Assuming Payroll

Often times, companies generate payroll and pay out an entire month’s wages to an employee before the month has ended. We call this assuming payroll. This is how it works: If payroll is generated an the 25th and paid out on the 27th, the manager pays the full month’s wages, up till the 31st, assuming that the employee will make it to work on the last few days. If he doesn’t, the manager  needs to deduct his wage in the next month

needs to deduct his wage in the next month

Assuming payroll is an inefficient and inaccurate way of paying employees. We’ve come across many business owners who do it in Singapore. Most of the time, it’s because they have been doing it for years and have never thought about changing the rule. We help our clients transition from assuming payroll to regular payroll which saves clients money and time. Here is a blog post on exactly how to transition from assuming to regular payroll.

Irregular Clock-in Timings

When an employee clocks in at 8.57am instead of 9.00am, the biometric device records it to the exact minute. Your HR manager needs to manually correct the irregularity because coming in 3 minutes early does not mean that the employee will get paid for those extra three minutes.

The PayrollHero app has a threshold feature that solves this problem. An HR manager can set a threshold: if an employee clocks in between 8.55am and 9.05am, their clock-in time resets to 9.00am, automatically correcting the irregularity that your HR manager would have had to deal with otherwise.

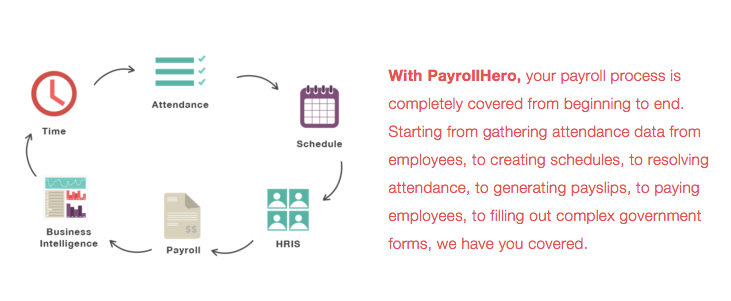

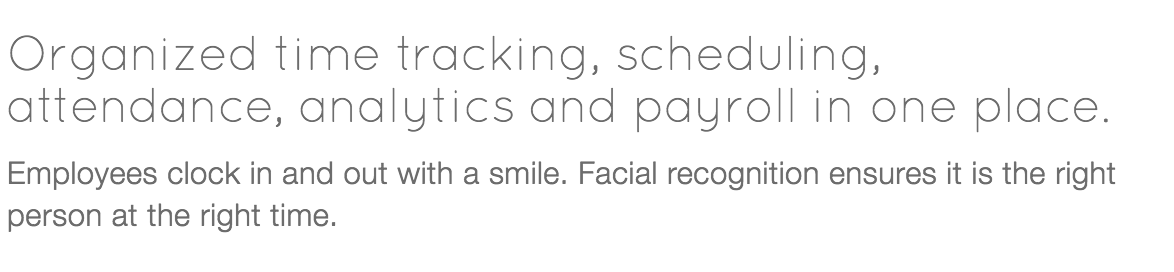

Disparate Systems for Time, Attendance, Scheduling and Payroll

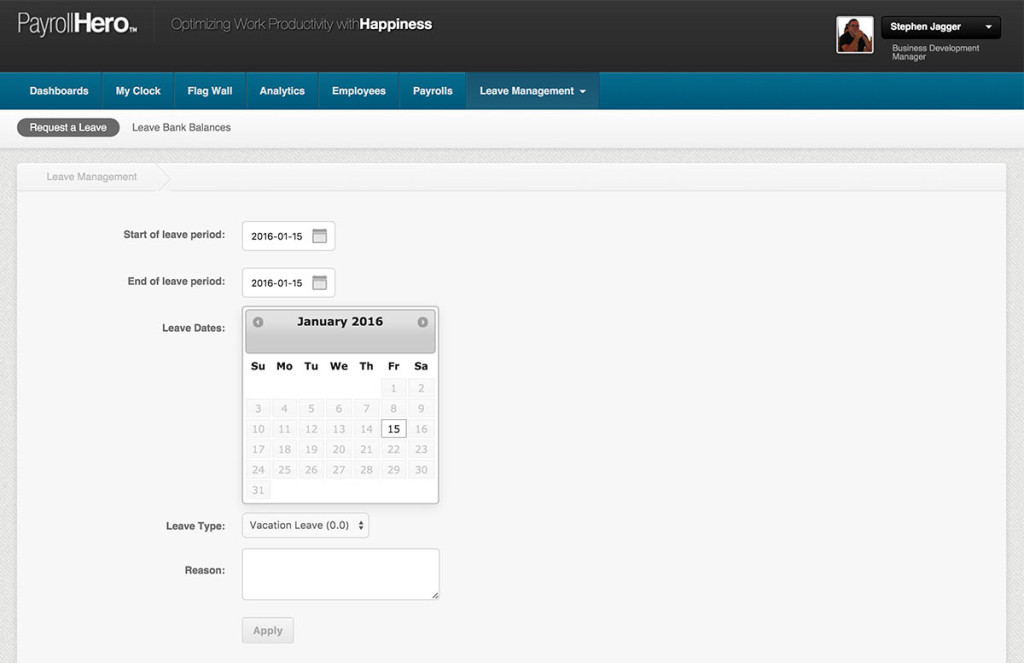

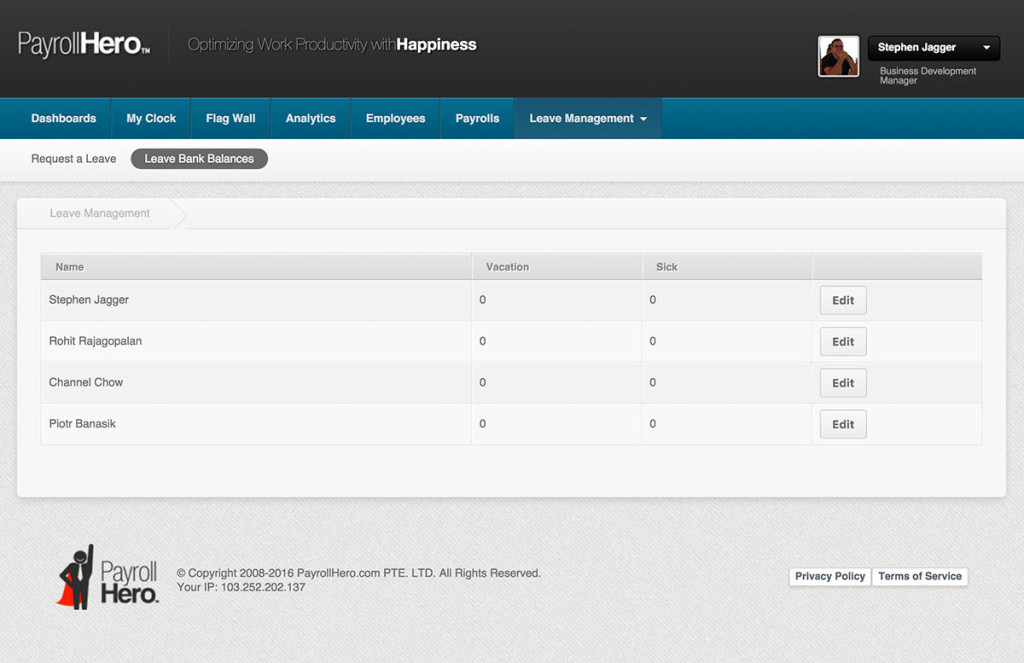

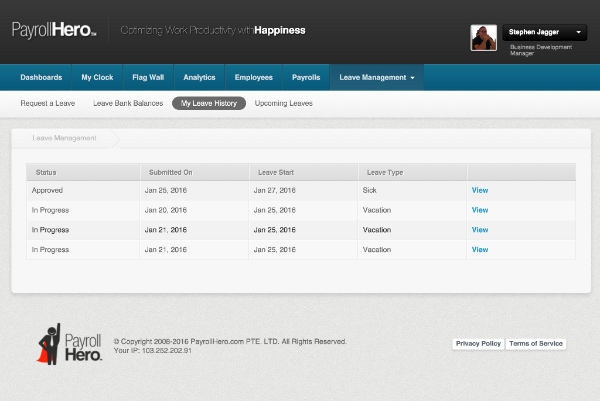

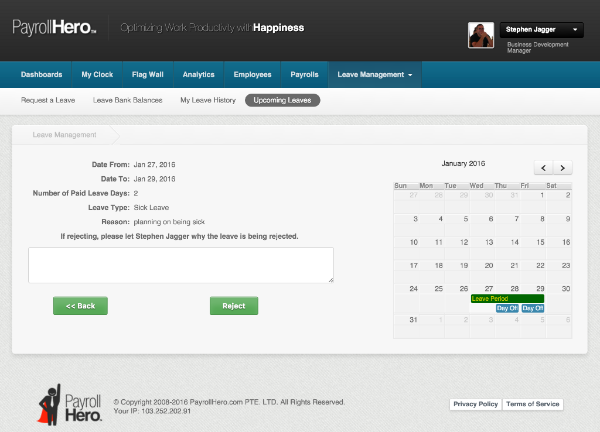

Business owners have multiple systems that deal with different HR problems; a biometric device to measure clock ins, a separate Excel sheet that imports data from the biometric device and generates payroll, another Excel sheet that needs to be updated every week with schedules for each employee and a whole other system that employees use to apply for leave. With so many systems to deal with, no wonder an HR manager barely has any time to engage with employees or find innovative ways to overcome Singapore’s labor crunch.

Business owners have multiple systems that deal with different HR problems; a biometric device to measure clock ins, a separate Excel sheet that imports data from the biometric device and generates payroll, another Excel sheet that needs to be updated every week with schedules for each employee and a whole other system that employees use to apply for leave. With so many systems to deal with, no wonder an HR manager barely has any time to engage with employees or find innovative ways to overcome Singapore’s labor crunch.

An end-to-end solution that removes any need for multiple devices is exactly what an HR manager needs. PayrollHero allows employees to click selfies on their phone or an iPad in the work site when they clock in. This data is stored in the Cloud and used when payroll is generate by the system. The same app is used when applying for leave or checking schedules for the week. An HR manager can use the app on his laptop, phone or any device with internet connection anywhere in the world and have full control over what is going on at his work site.

While these problems are seen as some of HR managers’ biggest in Singapore, they are faced by managers in the Philippines and pretty much any other place too. Some of the other problems HR managers need to deal with are changing tax laws, a labor crunch and laws against foreign workers in the country.

We hope that this post serves as a solution to some of your biggest HR problems. Do let us know your biggest HR problem and how you are currently dealing with it.

What if you could tell how happy your employees are. Would that change how you make decisions? Would you adjust your operating procedures?

What if you could tell how happy your employees are. Would that change how you make decisions? Would you adjust your operating procedures?

We value our customer’s security and work hard to ensure that our platform and procedures are focused on security of our clients data. A PayrollHero account contains all employee information and confidential material. For that reason, we take security, encryption, and system permissions very seriously.

We value our customer’s security and work hard to ensure that our platform and procedures are focused on security of our clients data. A PayrollHero account contains all employee information and confidential material. For that reason, we take security, encryption, and system permissions very seriously.