The interns in the PayrollHero Singapore office got together and made a video that discusses where they are from, what it is like living and working in Singapore and what they have been working on. Check it out:

Category Archives: PayrollHero

The World of Restaurant Technology in Singapore

The tiny red dot, as Singapore is often called, is an interesting testing ground for restaurant technology. Singapore is famous for its awesome food. From hawker stalls to gourmet dining, the restaurant scene in Singapore is vibrant and diverse.

At PayrollHero, a huge part of being ridiculously client focused is in understanding what our clients need and use on a regular basis. What do Singaporean restaurants do for point of sale systems, for reservations, for creating menus or for scheduling shifts for their employees? There are a ton of apps out there that are especially designed for this industry. We looked at some apps that piqued our interest.

Reserving Tables: Chope

Asia’s answer to OpenTable and SeatMe: Chope helps diners reserve tables at restaurants in Singapore, Shanghai, Beijing, Bangkok and Hong Kong, free of cost. Restaurants can manage reservations through Chope. The company is expanding and adding new restaurants to its list every week.

Point of Sales Systems: PCS

Prima Computer Systems tackles the problem of inefficient POS systems. The cloud based solution makes it easier for a multi-location restaurant franchises to integrate POS systems. The app allows you to create and change menus in iPads, therefore reducing manpower costs. Considering the labour crunch in the F&B industry in Singapore, this helps restaurants focus their employees towards providing better service.

Digital Wallets

Singapore was one of the first countries in Southeast Asia to adopt digital wallets, back in 2012. Many restaurants have adopted mobile payment options. In terms of consumer readiness, Singapore comes second only to the Philippines at 17%. It beats all other countries for electronic payments at 42%. Local and international banks are a part of this movement towards mobile payments. OCBC’s Pay Anyone, DBS’s PayLah! and Standard Chartered Bank’s Dash are all useful options that restaurateurs should look at to integrate their POS systems with.

An interesting thing to note for restaurants and for businesses that are building easier payment methods is that the demographics on who is using mobile payments is revealing of whom the target market should be. Unsurprisingly, millennials lead the move towards mobile payments. More importantly, data shows that men are twice as likely to adopt the new technology compared to women. CEO of Harbourtouch (company that did the survey on the demographics of mobile and electronic payments), Jared Isaacman, said that there is a void when it comes to mobile payment in restaurants. Retail stores use this technology far more frequently, which indicates a potential opportunity in the F&B industry.

Loyalty Apps: Perx

Perx says that customers spend 7 times more using Perx than without. Loyalty apps remove the hassle of printing loyalty cards and trying to measure how effective the cards are. Perx offers a CRM solutions and a platform for businesses. Restaurant owners have access to how effective the loyalty app is in increasing revenue.

Inventory Management: TradeGecko

TradeGecko is racing through Asia. The Enterprise Resource Planning software is integrated with Xero, Quickbooks and Shopify among other companies. It offers analytics reports on inventory and stock. From the perspective of the F&B industry, TradeGecko helps a chef or a restaurant keep tabs on supplies. All this is done using the cloud, which simplifies the entire process for a restaurant chain.

There are two similarities that link all these apps together:

- They are all cloud based

- They all complement scalability.

Our research into Southeast Asia led us to an interesting observation. A single restaurant franchise owner may operate across multiple countries. Apps like these are useful for the kind of owner that needs to keep tabs on all his outlets, across different countries. It helps the restaurant owner that currently owns one café and is looking for a way to open 25 more within two years.

We also noticed that in Southeast Asia, consumption trends suggest that fast food chains are going to excel in the next five years. For example, the compounded annual growth rate (CAGR) for fast food chains in the Philippines is 8.1% between 2013 and 2017. The potential that this poses for cloud based solutions is both exciting and massive.

Over the last few weeks, we have been looking deeply into the F&B industry. We focused on the Philippines and Singapore, with the idea of comparing and contrasting a nascent economy versus a mature one to figure out the potential that this region poses. We also compared what kind of employee compensation and benefits are provided by these countries with the perspective of figuring out what our client – a restaurant owner – is most concerned about.

While the data supported some assumptions or destroyed preconceived notions, we found out that there was more to this research than just raw data. We spoke to restaurant owners on the ground to listen to their stories and build a clearer picture.

Finally, we compiled all of it into a nice little package that we call the PayrollHero Knowledge Kit. It provides snippets into our research with statistics on the F&B industry in Singapore and the Philippines. We are super excited about sharing it with you because we want to know how it helps startups that are catering to the F&B industry. We also want to hear about the insight that you have gained from working in this part of the world.

The pictures below link you to the PH and SG Knowledge Kits. Open it, browse through it and shoot us with questions. We want to know what you think.

New Feature on the PayrollHero App!

We have a new feature on the PayrollHero app!

Our Devs (developers) are constantly working towards improving functionality of the app. To that end, we have a new feature to enhance a human resource manager’s tools. It’s a simple addition to the app that allows the HR manager or payroll administrator to:

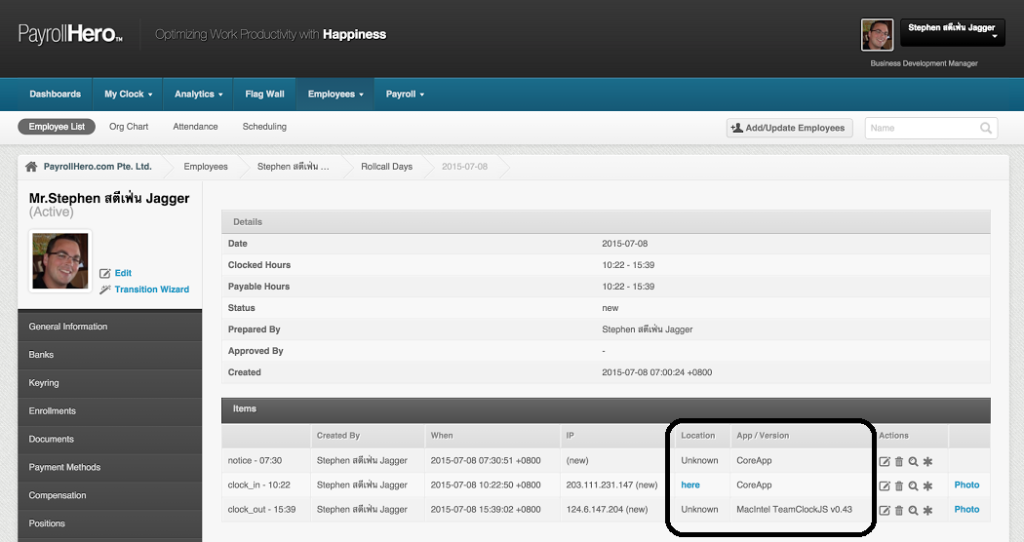

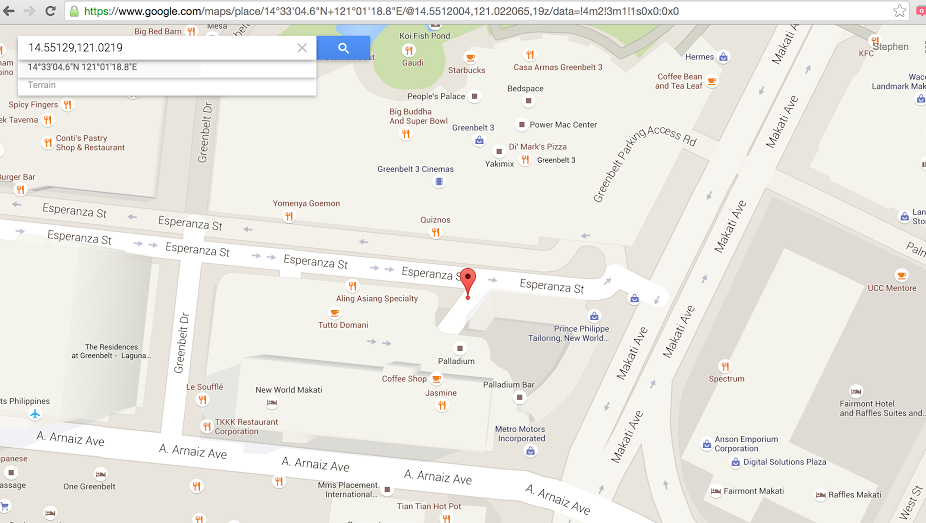

- check the GPS coordinates of employees who are clocking in.

- record which device they are clocking in from

The feature sits in the Employees tab and under the Rollcall Days section. You can see the list of days that the employee has clocked in, their IP address, GPS coordinates linking to Google maps and the device that they used: TeamClock or #MyClock. If there are any issues with clocking in with a particular device, the HR admin can point out what specific device the problem arose from. This information can also be used as Business Intelligence to make decision on staffing and installing the best devices in your outlets.

The feature is already live for all PayrollHero users!

PayrollHero’s First Twitter Contest!

As you know, we have been creating some handy guides for opening restaurants in Singapore and the Philippines. We call them the PayrollHero Knowledge Kits.

Since we’re so excited about them and want to share them with the world, we’re hosting our first ever Twitter contest! From now until July 17th (Hari Raya Puasa), all you need to do, is retweet the link below to as many people as you can on your network.

If you can reach out to the most number of restaurants, businesses or people, we will feature you on our own blog!

Why is this a good idea for you? Well, we have been featuring famous actors and basketball players on our blog: celebrities like Rocco Nacino, Shawn Weinstein and Sean Anthony have shared their favorite restaurants with us. How awesome would it be to get in on the action! You know you’re thinking to yourself, “this would be a great PR opportunity…”

Make sure you’re following @PayrollHero so you’re in the loop because in the coming weeks, we will be coming up with some great opportunities like this for you.

.@PayrollHero is hosting a contest! Tweet our NEW #KnowledgeKits at the most #businesses & #people to #WIN an exclusive feature on our blog!

— PayrollHero (@PayrollHero) July 6, 2015

The MUST HAVE #PayrollHeroKnowledgeKits – retweet them to be featured in our #blog! http://t.co/LmjavZ863p (PH) http://t.co/xCkTRy9KFl (SG)

— PayrollHero (@PayrollHero) July 6, 2015

So what are you waiting for? Get tweeting! Your 15 minutes of PayrollHero fame awaits.

Below, you can see an example of a Twitter post that retweets the Knowledge Kits:

How do I open a restaurant in Singapore? Presenting the PayrollHero Knowledge Kit!

The PayrollHero blog aims to be the knowledge repository for any restaurant owner or retailer in Southeast Asia. We have built our database with things you need to know while doing business in Singapore.

With that in mind, we have been working on a little project. Presenting the PayrollHero Knowledge Kit!

Download now… Free!

This starter kit was put together to give you high level information about Singapore, share some thoughts from restaurant owners, and present relevant statistics from our market research.

The information here includes research that will help you open a restaurant in Singapore or expand into the country.

- We talk about what CPF contributions are with information about the different Ethnic Funds that require contributions.The pages are linked to relevant tax forms and websites that offer more detailed information if you want it.

- There is an industry overview and analysis on the latest consumption trends in the country. We give you a salary table to refer to for your Human Resources (HR) team in Singapore.

- We also give you practical write-ups on how to get an import license, food hygiene requirements and the best internet service provider for your restaurants.

But we don’t want to give you simple hard facts that you could just Google anyway. The Knowledge Kit has a wealth of information in the form of personal stories and experiences in these countries. We interviewed the president of SaladStop!, Mr. Adrien Desbaillets. He gave advice on how he chooses locations in Singapore among other practical nuggets of information. We see it as a way to help the community because there is no better way to learn than from people who have gone through the same roadblocks as your are facing right now.

We hope this information is useful to you. We would love to hear back from you with what you think about the Knowledge Kit, how we can make things better and how you use this Kit for your own research into the restaurant industry.

Lastly, we are releasing more of these for the retail industry. Watch out for more information about these industries and countries. We have also created a Knowledge Kit for the Philippines.

So go ahead and click on the image above to access the Knowledge Kit. Let us know what you think. And good luck with your new business!

How do I open a restaurant in the Philippines? Presenting the PayrollHero Knowledge Kit!

The PayrollHero blog aims to be the knowledge repository for any restaurant owner or retailer in Southeast Asia. We have built our database with things you need to know while doing business in the Philippines.

With that in mind, we have been working on a little project. Presenting the PayrollHero Knowledge Kit for opening a restaurant in the Philippines!

Download it now – free!

This starter kit was put together to give you high level information about the Philippines, share some thoughts from restaurant owners, and present relevant statistics from our market research.

The information here includes research that will help you open a restaurant in the Philippines or expand into the country.

- We talk about what BIR, SSS, PhilHealth and Pag-IBIG are all about.The pages are linked to relevant tax forms and websites that offer more detailed information if you want it.

- There is an industry overview and analysis on the latest consumption trends in the country. For example, did you know that the Home delivery and takeaway sector grew at a staggering 10.3%. It’s closest competitor was the fast food industry at 8.1%.

But we don’t want to give you simple hard facts that you could just Google anyway. The Knowledge Kit has a wealth of information in the form of personal stories and experiences in these countries. We interviewed the owner of the Advent Manila Hospitality Group, Mr. Andrew Masigan, and asked him about how he runs his business in this part of the world. We see it as a way to help the community because there is no better way to learn than from people who have gone through the same roadblocks as your are facing right now.

We hope this information is useful to you. We would love to hear back from you with what you think about the Knowledge Kit, how we can make things better and how you use this Kit for your own research into the restaurant industry.

Lastly, we are releasing more of these for the retail and BPO industry. Watch out for more information about these industries and countries.

So go ahead and click on the image above to access the Knowledge Kit. Let us know what you think. And good luck with your new business!

Executive Interview: Nicholas Sinclair, President of the Outsourced Accountant

As part of a new series on this blog we will be profiling PayrollHero users to learn more about them, their business, where they go to learn and best practices.

Nick Sinclair is the President of the Outsourced Accountant. The company is a BPO in the Philippines that helps accounting firms in Australia and New Zealand improve their client value added services. We spoke to Nick about his experience in the Philippines.

Nick Sinclair is the President of the Outsourced Accountant. The company is a BPO in the Philippines that helps accounting firms in Australia and New Zealand improve their client value added services. We spoke to Nick about his experience in the Philippines.

- Tell us about your company.

The Outsourced Accountant is dedicated in helping Australian and New Zealand Accounting firms identify their current workflow blockages and employ the right team on a full-time basis to help them become proactive in client value added services. We are a BPO focused solely on this niche and our offering is unique and not like traditional BPO offerings.

- How and when did you realise the need for Australian businesses to outsource accounting?

I visited Manila for an Entrepreneurs Organization board conference approximately 3.5 years ago and I went and spent the day with Mike O’Hagan and saw his operation there, as well as a range of other businesses. This then got my mind racing and I then thought how I could flip my accounting and financial planning business to become more efficient and allow my Australian team to actually add value to clients. This then grew into a business when others in my industry saw what we were doing and didn’t want to reinvent the wheel so we started an outsourcing business based on what frustrated us most with the providers we used in Manila. I understand that most accounting firms are buried in paperwork and process-driven tasks, causing them to lose focus on adding value to clients. We want to help these firms get back to client facing work by having an offshore team who can take care of all the compliance and administration work.

- Where are you headquartered?

Our office in the Philippines is situated in Clark Freeport Zone, while our headquarters in Australia is located in Queensland.

- How many locations do you have in the Philippines? Why did you choose this location versus other locations that are perceived more conventional (i.e: why Clark over Manila)?

Just one inside Philexcel Business Park in Clark.

I prefer Clark over Manila because it’s a lot quieter and less congested environment. A lot of our team members who live within the region have already worked in Manila, since it’s obviously one of the biggest work environments in the Philippines, but they wanted to come home and live with their families. Here in Clark, it’s easier to get to work as people will not be sitting in traffic for hours. We’re very much about work-life balance with our team over here so we want them to spend more time with their families.

Moreover, Clark is accessible to expressways, has its own international airport, and enjoys a variety of amenities and government incentives. We also have a talent pool of close to 8 million people with very little competition (compared to Manilla and other regions).

- What was the biggest roadblock to establishing yourself in the Philippines?

The biggest roadblock was the time that I had to spend being in the Philippines, being away from the family and missing out on school events of the kids as I was constantly away.

The biggest roadblock to setting up in the Philippines is the legislation and getting the right advice as it isn’t straight forward and you need to register with multiple departments and each department needs the others approval. There are lots of experts who charge anywhere from $1500 to $10,000 AUD to provide this advice but a lot of the time they dont know what they are talking about. We struggled until we found a local lawyer, who is well connected and has a wealth of experience and endless connections. The other challenge is no one tells you all the things you need to have to even operate, things like Workplace health and safety approval, fire approval, a company nurse when you hit certain levels of staff. There is a lot more involved then get an office, hire some staff and your off.

6. Was there an unexpected outcome (positive or not) from moving into the Philippines?

The business we now have was an unexpected outcome. We originally did this to service our own firm’s needs, but we have since grown to 180 team members in less than 18 months and I have now sold my accounting and financial planning business to focus on our outsourcing business.

- How do you see this industry changing over the next few years?

I believe the industry is going to go through continued growth, but more BPO’s will start to niche in specific industries rather than be generalist BPO’s as this market is starting to become flooded with new BPO’s.

- What were your evaluation criteria before you chose the Philippines? Were there any other countries you were considering?

We had tried outsourcing in India, Vietnam and in Australia (and failed in all). The Philippines wins hands down.

The Philippines has a strong english culture, a strong accounting workforce and an even better number of accounting graduates coming out each year (its one of the main degrees Filipinos complete). The time zone suits perfectly as its only two hours behind for all Eastern states of Australia and the same time zone for Perth.

- What do you read to keep yourself up to date with your industry and the clients you are serving?

I don’t get too caught up in the BPO industry information, I focus on what is happening in the accounting industries in Australia and New Zealand. We focus on knowing our client, and talking to them regularly so we can continue to tailor our offering to meet there needs. We aren’t a traditional BPO. We also read a lot of industry information, specifically from industry thought leaders like Rob Nixon.

- What advice would you give a businessman moving into the Philippines, that you wish you knew before moving to the country?

It isn’t as easy as some people make it out to be (or it looks to be). I have had so many people say that we have had massive growth and made it look easy, but they don’t see all the work that goes on behind the scenes to deliver what we do. The Philippines isn’t a straight forward place to operate, its very paper based and not technology based which makes it hard. I also would say don’t employ an expat that hasn’t had experience managing a business the size you want to grow to. I have seen many expats that couldn’t manage 50 people in Australia but are managing more than this in the Philippines and failed due to lack of experience. There is plenty of local talent that have significant experience, so look locally (we just hired a gun Country Manager that has over 20 years’ experience managing large operations and he is a gun).

- What results that you delivered to your clients are you most proud of?

The growth of our business is testament that we are on the right track. 60% of our current growth is from existing clients putting more people on. We have plenty of case studies on it working for our clients. The comment we get regularly is our team are world class and pick it up quicker than our clients expect them to.

- How has PayrollHero helped streamline your business?

First of all, it made timekeeping more convenient. It has let us process calculations accurately, and kept us compliant with tax regulations. It also made it easy to manage and generate reports for government statutory benefits since the required forms are already provided and automatically filled.

The big benefit is our leadership team can login to the system, anywhere in the world to see the stats at a quick glance. The system has allowed us to focus on time and attendance and manage this as one of our business’s key strategic goals, and with tardiness being less than 1% late per day and attendance at 98% average for the year to date it is working (compared to the industry average).

- How did you run payroll before you found out about PayrollHero?

Before, we used biometrics door access control system for timekeeping, and we did payroll processing with excel spreadsheets. PayrollHero has certainly sped the process up and made it significantly more trackable and accurate.

14. What convinced you to choose PayrollHero over other payroll software vendors?

The unique TAS (Time, Attendance and Schedule) feature wherein team members have to take selfie photos to clock-in and out plus the good client experience (contact persons are accommodating; quick response time on queries raised) from inquiry to sign-up stage made us decide to go for PayrollHero.

PayrollHero Certification: Hands on Experience with the App

Last week, Kieran our Head of Client Success, conducted training sessions for the new PayrollHero team members in Singapore as well as a few clients. We got some hands on experience with the app, which helped us gain a deeper understanding of how the product works. As an intern who has been here for a few weeks, my knowledge about the product came from speaking with team members, listening to sales pitches and reading about the product online. So it was an interesting experience to use the product on a demo account and view it from the perspective of a payroll administrator. All new PayrollHero team members get certified on the platform so that they know exactly what the platform can do.

Last week, Kieran our Head of Client Success, conducted training sessions for the new PayrollHero team members in Singapore as well as a few clients. We got some hands on experience with the app, which helped us gain a deeper understanding of how the product works. As an intern who has been here for a few weeks, my knowledge about the product came from speaking with team members, listening to sales pitches and reading about the product online. So it was an interesting experience to use the product on a demo account and view it from the perspective of a payroll administrator. All new PayrollHero team members get certified on the platform so that they know exactly what the platform can do.

Kieran took us through every aspect of the product. My first thought when I was told about the training was, “Wow, a two and a half day training session? But I already know everything about it!” Which, as you may have guessed, turned out to be highly overstated. Within the first two hours of training, I came to the conclusion that the product was far more powerful than I had expected.

The first day was about Human Resources Information Systems (HRIS). The next day was spent on generating payroll and the final day was dedicated to understanding time, attendance and scheduling using the app.

The interesting part about the app is its customization capabilities. A human resources (HR) administrator can record the company’s organizational chart. The hierarchy allows you to identify employee types and positions. Thresholds allow you to set rules on what kinds of notifications you get based on the activities of employees under you in the hierarchy. The thresholds have multiple permutations and combinations that, once customized, help you prioritize information that you need instantly versus information that can wait till a more suitable time.

It didn’t stop there. Customization extended to how you segment payroll: employer contributions (CPF, SDL, FWL), bonuses, vacation payments, advance payments, claims that need to be redeemed. Any kind of payment outside of the basic calculation of an employee’s hourly wages can be segmented and customized so that all a payroll administrator has to do, is enter which segment the payment should go into. The app can take care of debiting/crediting the amount to the required account. It will notify you when the account is hitting a pre-recorded limit. The flexibility of the app went as far as allowing you to import data from a spreadsheet, allowing the app to automatically fill in employee details.

It didn’t stop there. Customization extended to how you segment payroll: employer contributions (CPF, SDL, FWL), bonuses, vacation payments, advance payments, claims that need to be redeemed. Any kind of payment outside of the basic calculation of an employee’s hourly wages can be segmented and customized so that all a payroll administrator has to do, is enter which segment the payment should go into. The app can take care of debiting/crediting the amount to the required account. It will notify you when the account is hitting a pre-recorded limit. The flexibility of the app went as far as allowing you to import data from a spreadsheet, allowing the app to automatically fill in employee details.

While all of this might seem like a rather dry topic to train on for nearly three days, Kieran managed to make the whole session more interesting by throwing in quizzes and having interactive sessions. Every demo account had characters from Kieran’s favourite fiction series. Homer Simpson got a bonus for his outstanding work (let’s pretend like that is EVER going to happen), Sherlock Holmes got promoted to the next level on the org chart, Buffy Summers asked for a change in her schedule for the next 3 weeks and Harry Potter recorded coming in early to work consistently. All these characters were a part of the certification exercises, which made the entire process not only informative but also engaging.

The time, attendance and scheduling part of the course was done through an online training portal on the PayrollHero website. Again, I was pleasantly surprised by how detailed the app was and how customizable the entire process of scheduling was. It was impressive that the app was user friendly and flexible with creating, adjusting or removing schedules based on timing, location and type of work: whether it was a routine desk job or a part time job that required changing schedules often. The app, as was intended, was perfectly designed for retailers and restaurant owners who deal with employees who have erratic schedules which require constant adjustments.

The exercises and quizzes were effective in understanding how much we grasped from the lessons. It was clear that working with app required you to be consistent and methodological with the processes for entering data, giving system permissions, organizing the company’s hierarchy and setting customized options especially since the data that the system works with is sensitive. Finally, the certification undoubtedly served its purpose: it gave us a complete picture of how the app works and how a payroll administrator can benefit by using all its features for time, attendance, scheduling and payroll.

Learn more about PayrollHero Certification in the Philippines and Singapore.

Carlos Celdran on the Philippine Business Environment

Editors Note: Maita Ocampo, Business Development at PayrollHero contributes to this blog on and off, this week, she had a call with one of the most famous Filipinos, Carlos Celdran.

One-on-One with Manila’s Main Man

One-on-One with Manila’s Main Man

John Charles Edward “Carlos” Pamintuan Celdran is a man who wears many hats (at times, even bunny ears!), but in most days, he is an artist and a tour guide. He uses performing arts to educate people about Intramuros and of course…..Manila.

Yesterday, I had the privilege of scoring a phone interview with Manila’s main man. I asked Carlos some questions about his work and his thoughts on the Philippine business environment.

The Changing Manila Skyline

When asked about the changes in the restaurant/retail business in Manila, Carlos says that he’s seen everything and finds it terrible that the city is becoming more mall-driven. Not to mention, the “building boom” that’s currently happening – he pointed out the increasing number of condos and high-rise buildings that’s changing the Manila skyline in so many ways.

Let’s Talk Business

What can the Philippines (or in this case, Manila) do better to attract business investment?

Carlos mentioned 3 items:

- Streamlining the tax system

- Working on safety and security on roads

- Addressing the traffic and flooding issues

What are the challenges for foreigners setting up a business in the Philippines?

– “The biggest obstacle would be the 60-40 rule on ownership wherein foreigners can’t fully own a local company. For me, that’s the biggest hindrance more than anything else.” (more on that topic)

What advice can you give a foreigner setting up a business in the Philippines?

– “It is important to find a good Filipino business partner and it’s always about location, location, location.”

It’s always been a joy speaking with Carlos – whether in one of his tours, over beers, or this time, through the phone. I love the fact that he’s passionate and vocal for his love of country – trying to alleviate the not-so-good and embracing it for what it truly is.

You should definitely attend one of his walking tours and get to know more about the Philippines in a very interesting way. Take note: free Choc-nut and halo-halo for everyone!

#MyClock iOS App Updated

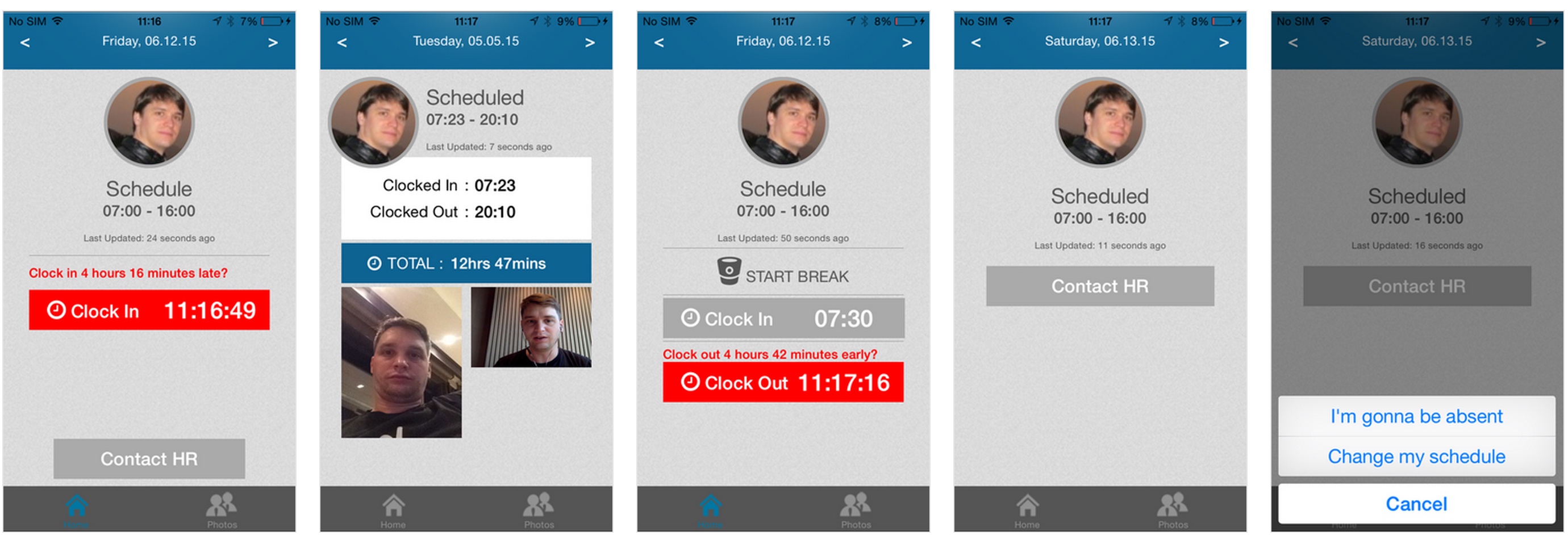

The PayrollHero #MyClock iOS app has been updated in the Apple app store. There are quite a few changes to the app, most noticeably is the design. The overall look has been updated as well as some new functionality.

The #MyClock iOS app is designed for individual employee use. The app shows an employee their upcoming and past schedules, their clock in and out data, the clock photos as well as lets them require a change to their schedule or notify of an absent.

The #MyClock iOS app is designed for individual employee use. The app shows an employee their upcoming and past schedules, their clock in and out data, the clock photos as well as lets them require a change to their schedule or notify of an absent.

Interested to know more about how PayrollHero works? Check out our website or reach out to our team and we would be pleased to give you a free one on one demo of the platform as well as the features and benefits.