The tiny red dot, as Singapore is often called, is an interesting testing ground for restaurant technology. Singapore is famous for its awesome food. From hawker stalls to gourmet dining, the restaurant scene in Singapore is vibrant and diverse.

At PayrollHero, a huge part of being ridiculously client focused is in understanding what our clients need and use on a regular basis. What do Singaporean restaurants do for point of sale systems, for reservations, for creating menus or for scheduling shifts for their employees? There are a ton of apps out there that are especially designed for this industry. We looked at some apps that piqued our interest.

Reserving Tables: Chope

Asia’s answer to OpenTable and SeatMe: Chope helps diners reserve tables at restaurants in Singapore, Shanghai, Beijing, Bangkok and Hong Kong, free of cost. Restaurants can manage reservations through Chope. The company is expanding and adding new restaurants to its list every week.

Point of Sales Systems: PCS

Prima Computer Systems tackles the problem of inefficient POS systems. The cloud based solution makes it easier for a multi-location restaurant franchises to integrate POS systems. The app allows you to create and change menus in iPads, therefore reducing manpower costs. Considering the labour crunch in the F&B industry in Singapore, this helps restaurants focus their employees towards providing better service.

Digital Wallets

Singapore was one of the first countries in Southeast Asia to adopt digital wallets, back in 2012. Many restaurants have adopted mobile payment options. In terms of consumer readiness, Singapore comes second only to the Philippines at 17%. It beats all other countries for electronic payments at 42%. Local and international banks are a part of this movement towards mobile payments. OCBC’s Pay Anyone, DBS’s PayLah! and Standard Chartered Bank’s Dash are all useful options that restaurateurs should look at to integrate their POS systems with.

An interesting thing to note for restaurants and for businesses that are building easier payment methods is that the demographics on who is using mobile payments is revealing of whom the target market should be. Unsurprisingly, millennials lead the move towards mobile payments. More importantly, data shows that men are twice as likely to adopt the new technology compared to women. CEO of Harbourtouch (company that did the survey on the demographics of mobile and electronic payments), Jared Isaacman, said that there is a void when it comes to mobile payment in restaurants. Retail stores use this technology far more frequently, which indicates a potential opportunity in the F&B industry.

Loyalty Apps: Perx

Perx says that customers spend 7 times more using Perx than without. Loyalty apps remove the hassle of printing loyalty cards and trying to measure how effective the cards are. Perx offers a CRM solutions and a platform for businesses. Restaurant owners have access to how effective the loyalty app is in increasing revenue.

Inventory Management: TradeGecko

TradeGecko is racing through Asia. The Enterprise Resource Planning software is integrated with Xero, Quickbooks and Shopify among other companies. It offers analytics reports on inventory and stock. From the perspective of the F&B industry, TradeGecko helps a chef or a restaurant keep tabs on supplies. All this is done using the cloud, which simplifies the entire process for a restaurant chain.

There are two similarities that link all these apps together:

- They are all cloud based

- They all complement scalability.

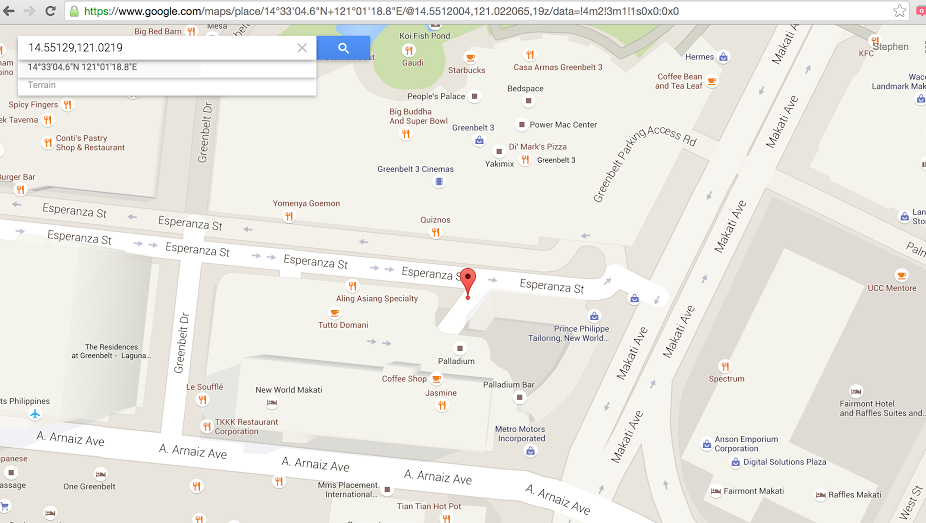

Our research into Southeast Asia led us to an interesting observation. A single restaurant franchise owner may operate across multiple countries. Apps like these are useful for the kind of owner that needs to keep tabs on all his outlets, across different countries. It helps the restaurant owner that currently owns one café and is looking for a way to open 25 more within two years.

We also noticed that in Southeast Asia, consumption trends suggest that fast food chains are going to excel in the next five years. For example, the compounded annual growth rate (CAGR) for fast food chains in the Philippines is 8.1% between 2013 and 2017. The potential that this poses for cloud based solutions is both exciting and massive.

Over the last few weeks, we have been looking deeply into the F&B industry. We focused on the Philippines and Singapore, with the idea of comparing and contrasting a nascent economy versus a mature one to figure out the potential that this region poses. We also compared what kind of employee compensation and benefits are provided by these countries with the perspective of figuring out what our client – a restaurant owner – is most concerned about.

While the data supported some assumptions or destroyed preconceived notions, we found out that there was more to this research than just raw data. We spoke to restaurant owners on the ground to listen to their stories and build a clearer picture.

Finally, we compiled all of it into a nice little package that we call the PayrollHero Knowledge Kit. It provides snippets into our research with statistics on the F&B industry in Singapore and the Philippines. We are super excited about sharing it with you because we want to know how it helps startups that are catering to the F&B industry. We also want to hear about the insight that you have gained from working in this part of the world.

The pictures below link you to the PH and SG Knowledge Kits. Open it, browse through it and shoot us with questions. We want to know what you think.

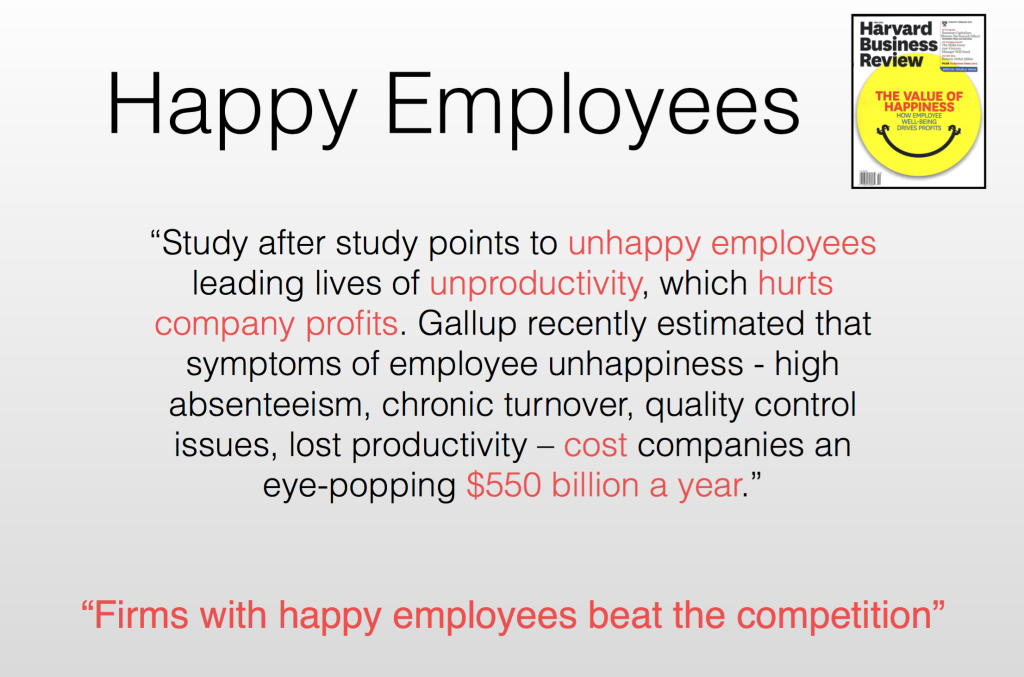

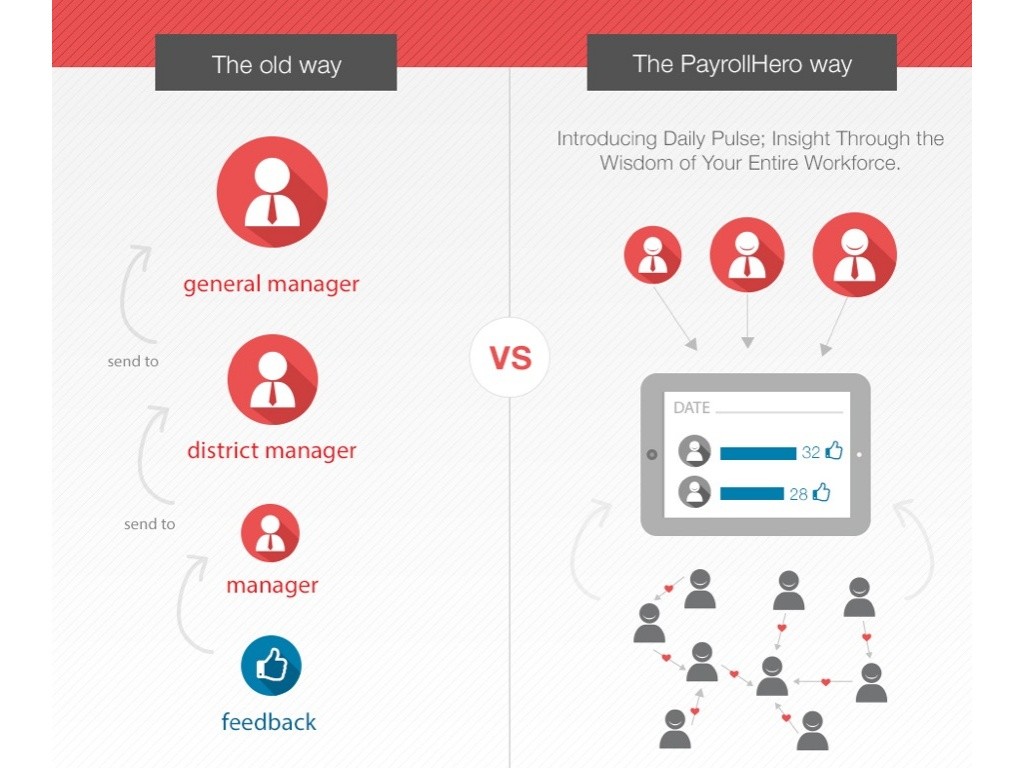

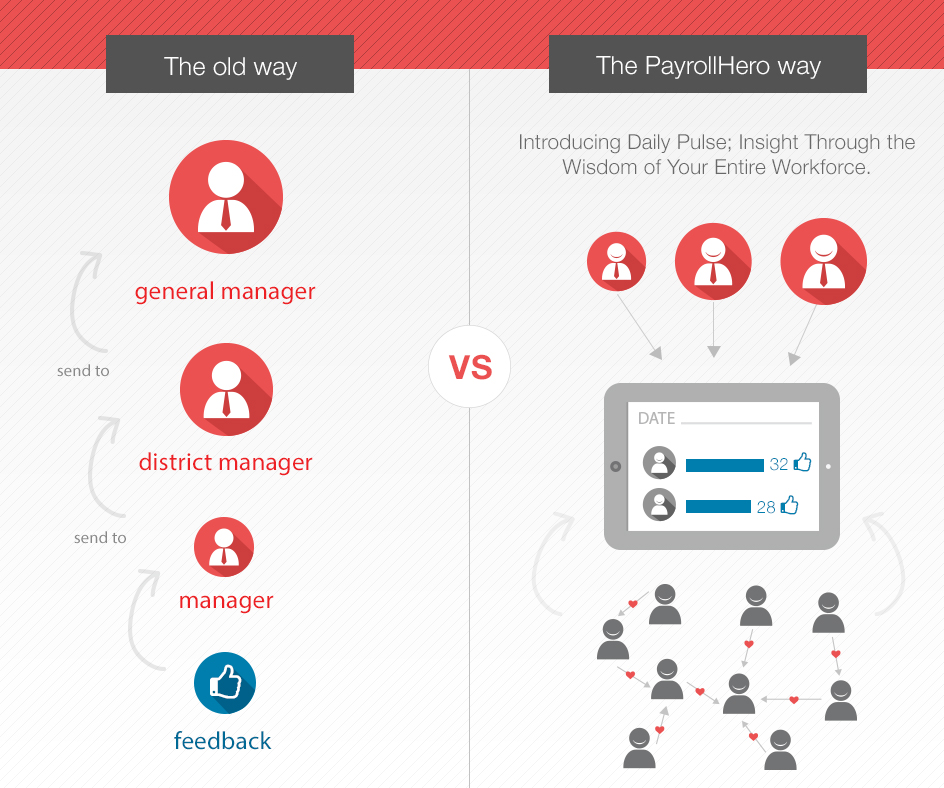

What if you could tell how happy your employees are. Would that change how you make decisions? Would you adjust your operating procedures?

What if you could tell how happy your employees are. Would that change how you make decisions? Would you adjust your operating procedures?

The Singapore Chinese Chamber of Commerce & Industry

The Singapore Chinese Chamber of Commerce & Industry

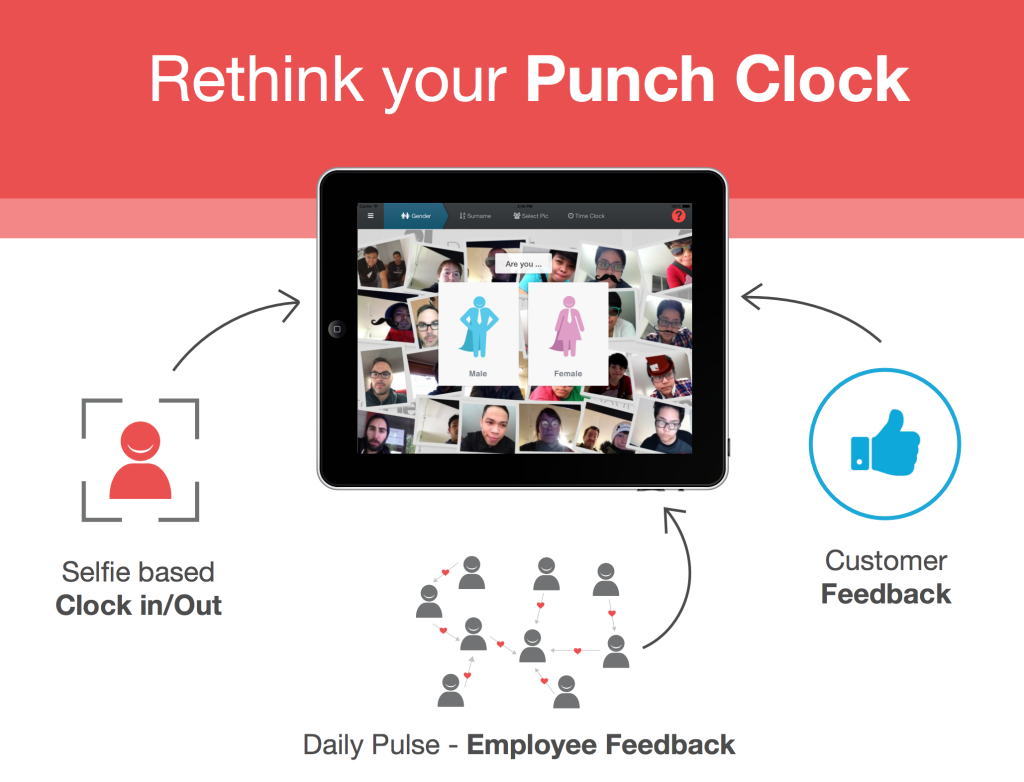

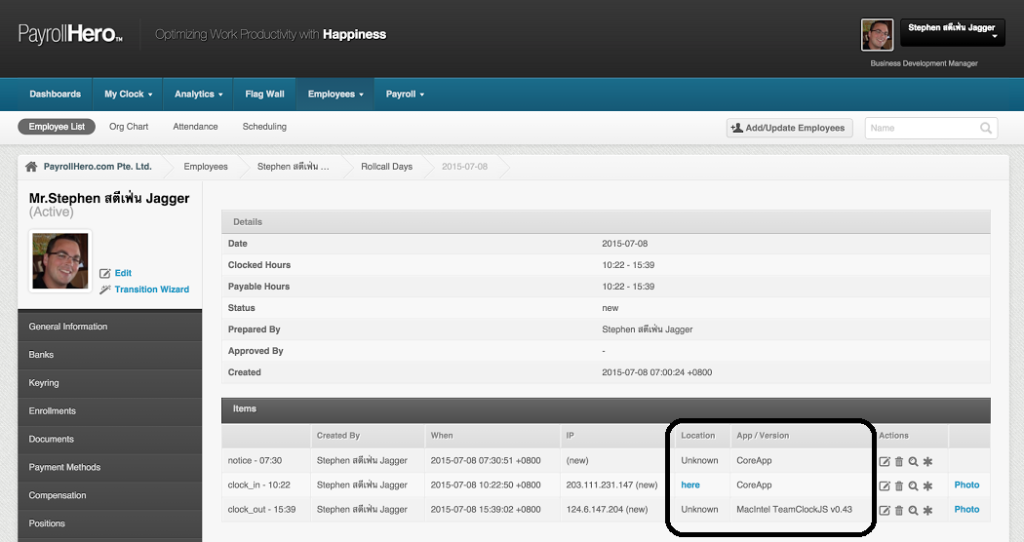

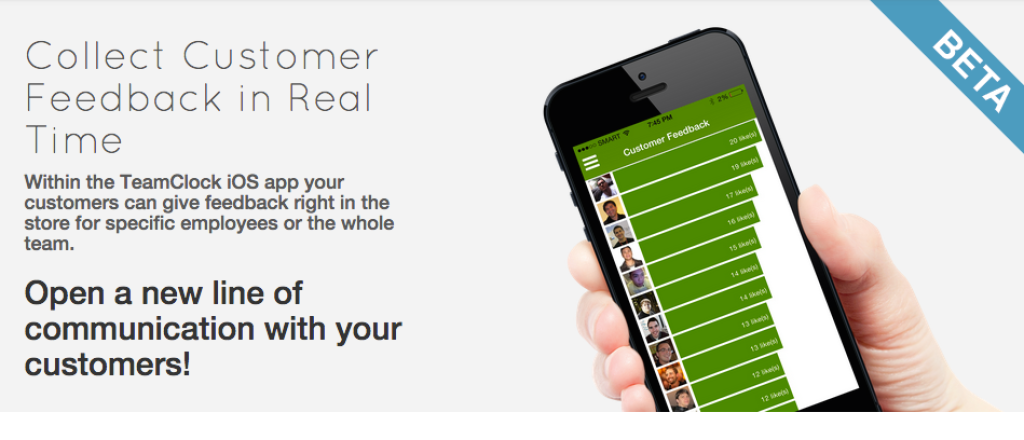

We are launching the newest tool to the TeamClock, Customer Feedback. Now within your TeamClock iOS your employees can not only

We are launching the newest tool to the TeamClock, Customer Feedback. Now within your TeamClock iOS your employees can not only