Editors Note: Introducing Pragya Gupta, Business Development Intern at the PayrollHero Singapore office. She will be contributing to the PayrollHero blog from time to time.

“To get a job you need experience; to get experience, you need a job.”

That pretty much sums up a college kid’s life-crisis. Enter: internships.

I am an intern at PayrollHero. Today marks the second day of my internship. I have been studying in a university in Singapore over the last two years. The importance of internships cannot be stressed enough to a college student. Universities even have an internship requirement that must be completed in order to graduate. So it is worth exploring how this works and what both parties, the intern and the company are required to do.

I am an intern at PayrollHero. Today marks the second day of my internship. I have been studying in a university in Singapore over the last two years. The importance of internships cannot be stressed enough to a college student. Universities even have an internship requirement that must be completed in order to graduate. So it is worth exploring how this works and what both parties, the intern and the company are required to do.

Internships, in general, are quite a messy affair. The first question that should/would strike anyone is: Why should I hire you? You’re just a kid, probably not a smart one, probably irresponsible and probably not good at what I need to get done. Most importantly, I am going to spend all these resources on you for two months or more, just to see you walk out that door by the end of it. What’s the point?

Great question. So here is the thing: companies take two or three months to train their newly hired staff just so they can get used to the way things work. And while that is true for interns as well, some companies use internship programmes to really judge how good a student is in order to hire them once they have graduated. By this time most of the training is already done and the company can be sure that the student fits the bill. Other companies need interns to help them with a particular project. In both cases, it’s a cost effective way to get things done. To give you a student’s perspective: an intern is always excited to do something new and get some experience. It is mutually beneficial, if all goes well.

Step 1: Who Can You Hire?

The Ministry of Manpower states rules that are different for a local student and an international student studying in a local university and looking for an internship. Local students in universities do not have binding requirements on the hours that they can work during term time. As an international student, I have a Student Pass that is valid for four years of college. During the term, I can work part-time for only 16 hours a week regardless of where I work: banks, startups, the neighbourhood Subway, anywhere. During holidays, there is no solid requirement that prevents me to work.

Leave of Absence: A student may take a Leave Of Absence for an entire term in order to get some internship experience, which can be a full-time internship. For an international student, this is possible only if the university’s internship requirement has not been completed. For a local student, the LOA has no binding requirement.

Step 2: Where Do You Look For Interns?

I applied for an internship using the standard internship search portals: StartupJobs.Asia, internsSG, the university jobs portal. Usually companies post about internship positions on these websites. Some of these companies partner up with universities and post job positions through the university portal or email. Some internships are structured while others are spontaneous and depend on the project that the company is currently working on. Companies specify the job scope in the search portals. PayrollHero worked a bit differently. It was featured on one of these sites. I clicked on the website, loved the look and content and decided to email them.

Step 3: Details, Payment, Contracts

The job applications have been posted; you have called the applicants in for an interview; you have picked a prospective intern. What’s next? Once an intern is hired, a contract must be drawn up. The contract specifies what the job requirement is, the number of weeks in the internship, number of hours in a day and the amount that the intern will be paid. An intern is covered by the Employment Act that entitles him or her to a stipend, a fixed number of hours and a few more entitlements (check links below). A regular internship is anywhere between 8 to 10 weeks. The regular stipend is between SGD800 and SGD1200 a month, depending on the hours and the job scope and excluding over-time pay. SPRING Singapore is an agency that supports SMEs to fund internships for local students. This is a good resource in case businesses have trouble paying for interns.

If the internship position was posted on the university portal, then the company and the university liaise together and the university directly clocks in the weeks for the student. In a self-sourced internship, if the student wants to clock in weeks, he or she keeps the university in the loop and they contact the company for details. Some universities require forms to be filled for the internship to be approved. Once the internship ends, the university sends a feedback form to the company for details on how the internship went and how the student performed.

Finally, internships are a great way to get people to know about your company. When a company ties up with a university, it can participate in career fairs and feature in promotional emails that the university sends out. Students get a chance to gain some experience and build skills for their future jobs. All in all, Singapore has a straightforward infrastructure set up to hire interns which makes it a worthy option for companies to explore the existing talent pool.

Happy Hiring!

For More Information:

Employment Act and who it covers: http://www.mom.gov.sg/employment-practices/employment-act/who-is-covered

Hours of work, over time pay and rest day: http://www.mom.gov.sg/employment-practices/hours-of-work-overtime-and-rest-days

SPRING Singapore: http://www.spring.gov.sg/Growing-Business/Grant/development-areas/Pages/HCD-SME-Talent-Programme-for-students.aspx

It is important to note that Singapore companies are required to pay Foreign Worker Levy (FWL) for the Work Pass and S Pass holders. This levy is imposed by the Singapore Government to regulate foreign workers numbers in the country.

It is important to note that Singapore companies are required to pay Foreign Worker Levy (FWL) for the Work Pass and S Pass holders. This levy is imposed by the Singapore Government to regulate foreign workers numbers in the country.

Filing taxes can be a daunting task. Figuring out

Filing taxes can be a daunting task. Figuring out

I am an intern at PayrollHero. Today marks the second day of my internship. I have been studying in a university in Singapore over the last two years. The importance of internships cannot be stressed enough to a college student. Universities even have an internship requirement that must be completed in order to graduate. So it is worth exploring how this works and what both parties, the intern and the company are required to do.

I am an intern at PayrollHero. Today marks the second day of my internship. I have been studying in a university in Singapore over the last two years. The importance of internships cannot be stressed enough to a college student. Universities even have an internship requirement that must be completed in order to graduate. So it is worth exploring how this works and what both parties, the intern and the company are required to do.

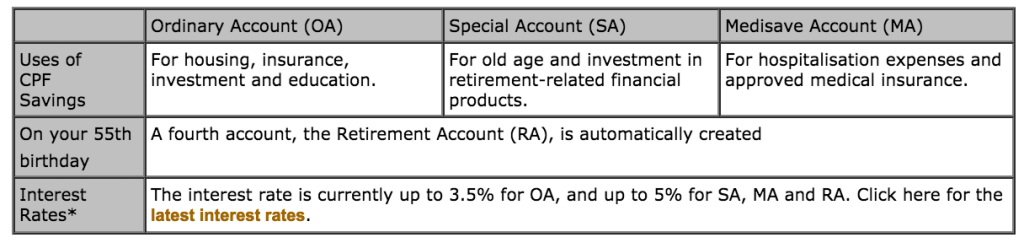

In Singapore, there a government fund call the CPF of The Central Provident Fund. It is a social security system that enables working Singaporeans and Permanent Residents (PR) to set aside funds for later in life. It also has a healthcare, home ownership, family protection and asset enhancement portion.

In Singapore, there a government fund call the CPF of The Central Provident Fund. It is a social security system that enables working Singaporeans and Permanent Residents (PR) to set aside funds for later in life. It also has a healthcare, home ownership, family protection and asset enhancement portion. As Singaporeans live longer, there is a need for a reliable stream of income to meet living expenses. Statistics have shown that today, 1 in 3 Singaporeans aged 65 is going to live to age 80 and 1 in 2 is going to live to age 90 and beyond.

As Singaporeans live longer, there is a need for a reliable stream of income to meet living expenses. Statistics have shown that today, 1 in 3 Singaporeans aged 65 is going to live to age 80 and 1 in 2 is going to live to age 90 and beyond.