As part of a new series on this blog [Retail / Restaurant Executive] we will be interviewing restaurant and retail executives from all over the world to gain insight and perspective into how they make their decisions, grow their businesses and deal with challenges.

First up is Eileen Grey, owner of The Picture Company in the Philippines.

Q. When and why did you start The Picture Company?

Q. When and why did you start The Picture Company?

A. In 2002, I was a new mom to 2 little boys and I wanted every moment frozen in time through photos. My search led me to dark photo studios. The photographers did not enjoy interacting with my babies to capture precious moments for me and my family. Within 6 months of that search, we opened our first “home” in The Podium Mall in the Philippines. We made a studio where kids and moms can feel at home, not just with the surroundings but with their personal photographers as well. Bright studios were put up, colored backgrounds, lots of play and fun. Our aim was to create magic in our studios everyday. Today, we continue to love what we do. We love babies and we love creating keepsakes for your family. The Picture Company has grown but we still keep it personal – just like the first day we opened our doors more than a decade ago.

Q. What is your background? (retail? or you figured it out as you went?)

Q. What is your background? (retail? or you figured it out as you went?)

A. My background is hotel management. I figured it out with the help of EO members that served as my mentors.

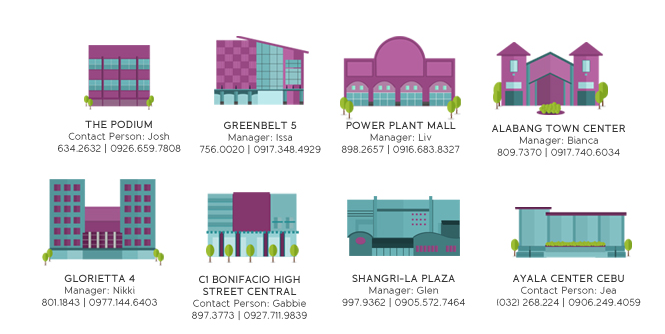

Q. How many locations do you have in the Philippines?

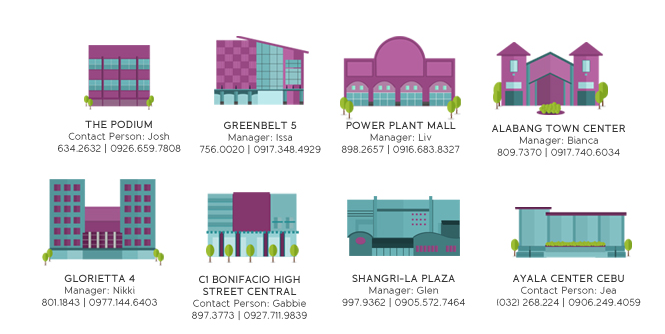

A. We have 9 locations across the Philippines. (The Podium Mall, Greenbelt 5, Power Plant Mall, Alabang Town Center, Glorietta 4, C1 Bonifacio High Street Central, Shangri-la Plaza and Ayala Center Cebu)

Q. How do you choose a location for The Picture Company?

Q. How do you choose a location for The Picture Company?

A. We look for malls that appreciate our product. Locations that have a lot of foot traffic for families and strollers.

Q. Will you ever take a sub-par location, if it is in an area you want to be in? or will you wait for the right spot?

A. We will always wait for the right spot. Our business is a weekend business (when the parents can go to the malls) and we have limited number of hours to do business (we can take maximum of 8 sessions a day for only 2 days a week), it is too risky to take a sub par location.

Q. How big is a Picture Company location? What have you learned about store size?

A. Our stores range from 36m2 to 120m2. In the beginning, we kept getting a bigger space to accommodate strollers and nannies and extended family, but we realised that when the store is big, it also lacks coziness. More attention is given to the customer when the space is just right. Another thing we need to consider is the malls have doubled and tripled their rental rates.

Q. Does a corner location matter for The Picture Company?

Q. Does a corner location matter for The Picture Company?

A. No. Of course good foot traffic is important but it doesn’t necessarily have to be a corner store.

Q. Are malls better? or street level locations?

A. We were successful in locations like Podium and Rockwell where clients expressed they feel safe. So when we first went street level like Bonifacio High Street, we were taking a chance. It turned out okay. A little warm and exposed to the weather changes like rain. More dirt comes in which isn’t friendly for a baby environment but it worked.

Q. At what point did the number of stores change how the business is run? I have been told, 1 or 2 stores is ok, but 3+ requires a different management approach, systems, procedures, etc. What was the tipping point for The Picture Company?

A. You are very correct! It was very personal and mom and pop until 3 stores. And then I had to consider personnel, training, back office space, production, logistics, etc.

Q. Anything you would like to add?

A. I wish we could locate The Picture Company in more spaces but new malls sprouting up (or the ones renovating) are creating bigger spaces and bringing up rent because of the international brands coming in. I wish they would always make spaces for the Filipino retailers so we have character in our malls and not look like every other mall with the same big brands. We also need to help the Filipino retailers thrive in their own country. I think the fight for all these brands to enter the malls is making every mall look alike and not offer anything new for its customers.

– Thanks to Eileen for participating!

Would you like to be profiles in our Retail Executive series. Reach out by commenting on this blog post or emailing support at payrollhero .com.

Are you interested in learning more about PayrollHero? Our payroll software is live in the Philippines and Singapore and our Time & Attendance solution is used all over the world.

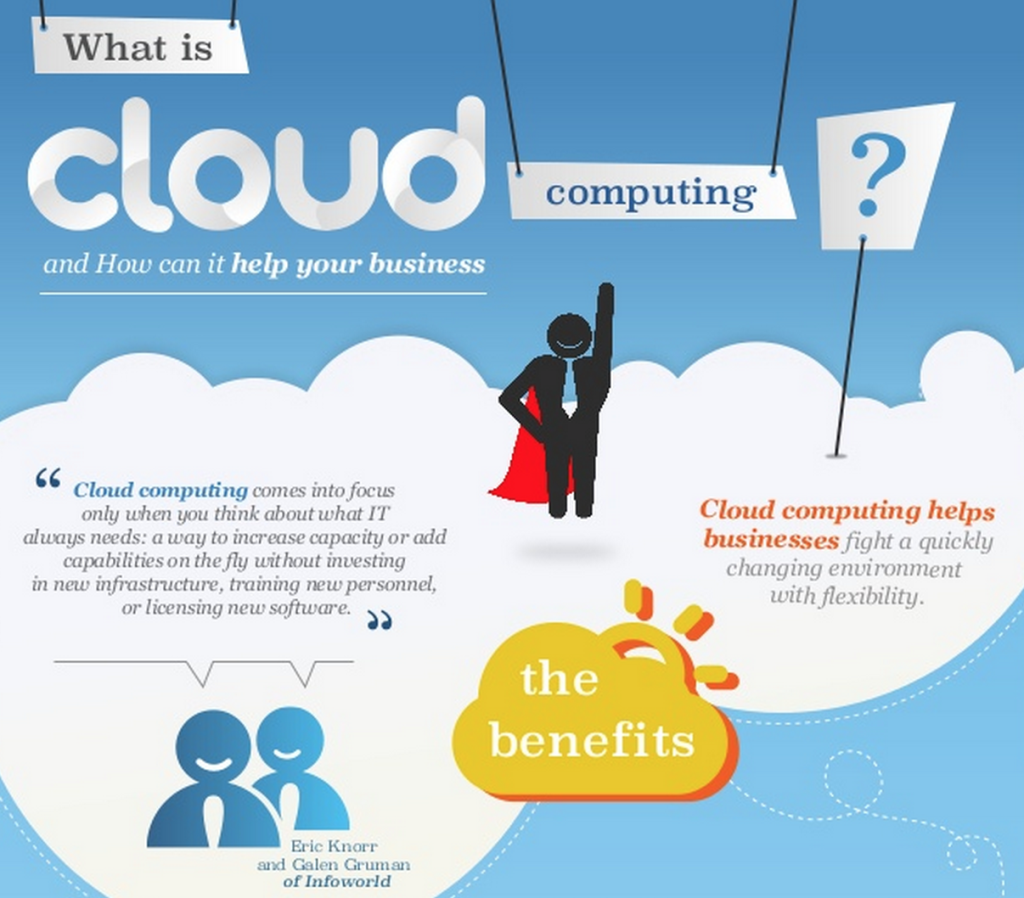

Cloud Computing, by

Cloud Computing, by

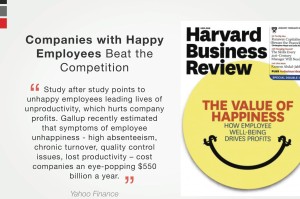

ted on increasing productivity: be it that of your rank and file workers or your manager. Higher productivity leads to a better workplace environment and happier people, which further leads to higher productivity. That is a virtuous cycle, if ever I saw one. In effect: optimizing work productivity with happiness.

ted on increasing productivity: be it that of your rank and file workers or your manager. Higher productivity leads to a better workplace environment and happier people, which further leads to higher productivity. That is a virtuous cycle, if ever I saw one. In effect: optimizing work productivity with happiness. Filing taxes can be a daunting task. Figuring out

Filing taxes can be a daunting task. Figuring out  Q. When and why did you start The Picture Company?

Q. When and why did you start The Picture Company? Q. What is your background? (retail? or you figured it out as you went?)

Q. What is your background? (retail? or you figured it out as you went?) Q. How do you choose a location for The Picture Company?

Q. How do you choose a location for The Picture Company?  Q. Does a corner location matter for The Picture Company?

Q. Does a corner location matter for The Picture Company? Getting Ridiculously Client Focused!

Getting Ridiculously Client Focused!