Today marks two weeks of my internship at PayrollHero. To celebrate my two-week-erversary, I went out to do a little survey. The aim was to understand what systems businesses have set up to manage scheduling, measure attendance and calculate payrolls.

The Costa Coffee crew.

I surveyed 10 cafés in the Central Business District in Singapore to find out how they schedule workers in their outlets. Some of the outlets I visited were Cedele, Starbucks, Joe & Dough and Costa Coffee. They all had similar systems set up to schedule workers, with a few interesting anomalies:

- With the exception of one cafe, everyone uses the punch card system or a regular excel sheet for workers to clock in and clock out. The exception in question has software set up to monitor attendance.

- Scheduling is done on a weekly basis. The worst case scenario is when a worker notifies the admin that he or she can’t show up just a few hours before the shift begins.

- Usually, the outlet manager calls another outlet to find a substitute. In the case of one cafe, Whatsapp groups are used to coordinate and find substitutes. Most outlet managers believe that the best way to reach someone is to call them. Texting or emailing is not a common communication channel.

- The HR admin in every outlet takes around 2 to 3 days to calculate payrolls.

With that simple survey, it was evident that cafés in Singapore use conventional ways to schedule shifts. While workers rarely drop shifts, outlet managers need to be on standby to call nearby outlets for substitutes immediately.

Using Data Analytics to Improve Productivity

When the weather is bad, or there is an MRT breakdown, the situation is worse because all outlets in the same region are affected equally. While an outlet manager is calling multiple outlets for substitutes, customers are walking in and waiting for service before walking out, disappointed and unhappy. That directly affects the bottom line. Managers should be able to access an online database and use data analytics to see which outlet is on top of things in real time in order to call that outlet directly and ask for a substitute.

The top priority for every outlet manager is to make sure the day runs smoothly. It becomes much harder when the manager is not equipped with the right data to plan ahead of time. In a country like Singapore that has high internet penetration rates and high cell phone penetration rates, installing an application that stores this data in the cloud is easy and inevitable. If managers had access to this data, it would also be a way to motivate workers to be regular in order to move higher up in the rankings among outlets.

Calculating Payrolls

The systems put in place for measuring hours worked per employee in order to calculate payrolls should also be revamped. It should not take a manager 2 or 3 days to calculate payrolls when she has a million other things to look after. What’s more, the hassle of buddy punching, human errors and shifts in multiple locations add to complications for the manager. More errors equal higher costs. Higher costs equal lower profits. The bottom line is affected by inefficiencies that can be wiped out by a one-time change in the basic infrastructure.

Finally, the idea behind having an app that does all of the above is predica ted on increasing productivity: be it that of your rank and file workers or your manager. Higher productivity leads to a better workplace environment and happier people, which further leads to higher productivity. That is a virtuous cycle, if ever I saw one. In effect: optimizing work productivity with happiness.

ted on increasing productivity: be it that of your rank and file workers or your manager. Higher productivity leads to a better workplace environment and happier people, which further leads to higher productivity. That is a virtuous cycle, if ever I saw one. In effect: optimizing work productivity with happiness.

Now, where have I heard that before…

It is important to note that Singapore companies are required to pay Foreign Worker Levy (FWL) for the Work Pass and S Pass holders. This levy is imposed by the Singapore Government to regulate foreign workers numbers in the country.

It is important to note that Singapore companies are required to pay Foreign Worker Levy (FWL) for the Work Pass and S Pass holders. This levy is imposed by the Singapore Government to regulate foreign workers numbers in the country.

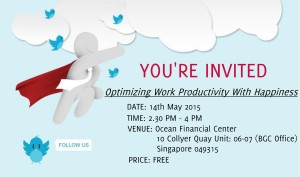

We are holding another event at our office in the Ocean Financial Centre at Raffles Place in Singapore on May 14th 2015. At this free event you will learn about the pitfalls of manual time and attendance systems, how PayrollHero can help and the amazing business intelligence that can be delivered to your iPhone in real time.

We are holding another event at our office in the Ocean Financial Centre at Raffles Place in Singapore on May 14th 2015. At this free event you will learn about the pitfalls of manual time and attendance systems, how PayrollHero can help and the amazing business intelligence that can be delivered to your iPhone in real time. Getting Ridiculously Client Focused!

Getting Ridiculously Client Focused!