is our example on how SSS contributions are calculated using PayrollHero software. As a bonus, we also have an example on how BIR taxes are computed.

That’s it for now! Check out our next few posts on Philhealth and Home Development Mutual Fund to find out everything you need to know about employer contributions.

Disclaimer: As always, consult your lawyer or accountant for advice! We are here to help, but your specific situation should be reviewed by a professional with complete knowledge of your situation.

If you are interested in learning more about PayrollHero for your Philippine business, check out our website at PayrollHero.ph. We would be pleased to chat further about your needs.

Today, there are a mind boggling number of channels to use while searching for the best candidate to join your team. In Singapore, the number one channel for recruiters to hire employees is through an online jobs portal. The other Southeast Asian nations are catching up to the trend. Which means, not only do you have to post in multiple online portals, you also have to stand out from every other company in your industry because everyone is using the most popular channel. We want to help you with that. Here we have a list of jobs portals, both conventional and specialized, for restaurant and retail owners to recruit staff.

Today, there are a mind boggling number of channels to use while searching for the best candidate to join your team. In Singapore, the number one channel for recruiters to hire employees is through an online jobs portal. The other Southeast Asian nations are catching up to the trend. Which means, not only do you have to post in multiple online portals, you also have to stand out from every other company in your industry because everyone is using the most popular channel. We want to help you with that. Here we have a list of jobs portals, both conventional and specialized, for restaurant and retail owners to recruit staff. Kalibrr

Kalibrr

It is important to note that Singapore companies are required to pay Foreign Worker Levy (FWL) for the Work Pass and S Pass holders. This levy is imposed by the Singapore Government to regulate foreign workers numbers in the country.

It is important to note that Singapore companies are required to pay Foreign Worker Levy (FWL) for the Work Pass and S Pass holders. This levy is imposed by the Singapore Government to regulate foreign workers numbers in the country. We moved over from

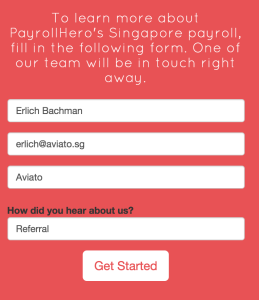

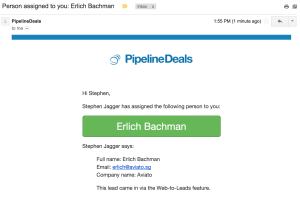

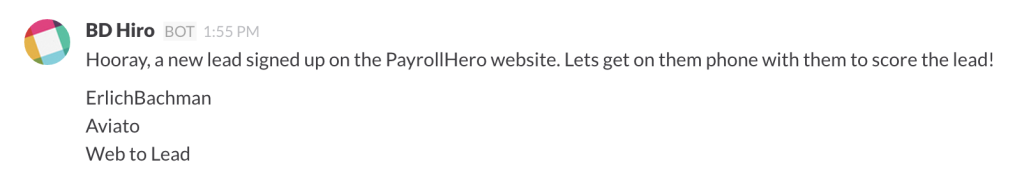

We moved over from  For example, when a visitor comes to our website and fills in one of the led forms, the information from that form shows up in a few places so that it can be actioned immediately.

For example, when a visitor comes to our website and fills in one of the led forms, the information from that form shows up in a few places so that it can be actioned immediately. We also have PipelineDeals tied into

We also have PipelineDeals tied into

Filing taxes can be a daunting task. Figuring out

Filing taxes can be a daunting task. Figuring out