Exciting News! PayrollHero is now on Reddit! Join us at r/payrollhero for the latest updates, discussions, and direct chats with our team. Your voice matters, so dive in now! — https://reddit.com/r/payrollhero/ #PayrollHeroOnReddit

Exciting News! PayrollHero is now on Reddit! Join us at r/payrollhero for the latest updates, discussions, and direct chats with our team. Your voice matters, so dive in now! — https://reddit.com/r/payrollhero/ #PayrollHeroOnReddit

Exciting news – PayrollHero just hit the big 10! 🎉🥳 We’ve been on this journey together, and we want to take a moment to celebrate and reassure you about your data’s security.

🔐 A Decade Strong – Zero Security Breaches:

Guess what? We’ve had your back for 10 years, and not a single security breach! Your data is as safe as ever.

💪 We’re Always Improving:

We’ve been investing in top-notch tech, regular security checks, and staying ahead of the game to keep your info locked down. We take security seriously, and we’re not slowing down.

🙏 Thanks for Trusting Us:

Big shoutout to you – our awesome community! Whether you’re a long-timer or a newbie, your trust keeps us going. We couldn’t have hit this milestone without you.

🚀 What’s Next? Share Your PayrollHero Story:

We want to hear from YOU! Drop a comment and tell us about your PayrollHero journey. What features do you love? How has it helped you? We’re all ears.

Here’s to a decade of success, and many more to come!

With Covid-19 changing how the world works, Jeff Booth timely book, The Price of Tomorrow, is a ‘must read’, particularly for the next generation of leaders.

From Jeff’s website:

“Technological advances are happening at a rate faster than our ability to understand them, and in a world that moves faster than we can imagine, we cannot afford to stand still.

We need to build a new framework for our local and global economies, and soon. Otherwise, the same technology that has the power to bring abundance to us and our world will instead destroy it.

In this extraordinary contrarian book, Jeff Booth, a leading mind and CEO in e-commerce and technology, details the technological and economic realities shaping our present and future, and the choices we make as we got forward – a potentially alarming, but deeply hopefully situation.” The Price of Tomorrow

Jeff’s take challenges conventional wisdom and looking at markets, fiscal policy and consumer behaviour through the lens of tomorrow – which is why this should be required reading.

Take a moment to watch this interview with Jeff Booth in New York just over a month ago and comment below with what your thoughts are.

In light of the recent events happening all over the globe due to Coronavirus Disease 2019 (COVID-19), we would just like to reassure everyone that PayrollHero remains operational.

We’re committed to support you and your team during this time of uncertainty. We’re continuing to deliver best and reliable service for our system. Our client success, support, training, and teams are standing by to help you with any needs. Online resources are available including our Knowledge Base, Blogs, Online Trainings, and Scheduled Calls. Our support hours still follows as 8AM-5PM, Monday-Friday (MNL time).

Here are some resources that might assist you;

– Philippine Government Support Measures

– The science behind hand-washing: why soap and water kill the COVID-19

– Watch this interview with Bill Gates by Trevor Noah from the Daily Show where he explains how the Bill & Melinda Gates Foundation is contributing to the race for a vaccine.

Please stay safe and healthy. Take care of yourself, your family, and your loved ones and let us know if there is anything we can do to help during this difficult time.

On behalf of the PayrollHero team, we’re here for you.

PayrollHero

PayrollHero is proud to sponsor Ronster Baetiong’s new podcast –hustleshare.com.

“The podcast that features the daily grind of unique business owners and professionals to show not our differences but to show that most of us are very much alike. Hustleshare was made to showcase the triumphs and challenges people go through in their unique professions and learn how we can apply them to our own daily hustles.”

Location: Manila, Philippines

Starting Salary: PHP30,000 or more

Commissions: Uncapped

PayrollHero is a software platform designed for HR and Payroll teams. Our software helps business optimize their workflows. Our products cover timekeeping, attendance, scheduling, leave management, HRIS and payroll. Our founders created PayrollHero to solve the challenges they were facing running a BPO in the Philippines so our products are uniquely positioned to help customers located there.

Since then we have expanded our product offering to service the globe and extending our payroll functionality to help Singapore based customers. Our selfie clock in features are loved by employees worldwide. For more information check out https://payrollhero.com

Our sales associates are advocates of our product and brand. They have a great appreciation of the benefits are products can provide and work to help organizations take advantage of them.

They want to make sure that our prospective clients will truly benefit from our products so they spend the time to get to know our clients businesses and needs and only make recommendations that will truly benefit our customers.

They will spend their time reaching out to interested parties, meeting with them to understand their business and selling our products and services to people who need them.

This is position is designed for people who want to work remotely. As a result you will need to be able to manage your own time and prioritize well.

Before you go we’d like to get to know how you handle clients. Below are three scenarios that you might encounter when trying to help customers. Please include an answer to each question with your application.

Please send a cover letter, cv and your answers to the above questions to jobs@payrollhero.com

One of the best books I read in 2018 was recommended to me by a friend and coach. It was called Radical Candor: How to be a great boss without losing your humanity. It’s a framework for managing a team effectively. As the title suggests the author Kim Scott proposes that there is a path to being a great boss without having to be an a**hole.

There has been a trend over the last couple of decades that has linked effective management to being ruthless and lacking compassion. One could argue that Steve Jobs was a good example of such a leader, an opinion that I can understand but personally disagree with. Donald Trump or Alan Sugar on the Apprentice both come across as bosses who are susceptible to monstrous outbursts. Regardless of whether this is a true portrayal of their management styles that is what our expectation of a leader is. In our pop culture being an a**hole is synonymous with being an effective leader.

This is why Radical Candour immediately resonated with me. It finally provided a framework as to why this style of management is effective and at the same time provided a logical path to how you can be nice and a great leader at the same time. As one of my idols Gary Vaynerchuk likes to say frequently the fact that “nice guys finish last is just not true”.

The argument put forward is that it takes two traits to be an effective boss. You must challenge directly and care personally. She uses a great example in the book of someone to illustrate the diagram above.

Imagine you walk into a crowded room with your trousers undone. If someone cares and is willing to challenge you directly they might take you aside and say “Hey, I just thought you’d want to know your fly is open.” You can then discreetly solve the problem. This is Radical Candour.

Imagine you walk into the same room and someone who doesn’t care but is willing to challenge you directly says something instead. They shout across the room “Hey your trousers are undone.”

Everyone hears and looks at you. You’d probably be a bit embarrassed but you are now able to solve the problem. The person could have handled the situation in a more compassionate way, but at least the matter is resolved. This is the a**hole boss right here. They might be an a**hole about how things get done but they get done. This is called Obnoxious Aggression.

Now imagine that you walk into the same crowded room and someone does care but they don’t want to challenge you directly. They “don’t want to upset your feelings.” Your fly stays open and everyone notices. Everywhere you go for the rest of the day people notice. The problem never gets resolved and when you do finally realize you think “why didn’t they tell me.” This is Ruinous Empathy. They are trying to protect your feelings but it’s actually to your detriment.

Last of all we have the people who don’t care and don’t challenge directly. They are the ones that tap a friend on the shoulder and say “hahaha look at that person they left their fly open.” That’s called manipulative insincerity.

Hopefully this analogy makes sense as it made a ton of sense to me. It really shows why challenging directly, even without caring, is way more effective than caring without challenging. Yet none of us, I hope, want to be obnoxiously aggressive.

So how do we achieve radical candour? It’s really simple, you have to care about your employees. If you read that sentence, want to manage people and think that’s not within the realms of possibility for you; please seriously reconsider your chosen career path. 😃

If you read that sentence and think “well no sh*t Kieran” or “yes that’s something I can do” then awesome! You are a considerable part of the way to being a good manager.

The challenge directly aspect comes down to how you provide feedback and understand the needs of your employees. Ultimately that means having structures in place to allow you to communicate with your staff on a frequent basis. This should be a two way street. You want to provide feedback about performance in a timely fashion whilst the feedback is relevant and you want to stay up to date with what’s important in your employee’s lives.

Imagine your employee drops the ball on a certain task. If you wait until their quarterly review they could keep making the same mistake and create more issues. You may have lost 3 months where they could have been getting better at that task and not just compounding the issue.

Why is it important to know what’s going on in an employees lives? Context. Imagine if an employee’s performance is slipping. You know that they have a sick relative, maybe you’ll give them some time off to deal with that and understand the reason why they are not meeting your expectations or goals. Alternatively, an employee finds out they are expecting a child. Their career goals might shift fundamentally in the short/medium term and you will want to adjust with them to support.

Whilst I strongly recommend reading the book to get a good grasp on of the framework. Here are some immediate actions you can take in your business today that I took away from the book.

I don’t use the exact structure they advise in the book. We have a spreadsheet where the employee or myself can write down agenda items. We then meet for 20-30 minutes once a week and we discuss the most important items on the list.

Being specific encourages growth instead of sounding like a vague platitude.At the same time for criticism it allows the employee to focus on the problem and work to improve it. If you just tell someone “that sucks” it generally leaves them feeling demotivated and disengaged. You want to encourage the people who work for you and being specific can help do that.

We should have opportunities in place that encourage people who want to lead to do so. At the same time, we should allow people who are amazing at what they do and love doing it to keep doing it. Career progression doesn’t just mean getting a promotion.

It’s amazing how taking on the points made in this book can transform your work environment. It creates a culture of collaboration and transparency. It allows a top down approach to removing politics from your organization. Your employees will never have to second guess what’s going on in their managers head. It is one immediate access to creating lasting positive changes to your company culture.

If you do read the book or try to implement any of the points above I’d love to hear about it in the comments below!

We have just launched a new version of our TeamClock to the AppStore (iOS) and PlayStore (Android.) This new version includes a lot of new features that can help your company manage your employee’s timekeeping.

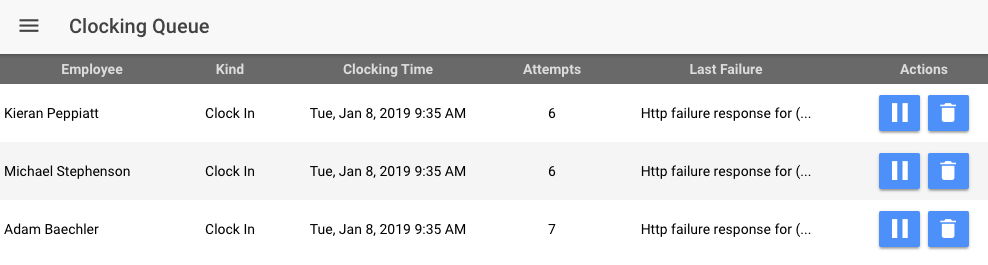

Some locations don’t always have the best internet connection. This can create issues for collecting your employee’s realtime clocking data. We have a new and improved version of our offline mode.

Now when one of your worksites has internet problems your staff will be able to continue to clock in and out. Any clockings that are unable to send will be retained on the device, and visible in the clocking queue.

As well as creating visibility for the queued clockings the app will also warn your employees that there is an issue. They will be advised to contact your HR/IT department so someone can investigate the issue.

As well as creating visibility for the queued clockings the app will also warn your employees that there is an issue. They will be advised to contact your HR/IT department so someone can investigate the issue.

It’s now possible to completely lock down the TeamClock app so that only people with permission to update the settings and logout of the device can. Just access the settings in the side menu of the device and select “Lock Settings Menu”

You will be prompted to enter a 6 digit pin. Once added only team members who know the pin number will be able to change the settings of the device.

For more information about how PayrollHero can help with your Time, Attendance and Scheduling needs please visit payrollhero.com or contact support@payrollhero.com