Announcing Our Latest Import

MYKOLA KYRYK

MYKOLA KYRYK

Our #AdventureEngineering message has reached far and wide! Software developers who have heard about PayrollHero’s Adventure Engineering have written to us, aspiring to be part of the team.

“I felt like it was a perfect match

from the moment I saw this video”

Mykola Kyryk

Here’s what Mykola did to catch our attention from his point of view:

Mykola: We had a couple sessions of remote pairing/discussion sessions. All people I talked to were very interesting interlocutors and I felt like I could bring a lot of value into the team.

Mykola spills the beans about his home country and moving to Singapore.

Tell me about your hometown. How many people are there?

Mykola: I’m from Lviv, Ukraine. It is a nice ancient city (founded in 1256). This city was part of Poland, Hungary, Austria and Russia for many years. So the country side has mixed architecture and culture with a population of around 850,000.

What kind of things you like to do back at home?

Mykola: Besides IT? Well a lot actually. I play basketball and travel a lot. In the last 2 years I’ve been to 8 different countries. I like different extreme activities. I’ve already tried scuba diving, skydiving and caving. I also like to ride my bike and go skiing.

What did the people closest to you say about your plan to move to Singapore to be a PayrollHero Adventure Engineer?

Mykola: That I was mad 😉 Some were surprised that I’m going that far away from my homeland. Most knew nothing about Singapore at all.

What were your first thoughts on Singapore after you’ve arrived?

Mykola: It is hot here! I went from +12 to +32 in 20 hours. Now I don’t find it hot anymore. I was also amazed with how structured and well organized everything is. Really convenient place to be.

What you think about the food and the hawker centers?

Mykola: Like nothing like I’m used to. Ton of options, any cuisine, for any taste. I’m still far from saying I’m used to all of this, but I love the adventure of it all. Hawker centers are great and also cheap!

Do you like the beaches in Singapore?

Mykola: That was the first thing I did when I arrived. I didn’t know how to get to the beaches so I spent almost 2 hours walking there. Night swimming is prohibited here, but I got what I came for. Beaches are really nice, especially at Sentosa island.

Was it easy for your to get your Singapore Employment Pass (EP)?

Mykola: I got mine while I was still in Ukraine. It was really a really quick and straightforward process. Once I arrived I had to go to the Ministry of Manpower to finalize the paperwork and got my EP card in 5 days. Amazingly quick and efficient.

What do you miss about home?

Mykola: I don’t really have time to miss about anything. Singapore is an amazing place. And there is still so many places I want to go and things I want to try. Of course, miss my family, but Skype helps to stay in touch. Hope to see them soon.

Did you know,… We’re Hiring!

Wanna be an Adventure Engineer with PayrollHero? Check out our job openings and get in touch!

Filing taxes can be a daunting task. Figuring out

Filing taxes can be a daunting task. Figuring out

I am an intern at PayrollHero. Today marks the second day of my internship. I have been studying in a university in Singapore over the last two years. The importance of internships cannot be stressed enough to a college student. Universities even have an internship requirement that must be completed in order to graduate. So it is worth exploring how this works and what both parties, the intern and the company are required to do.

I am an intern at PayrollHero. Today marks the second day of my internship. I have been studying in a university in Singapore over the last two years. The importance of internships cannot be stressed enough to a college student. Universities even have an internship requirement that must be completed in order to graduate. So it is worth exploring how this works and what both parties, the intern and the company are required to do.

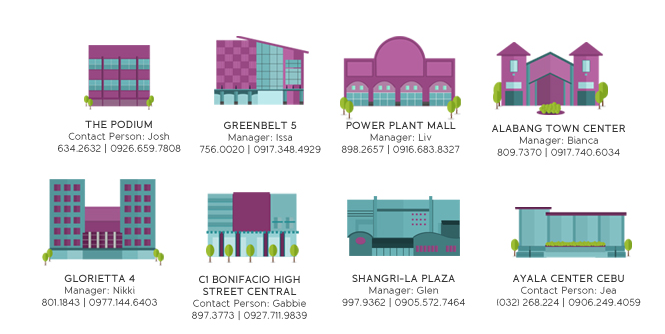

Q. When and why did you start The Picture Company?

Q. When and why did you start The Picture Company? Q. What is your background? (retail? or you figured it out as you went?)

Q. What is your background? (retail? or you figured it out as you went?) Q. How do you choose a location for The Picture Company?

Q. How do you choose a location for The Picture Company?  Q. Does a corner location matter for The Picture Company?

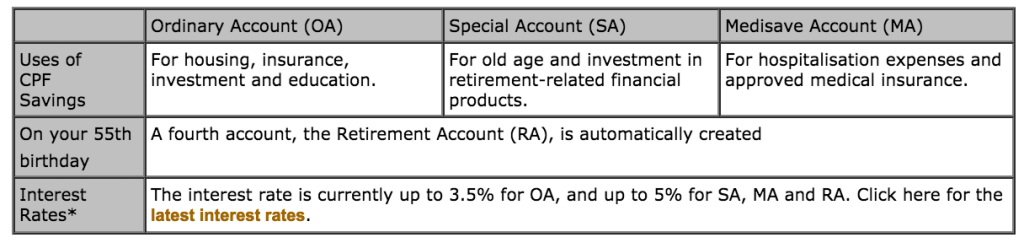

Q. Does a corner location matter for The Picture Company? In Singapore, there a government fund call the CPF of The Central Provident Fund. It is a social security system that enables working Singaporeans and Permanent Residents (PR) to set aside funds for later in life. It also has a healthcare, home ownership, family protection and asset enhancement portion.

In Singapore, there a government fund call the CPF of The Central Provident Fund. It is a social security system that enables working Singaporeans and Permanent Residents (PR) to set aside funds for later in life. It also has a healthcare, home ownership, family protection and asset enhancement portion. As Singaporeans live longer, there is a need for a reliable stream of income to meet living expenses. Statistics have shown that today, 1 in 3 Singaporeans aged 65 is going to live to age 80 and 1 in 2 is going to live to age 90 and beyond.

As Singaporeans live longer, there is a need for a reliable stream of income to meet living expenses. Statistics have shown that today, 1 in 3 Singaporeans aged 65 is going to live to age 80 and 1 in 2 is going to live to age 90 and beyond.

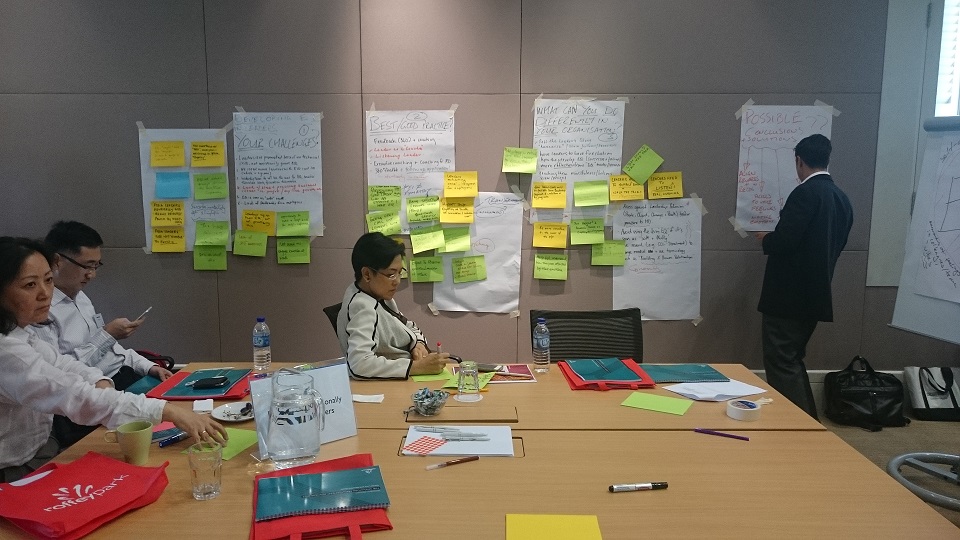

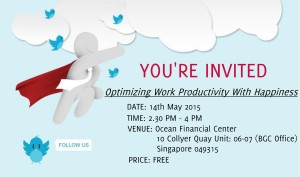

We are holding another event at our office in the Ocean Financial Centre at Raffles Place in Singapore on May 14th 2015. At this free event you will learn about the pitfalls of manual time and attendance systems, how PayrollHero can help and the amazing business intelligence that can be delivered to your iPhone in real time.

We are holding another event at our office in the Ocean Financial Centre at Raffles Place in Singapore on May 14th 2015. At this free event you will learn about the pitfalls of manual time and attendance systems, how PayrollHero can help and the amazing business intelligence that can be delivered to your iPhone in real time.