This is the final iteration of the ‘Employer Contributions in the Philippines’ set of blog posts. So far, we have given you an overview of the BIR, the SSS and PhilHealth. We will now talk about the Home Development Mutual Fund – popularly known as Pag-IBIG Fund. The fund is the biggest source of housing finance in the Philippines. Along with the SSS and PhilHealth, employers also need to register to Pag-IBIG.

Requirements: Before you register your business with Pag-IBIG, you will need the following:

- Employer’s Data Form (make sure you have a TIN and your SSS employer number to fill the form)

- Specimen Signature Form (SSF [HQP-PFF-003])

- SSS certification

- Proof of business existence (Business permit/ Mayor permit)

You need to fill these forms and take them to the nearest Pag-IBIG service center. After the documents are processed, you will receive the Pag-IBIG Employer ID.

The following is the contribution that is required by the employer and employee

The Pag-IBIG registration process can be done online as well. After deductions, payment to the fund can be done online or through one of the accredited banks.

| Employee Share | Employer Share | |

| PHP 1,500.00 and below | 1% | 2% |

| Over PHP 1,500.00 | 2% | 2% |

Finally, here we have an example on how PayrollHero calculates Pag-IBIG deductions.

This marks the end of our 3 part blogpost on Employer Contributions in the Philippines. For details on BIR, SSS and PhilHealth, click on the links. To see how PayrollHero calculates deductions on BIR, SSS and PhilHealth, make sure to click on the links.

Here is a helpful video from our friends at ZipMatch.com about Pag-IBIG

Disclaimer: As always, consult your lawyer or accountant for advice! We are here to help, but your specific situation should be reviewed by a professional with complete knowledge of your situation.

If you are interested in learning more about PayrollHero for your Philippine business, check out our website at PayrollHero.ph. We would be pleased to chat further about your needs.

Our

Our

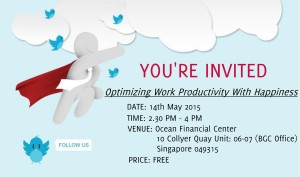

ted on increasing productivity: be it that of your rank and file workers or your manager. Higher productivity leads to a better workplace environment and happier people, which further leads to higher productivity. That is a virtuous cycle, if ever I saw one. In effect: optimizing work productivity with happiness.

ted on increasing productivity: be it that of your rank and file workers or your manager. Higher productivity leads to a better workplace environment and happier people, which further leads to higher productivity. That is a virtuous cycle, if ever I saw one. In effect: optimizing work productivity with happiness. It is important to note that Singapore companies are required to pay Foreign Worker Levy (FWL) for the Work Pass and S Pass holders. This levy is imposed by the Singapore Government to regulate foreign workers numbers in the country.

It is important to note that Singapore companies are required to pay Foreign Worker Levy (FWL) for the Work Pass and S Pass holders. This levy is imposed by the Singapore Government to regulate foreign workers numbers in the country.

We are holding another event at our office in the Ocean Financial Centre at Raffles Place in Singapore on May 14th 2015. At this free event you will learn about the pitfalls of manual time and attendance systems, how PayrollHero can help and the amazing business intelligence that can be delivered to your iPhone in real time.

We are holding another event at our office in the Ocean Financial Centre at Raffles Place in Singapore on May 14th 2015. At this free event you will learn about the pitfalls of manual time and attendance systems, how PayrollHero can help and the amazing business intelligence that can be delivered to your iPhone in real time.